Photo Credit: SEBASTIAN KAULITZKI (gettyimages)

Seismic structural shifts challenge the forecasters

While most analysts are pondering the lessons learned from the global financial crisis, we and other researchers have been busy trying to understand some seismic structural shifts in the macroeconomy. These changes to our economy pose a number of puzzles, and how we square these circles has implications for businesses, households, investors and policymakers. Recent research sheds light on the somewhat surprising combination of rising industry concentration and a higher profit share of GDP, alongside a slower productivity growth trend and persistently low consumer inflation. The special nature of investment in intellectual property and technology is found to explain the observed trend toward a few “superstar firms” dominating various industries, while the high cost of winning the intense technology race helps explain why we still observe a slower trend in productivity growth. Greater concentration helps explain sluggish wage gains even as the transparency of online pricing restrains pricing power and keeps inflation subdued. Should these new industrial structures persist we can see less inflation with low unemployment rates and continued subdued GDP growth trends which should combine to keep interest rates low. There is a risk that increasing concentration will eventually give rise to pricing power and inflation, and the current trade war will be an important test of firms’ ability to pass along higher prices to consumers and protect margins, versus their ability to restrain wage gains in a more inflationary environment and a tight labor market.

Kansas City Fed President Esther George tasked a number of academic researchers with analyzing structural changes in the economy that might stem from technological transformation. They presented their results at the annual Jackson Hole Symposium widely attended by global central bankers this past August. After reading the papers and conferring with the authors we think we found some preliminary insights that are worth sharing.

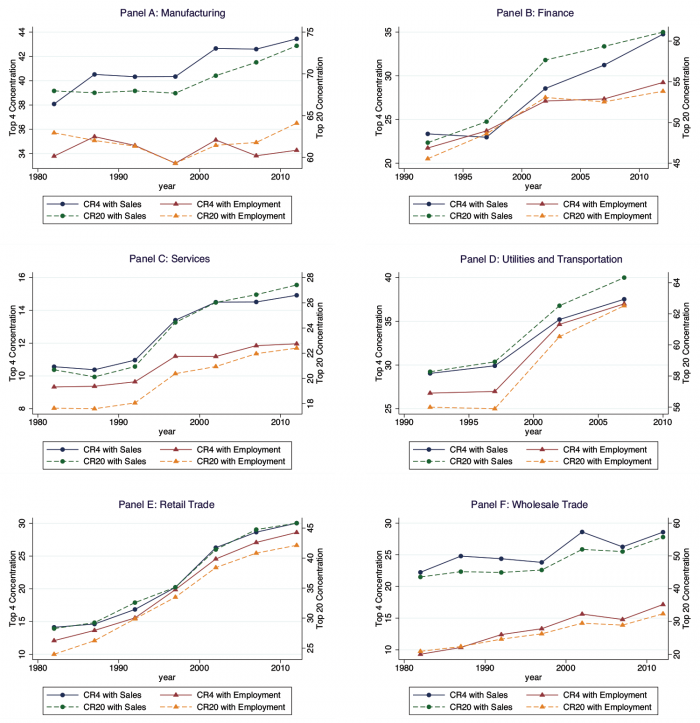

Let’s start with the macroeconomic stylized facts that reveal the rapid pace of structural change. Starting in the latter part of the 1990s, a wide range of industries saw increased concentration of sales and employment in a smaller number of larger firms. Figure 1 shows the results of a meticulous analysis of this rising concentration by a number of academic economic researchers, some of whom also presented work at this year’s Jackson Hole conference. These authors call this trend the rise of “superstar firms” and show how it helps explain a related macroeconomic trend, that of the declining labor share of GDP.

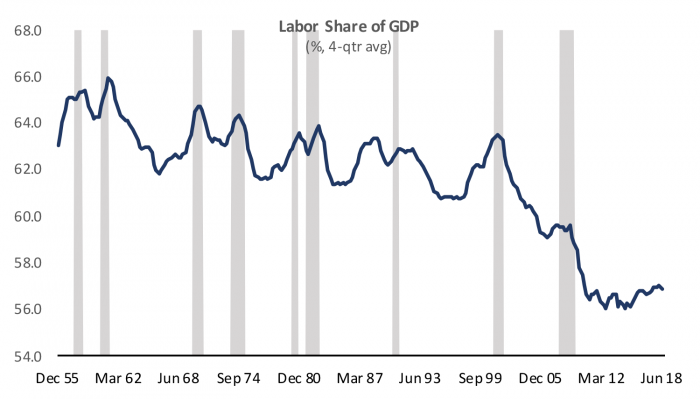

Labor’s declining share of GDP is illustrated in Figure 2. The labor share of GDP – that is, the value of GDP that is paid out to workers in the form of wages, benefits and other labor compensation – has historically declined during and after recessions as the job market weakened and then recovered as unemployment fell and workers recovered their bargaining power. Workers realized a healthy cyclical rebound in the late 1990s even as the trend toward increasing concentration among firms was taking root. However, since the cycle peak of the labor share in 2000, US workers have seen a steady secular decline in the share of GDP they take home. In addition, the pattern of cyclical recoveries also appears to have been greatly attenuated. Workers are now paid out just over half of GDP as compensation with the remainder mainly going toward business profits.

