At look at how the Fed uses its balance sheet to ease and tighten policy

After lowering short term interest rates to zero during the financial crisis, the Fed expanded its balance sheet by buying Treasury and Mortgage bonds in a process commonly referred to as Quantitative Easing (QE). More recently the Fed has been reducing its balance sheet in what market commentators often refer to as Quantitative Tightening (QT). QT took center stage in December last year when many investors believed it was contributing to the sharp market correction. Fed officials generally rejected that interpretation but recalibrated the balance sheet reduction plan and announced an earlier end to QT than previously planned. With interest rates likely to remain lower than in the past, use of the Fed’s balance sheet in easing and tightening monetary policy should no longer be considered unconventional policy: the Fed will likely lower short-term rates to zero again in the next recession and may very well resort to using its balance sheet. I explore what we know about the way QE and QT affect financial markets and the economy. These policies have become increasingly common in advanced economies yet our understanding of how they work is very much a work in progress. The Fed’s recalibration of its balance sheet has contributed to an easing in financial conditions and reduced risks to the outlook. It has also illustrated some of the transmission channels which will help the Fed calibrate the use of this policy tool going forward.

The Long and Winding Road to a Big Balance Sheet

The Federal Reserve has long maintained a balance sheet that has average between 5 and 6 percent of GDP comprised mainly of short-term Treasury bills and notes. The size of the balance sheet was traditionally determined by demand for currency which was the Fed’s main liability before the financial crisis. In the early stages of the financial crisis of 2008 and 2009 the Fed worked to resolve a liquidity crunch in bank funding with a variety of facilities that provided liquidity to financial institutions and other central banks. The Fed recognized the run on the banking system and used its balance sheet in the central bank’s role as lender of last resort. The Fed financed this lending by crediting borrowers with newly created reserves held at the Fed.

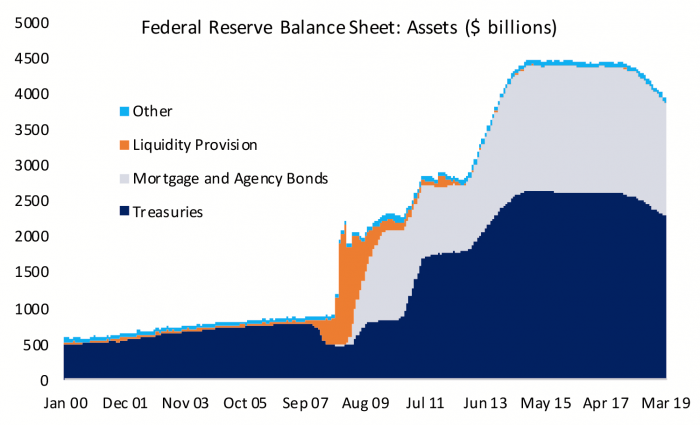

Figure 1: The Fed Has Expanded and Shrunk its Balance Sheet

As the crisis deepened the Fed started buying mortgage bonds (Figure 1). The Fed announced QE1 in November 2008 to provide liquidity to an increasingly dysfunctional mortgage finance market suffering from a crisis of confidence. The Fed announced it would buy $600 billion in mortgage-backed securities and the debt of mortgage finance government-sponsored enterprises Fannie Mae and Freddie Mac. The purpose of QE1 was “to reduce the cost and increase the availability of credit for the purchase of houses” given that the housing market was in free fall.

QE2 and QE3 represented a new phase of monetary policy that went beyond liquidity provision to increasing monetary stimulus. In November 2010 the stock market was up significantly from the lows and the economy was growing 2.5%-3.0%, but the unemployment rate was still elevated at 9.8% and the recovery looked fragile. The Fed had cut short-term rates to zero and felt compelled by its Congressional mandate to support the economy, particularly as partisan politics precluded the passage of additional fiscal stimulus. The Fed no longer wanted to be in the business of picking winners in the credit market and decided to avoid buying mortgage bonds. Policy makers thought the best way to lower borrowing costs in the most market-neutral way was to buy an additional $600 billion, this time in longer-term Treasury securities with purchases set to take place between November and June 2011.

The idea of buying bonds with printed money didn’t come out of thin air; years earlier Ben Bernanke laid out a menu of options for supporting the economy in the event the Fed had already cut rates to zero. QE was one option, in addition to making explicit promises to hold interest rates at zero for an extended period, known as forward guidance. The Fed actively employed QE and forward guidance in the aftermath of the Great Recession.

The economy was still not on solid footing in 2011 as QE2 was wrapping up, yet the Fed was reluctant to keep expanding its balance sheet, in part because it was coming under increasing scrutiny and criticism from politicians. In September 2011 the Fed launched Operation Twist through which the Fed would extend the maturity of its bond holdings by buying long-dated Treasury bonds and finance the purchases with sales of its shorter-dated securities. This again didn’t prove sufficient and the Fed launched QE3 in September 2012 through which it would buy mortgage bonds again, as well as additional Treasury securities. The innovative feature of QE3 was that instead of a fixed dollar amount and time frame, it was open ended. The Fed statement promised that “if the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved.”

