Politics and a cooling economy create a challenging environment.

Trump’s attacks on the Federal Reserve have intensified in recent months as the economy has showed signs of cooling. The Fed has responded by studiously maintaining open lines of communication with Congress and adopting a methodical and transparent approach to policy making. Yet any turning point in the economy sometimes comes with stumbles in Fed communication and the current environment is no exception. There have been mixed messages on the direction of policy by members of the Federal Open Market Committee and most egregiously former New York Fed President Bill Dudley penned an editorial suggesting the Fed withhold rate cuts in order to influence the outcome of the 2020 presidential election. The editorial risks fueling deep state conspiracies and spurring a further intensification of political attacks on the Fed that, combined with muddled messages on policy could add to market volatility and an already high and rising environment of uncertainty for businesses and consumers.

All of this comes at a time when interest rates are low around the world and there are increasing discussions about the limitations of monetary policy and calls for increased reliance on fiscal policy to manage business cycles. Yet the political environment in the US and elsewhere has also become more divisive and dysfunctional suggesting limitations to greater reliance on fiscal policy. A recent paper by former central bank luminaries calls for new policy tools. The proposal would create a fiscal facility financed by central bank money creation to be deployed only when interest rates fall to zero and in the context of continued inflation targeting to ensure discipline. Other configurations of so called “helicopter money” are possible. Monetary policy independence has paid dividends through low inflation and inflation expectations and is better positioned to respond to cyclical swings in the economy in a timely and focused way. Declaring monetary policy impotent reflects a failure of imagination but expanding the toolkit would require some degree of political will. The current environment is a dangerous and challenging one for monetary policy makers.

Political pressure on the Fed is intensifying, some recent Fed communication doesn’t help the situation

Trump’s attacks on the Fed have intensified in recent months as the economy shows signs of cooling. Wall Street Journal reporter Nick Timaroes calculated that Trump has made 80 statements on Fed policy in some form (in tweets, interviews, speeches or press scrums) since 2018. More than half of those have occurred in the last two months. Trump is now urging specific policy action; ahead of the Fed’s policy meeting in July Trump indicated he wanted “large cuts” in interest rates and the immediate end to balance sheet runoff. He makes his attacks personal, at times calling the Fed “clueless” and asking, “who is our bigger enemy, Jay Powel or Chairman Xi?”

Knowing the Fed is under a political microscope, Fed Chair Powell has studiously maintained open lines of communication with members of Congress from both political parties. The Fed is a creation of Congress and all political appointees to the Federal Reserve Board of Governors must be approved by the Senate. If Congress is happy with how the Fed is doing its job the President has limited ability to intervene. That strategy has paid dividends so far; some of the more controversial, overtly political Trump nominees to the Federal Reserve Board have never gotten a Senate hearing and, in contrast to the bombast on Twitter, Chair Powell’s testimonies before Congress this year have been some of the least contentious hearings I have seen.

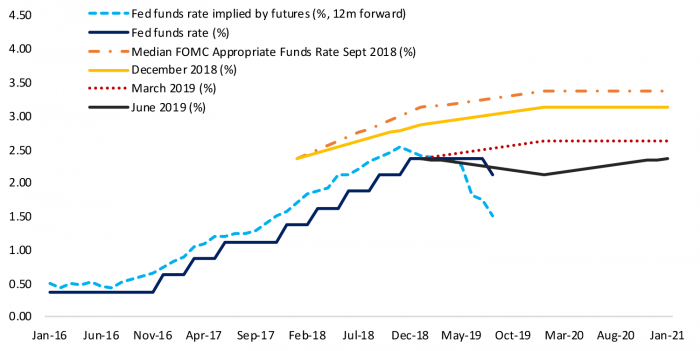

A couple of recent missteps in fed communication have roiled markets, attracted the attention of the broader press and could make it harder for the Fed to defend its political independence down the road. As 2019 has unfolded the Fed has moved from projecting further rate increases interest rates to being on hold to cutting interest rates as evidence points to cooling growth (Figure 1). Shifts in the economy and Fed policy often come with bumps in the road of communication given the difficulty in gauging where the economy is heading in real time and differing views of appropriate policy among Fed officials. Figure 1 illustrates that while the median FOMC official didn’t project cutting rates until 2020, the Fed actually lowered rates at the following meeting. It also shows that the market is still priced for more rate cuts than the median FOMC respondent.

Figure 1: The Fed has Shifted from Rate Hikes to Rate Cuts as 2019 Progressed

The rapid shift in policy orientation has come with mixed messages from Fed officials. New York Fed President delivered a speech just ahead of the July FOMC meeting that markets quickly interpreted as suggesting the Fed might cut the funds rate 50 basis points instead of the anticipated 25 basis points. A spokesperson from his own bank had to issue a clarification after the speech that it was intended to be “academic” and not a policy signal. Even as the Fed delivered the expected 25-basis point cut in the funds rate in July, investors expecting a signal that this was the start of a series of adjustments were frustrated with Chair Powell’s message that left the next move in policy ambiguous.