Much of the focus of research exploring the drivers of rising concentration across sectors has focused on the role played by technological disruption and change. One paper presented at Jackson Hole used firm-level data to decompose the rising profit share of GDP and found that the vast majority of rising markups are due to reallocation among firms in a given industry toward the larger, more productive and profitable “superstar” firms. This in turn seems to be the result of intense global competition and returns to technological first mover advantages that produce “winner take all” market structures. Consistent with this hypothesis, the author finds that most American firms have seen either no increase or a fall in their mark-ups in recent years and industries growing most concentrated appear to have exhibit increased productivity and innovation.

Figure 1: Concentration of Sales and Employment Within Industries by Sector

The pattern of industries dominated by a handful of highly productive and profitable superstar firms is replicated across countries and industries suggesting rising concentration and profits are indeed the result of the special nature of competition driven by technology and investment in intellectual property rather than antitrust regulators falling asleep at the switch and allowing unproductive monopolistic firms to take over. Another group of Jackson Hole authors pointed out that investment in intellectual property features increasing returns to scale and the need for intellectual property protection to reap the return on investment, helping to explain the result of rising concentration amid intense competition.

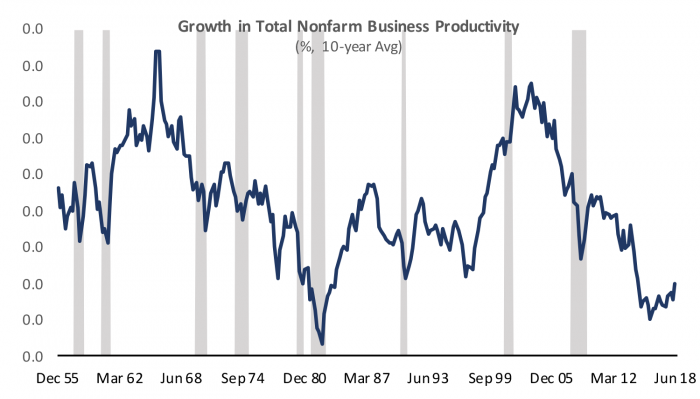

Yet the idea of a macroeconomy dominated by super productive, highly profitable, tech savvy firms across industries defies another macroeconomic trend, that of a decline in productivity growth. Like rising concentration, the trend toward slower productivity growth is seen across advanced economies. Figure 3 shows the ten-year average growth rate of nonfarm business productivity in the United States. It is worth remembering that any positive gains in productivity mean businesses are becoming increasingly efficient, facilitating potential gains in living standards. However, the pronounced slowing in the pace of gains has been somewhat surprising. In other research some of the same economic researchers square the finding of competitive and productive albeit concentrated industries with the aggregate trend toward slower productivity growth in advanced economies by showing that costs to develop new ideas and technologies are on the rise. In other words, the race to the achieve and maintain superstar status is expensive and diminishing marginal returns to investment seem to hold in the aggregate even in the new technology-driven era.

Figure 2: Labor’ Share of GDP Has Been Declining and Has Become Less Cyclical

Another puzzle stemming from a traditional view of rising firm concentration is the trend toward persistently low inflation. While the observed trend of sluggish wage growth and a stubbornly low labor share makes sense in light of rising concentration, traditional economic models suggest that market power should also confer pricing power to firms, and we would see higher and more cyclical consumer inflation. Again, researchers are pondering whether technology might lead to different pricing behavior. Recent works find evidence of an “Amazon effect” whereby technology facilitates transparency and competition and conspires to hold down inflation. The research finds evidence of a structural increase in price flexibility in markets with online price transparency, which describes an ever increasing share of goods and services in the consumer’s basket.

Figure 3: The Productivity of US Businesses Advancing at a Slower Rate

The implications of recent work on the role of technology and changing market structure suggest that if the same industrial competitive environment persists, inflation and wage pressures may remain subdued, allowing the labor market to strengthen further before firms are forced to grant real wage gains and we see an actual rise in the labor share of GDP. The work also suggests that rapid technological transformation isn’t necessarily inconsistent with slower productivity trends and lower growth trends in advanced economies.

The effects on inflation and wage growth could be long lasting given evidence of a structural change in technology and pricing behavior tied to online transparency and competition. However, there is a risk that firms eventually use their market power to raise prices. The monetary policy makers in attendance at the Jackson Hole conference will likely want to evaluate incoming data on wage and price setting carefully in light of what they heard. The current trade war will be an important test of firms’ ability to pass along higher prices to consumers and to protect margins, versus their ability to restrain wage gains in a more inflationary environment and a tight labor market.