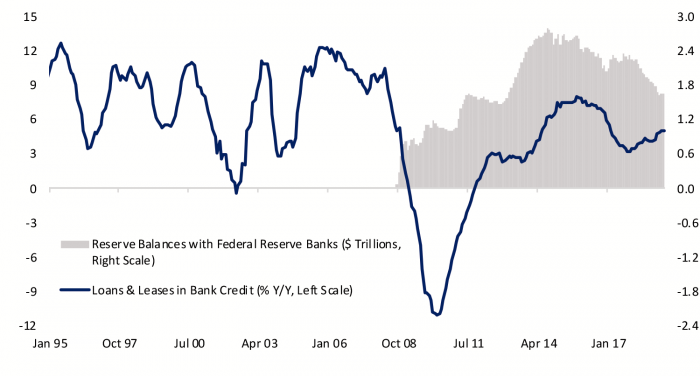

Figure 2: Bank Lending and Reserves Aren’t Closely Related

The Fed began tapering its QE3 purchases in December 2013 when the unemployment rate had fallen to a still elevated 6.7% and their preferred measure of core inflation was running at a still subdued 1.6% y/y. Nonetheless the recovery was increasingly well established, and the Fed concluded the economy could continue to grow with less support from monetary policy. Purchases ended altogether in November 2014 at the peak balance sheet size of $4.5 trillion, an expansion of $3.6 trillion from before the crisis. The balance sheet had grown from 6% of GDP to 25% of GDP.

Originally the Fed had planned to reduce the balance sheet before raising rates, but the market turmoil that ensued when they first indicated they would reduce their asset purchases led them to reconsider. The taper tantrum of 2013 featured a more than 100-basis-point jump in the yield on the 10-year Treasury bond over the course of three months, leading the Fed to delay and slow its planned reduction in bond purchases. A 25-basis point increase in the federal funds rate in December 2015 was the Fed’s first move to remove the accommodation it had put in place since during the Great Recession. That was followed by another 25-basis-point increase a year later. After the federal funds rate reached 1.0% the Fed socialized a gradual balance sheet reduction plan that began in October 2017. The Fed’s plan for balance sheet reduction was open ended and in March of this year the Fed announced that it will end balance sheet reduction at the end of September 2019. The balance sheet will then be in the neighborhood of $3.8 trillion, or roughly 18% of GDP.

Balance Sheet Policy Works in Multiple and Sometimes Mysterious Ways

Traditional monetary economics would suggest that QE affects the economy by increasing the monetary base, which in turn boosts bank lending and therefore investment and consumer spending. The Fed expands its balance sheet by buying securities and crediting the sellers with bank reserves that they create with a keystroke, thereby increasing the monetary base. There has been a point of confusion that QE should prompt banks to lend out their excess reserves, and that since excess reserves didn’t decline after QE was initiated the program was a failure. However, the Fed controls the amount of reserves in the banking system; if banks step up their lending it increases the velocity at which the reserves circulate through the system. QE can stimulate credit growth, but the amount of excess reserves will still be the amount the Fed created to finance its asset purchases. Figure 2 plots the amount of reserves in the banking system against the annual growth in bank lending. Prior to the financial crisis the US operated with a system of scarce reserves, yet bank lending was robust. Bank lending gradually recovered from a severe downturn as the recovery from the Great Recession proceeded and bank reserves increased, but lending has continued at a moderate pace despite the decline in reserves in recent years. QE and other actions that supported the recovery of the banking sector likely contributed to the recovery in lending, but the amount of bank reserves in the system doesn’t capture the impact.

