Despite recent pressure, the Fed chairman is likely to stay the course

Last week President Trump and some of his advisors publicly expressed their displeasure with the Fed’s plans to continue gradually raising interest rates. Despite the executive branch’s angst, Chairman Powell’s testimony before Congress was relatively free of controversy, and the Fed as an institution still enjoys the protection of checks and balances. The President’s angst stems from the recent strengthening of the dollar that has come with the outperformance of the US economy on the back of fiscal stimulus. That outperformance has also meant that the Fed has judged it prudent to continue gradually and patiently raising interest rates, with the next rate hike anticipated in September. Steady, independent monetary policy may offset some of the stimulus in the near-term, but it protects the stability of our economy over a longer horizon. We should expect continued jawboning, but we should also expect that the Fed will make its decisions independent of this pressure.

President Trump waded into monetary policy last week saying he is “not happy” about the fact that the Fed has been gradually but steadily moving up short-term interest rates. He asserted that despite his displeasure, for now he is “letting them do what they feel is best.” He specifically noted his frustration that “all of this work” he is engaged in to stimulate the economy is being eroded through a stronger currency. There are two dimensions of the President’s comments that merit attention. The first is monetary policy independence, how vulnerable it might be and why it is valuable. The second is the drivers of the recent strengthening of the dollar that is causing the President angst as he seeks to renegotiate the global trading order.

The Federal Reserve enjoys a state of quasi independence. The Federal Reserve System was created by Congress in 1913 and its current dual mandate “to promote the goals of maximum employment, stable prices, and moderate long-term interest rates” was established by the Federal Reserve Reform Act of 1977. Congress has the power to change the Fed’s mandate and structure. Barring an act of Congress, the Fed has the freedom to pursue its mandates without Congressional approval.

Chairman Powell and Congress are on Good Terms

The Fed is frequently the subject of criticism from different sides of the political aisle, but it would require a deep state of dissatisfaction with the job the Fed is doing for Congress to decide to spend its time and political capital on reforming the Fed. Despite being criticized by the President last week, Chairman Powell also appeared before Congress to deliver the semi-annual Monetary Policy Report. Chairman Powell described the strong state of the economy and the Federal Open Market Committee’s assessment that “for now–the best way forward is to keep gradually raising the federal funds rate.”

Chairman Powell’s testimony was largely without controversy. There was concern from Republicans and Democrats about persistently sluggish wage growth, but not much criticism of the Fed’s patient approach to raising interest rates. In a recent interview with Marketplace ahead of the testimony Chairman Powell described his plan to “to wear the carpets of Capitol Hill out by walking those halls and meeting with members. I feel like that’s a really important thing that the chair can do…I want them to think that we’re responsive to their concerns and their thoughts and that we’re here to be as clear as we possibly can.” Chairman Powell has been at the Federal Reserve Board for six years now and has a thorough understanding of the structure of the system; if he keeps Congress happy he will be left alone to do his job. In that same interview Chairman Powell noted that “we have a statute that gives us the independence” to make decisions “without political considerations.”

In the near term the independence of the Fed’s decisions is not at risk. President Trump appointed Jay Powell as Chairman of the Fed to a four-year term that started in February 2018. Powell was selected over candidates that were likely to be even more aggressive in their desire to raise interest rates and despite the fact that he is a known level-headed centrist rather than a true believer in the President’s agenda. Powell and the other Governors currently serving on the Federal Reserve Board in Washington will all outlast President Trump’s first term. The President has nominated three people for vacant spots on the Board, Marvin Goodfriend, Richard Clarida, and Michelle Bowman, none of whom are known to be advocates of easy monetary policy. Clarida and Bowman have been approved by the Senate Banking Committee and are awaiting a vote by the full Senate which is expected to come before the Fed’s September policy meeting at which they are widely expected to raise interest rates again. Goodfriend’s nomination has proved more controversial and may not go through. For the remainder of the President’s term, the Fed will very likely be able to pursue monetary policy as it sees best regardless of Tweetstorms.

Why is the President Fussing Over Monetary Policy?

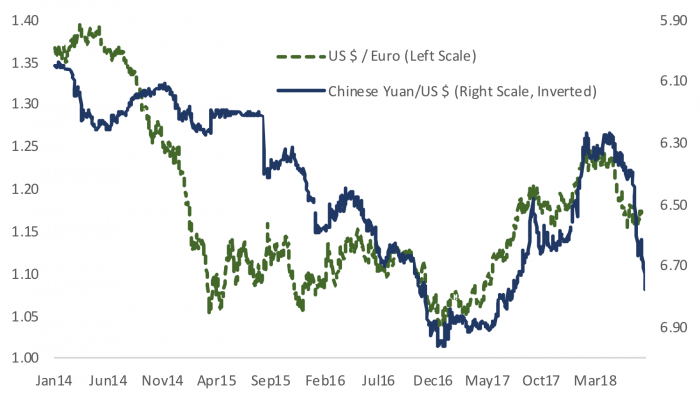

In his remarks the President specifically cited the strengthening of the dollar against the Euro and Chinese Yuan as source of frustration and blamed the strength on rising rates. The weakening of these currencies against the dollar this year is illustrated in Figure 1. Interest rate differentials are indeed one cause of the primary drivers of movements in exchange rates. While the Fed is raising rates at a gradual, steady pace, markets think the European Central Bank is at least a year or more away from initiating rate hikes and China has been cutting short-term rates. These policy decisions on interest rates reflect the relative strength in the three countries. Even before trade skirmishes took effect, the European economy unexpectedly slowed after a stellar performance in 2017 and China has begun a long anticipated slowdown after a period of strong stimulus. The dollar strength we have seen doesn’t fully unwind last year’s weakness as the Euro area and Chinese economies outperformed the US.

There is an accepted trilemma in international economics that holds that market economies must choose between free capital mobility, exchange-rate management and an independent monetary policy. Only two of the three are possible. The United States and most advanced economies have opted for independent monetary policy and free capital flows and allowed their currencies to be market determined. These regimes have delivered the greatest stability and efficiency by allowing currencies to adjust to changing conditions while supporting credible independent central banks that support a stable economy and thereby encourage capital inflows. Emerging markets that peg their currencies and/or intervene in monetary policy often find themselves in crisis. The two most recent examples are Turkey and Argentina. When a country loses the trust of investors in credible monetary policy they are often forced to raise interest rates sharply to stem capital outflows or impose capital controls. In Argentina short-term rates currently stand at 40%, up from 25% early last year. In Turkey the central bank’s policy rate stands at 37% up from 8% at the start of the year.

The US still has checks and balances in place to prevent the potentially devastating loss of central bank credibility that can occur when a political regime attempts to bend monetary policy to its will for short-term gains. Indeed, interest rates barely budged on last week’s jawboning. Former Treasury Secretary Larry Summers tweeted that the likely result of President Trump’s pressure on the Fed will be higher rates than would have otherwise prevailed as the Fed will need to assert its independence. I disagree. The Fed has nothing to prove; it has a well-established track record of making decisions based on economic conditions and independent of political pressure. My guess is Chairman Powell will keep calm and carry on.