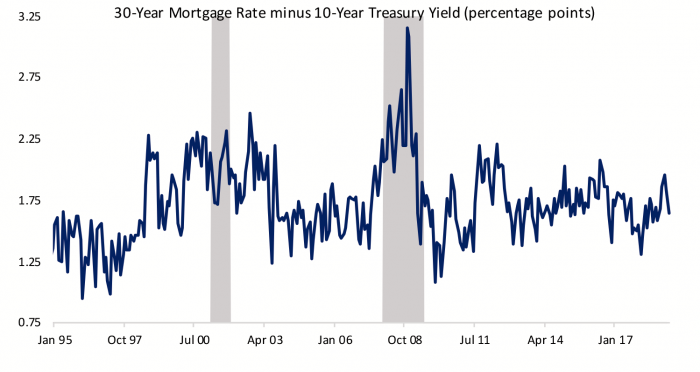

Figure 3: Mortgage Spreads Were Supported by Fed Policy

There are a number of channels in addition to boosting bank lending though which the Fed’s bond purchases and sales are thought to affect financial markets and the economy. A recent speech by Simon Potter, manager of the Fed’s balance sheet at the New York Fed, provides a summary of the Fed’s understanding of the various transmission channels. The most unambiguously powerful channel is when the Fed provides liquidity to markets that are seized up from lack of confidence. Figure 2 shows the spread between the mortgage rates paid by consumers and the yield on the 10-year Treasury bond. This spread is compensation to the investors funding mortgages for credit and interest rate risk, and the cost of operating what is a complex and labor-intensive business. The spike in the spread during 2008 and 2009 reflected a crisis of confidence among investors and meant consumers saw rising mortgage costs at a time when the housing market was already in decline. The Fed’s mortgage purchases under QE1 encouraged investors to return to the market and contributed to a significant narrowing in mortgage spreads that in turn helped the housing market stabilize.

Outside of crises and illiquid markets, QE and QT work primarily through the portfolio balance and signaling channels. The portfolio balance channel refers to the removal of securities available for investors to purchase. When the Fed buys mortgage or Treasury bonds, the reduced supply pushes up their prices (lowers their yields). Higher prices on low risk assets lead investors to reallocate their portfolio, boosting the prices of other asset classes, including riskier assets like stocks, corporate bonds, and emerging market assets. Higher net worth for companies and consumers will in turn stimulate spending and investment.

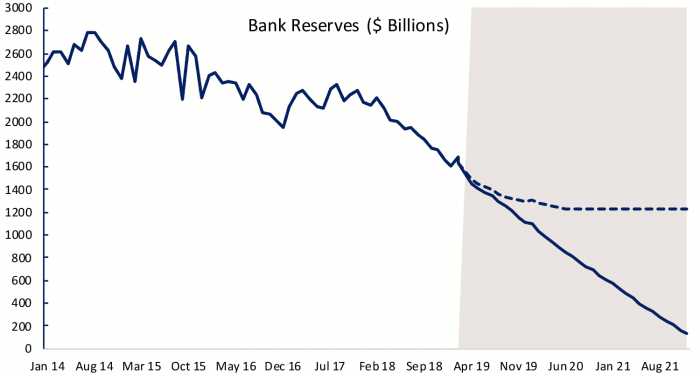

Figure 4: The Fed Now Plans to Hold a Larger Balance Sheet

The overall amount of the balance sheet action will determine the impact through the portfolio balance channel, as well as the composition of assets purchased and market conditions. Economists at the Federal Reserve Board estimate that the combined effect of QE1, QE2 and QE3 lowered yields on 10-year Treasury bonds by 100 basis points relative to where they would be without QE. The yield on the 10-year Treasury is also a key benchmark in valuing risky assets like equities and lower yields generally lead to higher risky asset valuations. Potter notes that there has been little analysis of the impact of QE on other asset classes and cites it as an area for further study. Additional study of the portfolio balance channel would help the Fed calibrate the next intervention.

The signaling channel refers to the signal QE implies for short-term rates. QE is thought to have reinforced forward guidance promises the Fed made to keep rates at zero during the long recovery from the Great Recession; as long as the Fed is buying bonds it is unlikely to raise rates. Similarly the Fed’s “autopilot” plan to reduce its balance sheet in coming years may have sent a worrisome signal on the Fed’s interest rate intentions this past December when perceived risks to the US and global economies were on the rise; if the Fed still thought it appropriate to continue tightening policy by running down its balance sheet despite growing downside risks, investors may have believed the Fed would be less willing to cut short term rates should the economy wobble.

The market correction in December and subsequent reaction to the Fed’s announced recalibration illustrate both the portfolio balance and signaling channels. Figure 4 illustrates that the difference between the Fed’s prior balance sheet plan and the recalibration announced in March is worth more than $600bn through the end of 2020, the same size as QE1 and QE2, suggesting greater support for Treasury yields and other asset prices. The end of the Fed’s balance sheet plan in September also likely reinforces the signal that the Fed is flexible and willing to cut short-term rates if needed. Both interest rate and balance sheet policy also work by boosting business and consumer confidence and signaling a willingness to shift course to support the economy is likely a positive as it provides a sense of insurance to investors at a time when risks and uncertainties are elevated.

The Fed’s actions interact with what is happening in the broader global economy, which means the impact of a given policy can differ depending on conditions outside the Fed’s control. This can make policies hard to calibrate, particularly market interventions, but the low level of interest rates suggests that we are likely see QE again some time down the road.

Both interest rate and balance sheet policy support financial markets, and easy financial conditions in turn boost economic activity. However, QE in particular has come under fire for being regressive since it works more directly by boosting asset prices at a time when wealth inequality has widened dramatically. The Fed’s response has been to urge politicians to contemplate policies that address inequality since their monetary policy tools are limited to aggregate interventions. Polarized politics have thus far meant structural reforms to make the economy more equitable have been few and far between.