Crossed wires from President Williams and Chair Powell fall within the realm of normal communication challenges at policy turning points. The most egregious misstep in recent communication came from former New York Fed President Bill Dudley, who in a Bloomberg editorial suggested that the Fed consider not cutting rates in response to downside risks to the outlook from the trade war with China as that would “enable” policies Dudley described as potentially “disastrous.” Most controversially Dudley suggested that “if the goal of monetary policy is to achieve the best long-term economic outcome, then Fed officials should consider how their decisions will affect the political outcome in 2020.” In other words, the Fed should attempt to influence the outcome of the 2020 election in order to depose Trump.

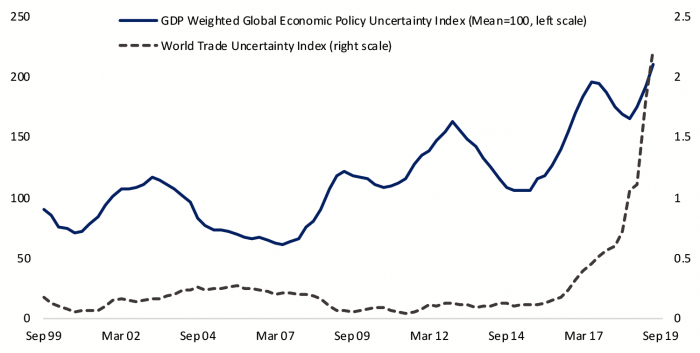

Even if he no longer serves on the FOMC, Dudley’s editorial calls into question the Fed’s carefully cultivated reputation for a dispassionate and methodical approach to setting policy independent of politics. His remarks can further fuel deep state conspiracy theories and embolden Trump who has threatened to fire Chair Powell on numerous occasions. A further intensification of political attacks on the Fed combined with muddled messages on policy could add to market volatility and an already high and rising environment of uncertainty for businesses and consumers. Figure 2 shows two indexes of policy uncertainty, one is calculated based on mentions of uncertainty around all types of economic policy in news reports and one is calculated just for trade policy. Both indexes are at all-time highs and the Fed has reported that its business contacts are increasingly reluctant to invest with the outlook so unclear.

We are at a crossroads for monetary policy

I wrote a previous blog post on the history and value of the Fed’s independence in the wake of political attacks from the current Administration. Some degree of political pressure is not new, and the Federal Reserve Act structured the Federal Reserve System such that policy makers could formulate regulations and policy independent of short-term political pressures. Central bank independence became the norm globally in advanced and many emerging economies in response to the high inflation and low growth of the 1970s when central bankers were generally thought to have been too responsive to political pressures.

Figure 2: Rising Policy Uncertainty Could Dampen Investment, Hiring and Spending

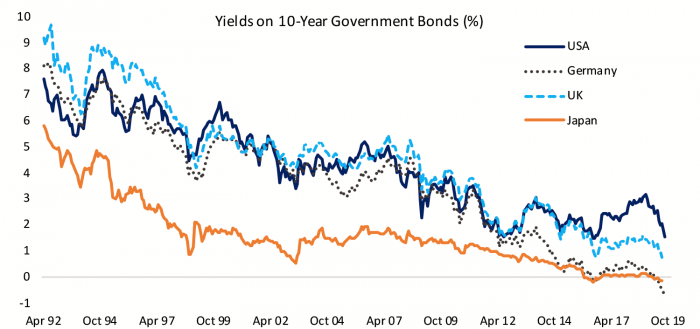

Intensifying political attacks on the Fed come at a time when there is a rising mantra among economists that monetary policy is running out of ammunition and countries should rely more on fiscal policy to smooth the ebbs and flows of business cycles. Limited monetary policy space is an obvious conclusion given that interest rates are the Fed’s primary policy tool and rates have fallen dramatically around the world (Figure 3). Yet it is also the case that the political environment in the US and elsewhere has also become more divisive and dysfunctional suggesting limitations to reliance on fiscal policy.

The tools of monetary policy have been in a constant state of evolution. If the current configuration of tools isn’t optimal to achieve the desired outcome of a stable financial system, stability in the purchasing power of the currency, and growth as close to the economy’s potential as possible, the central bank should not declare itself impotent as suggested by former Treasury Secretary Larry Summers and Harvard PhD candidate Anna Stansbury ahead of the annual Jackson Hole gathering of central bankers in August. Instead central bankers should ask for new tools appropriate to the current structure of the economy in order to achieve their mission.

A greater role for fiscal policy is sensible in a low rate, low growth environment, however it would also be wise to expand the central bank’s toolkit so they can continue to be responsible for managing business cycles in a politically independent way. Monetary policy independence has paid dividends through low inflation and inflation expectations and is better positioned to respond to cyclical swings in the economy in a timely and focused way.

A new proposal by Blackrock’s head of macro research Elga Bartsch, former Deputy Governor of the Bank of Canada Jean Boivin, former Fed Vice Chair Stanley Fischer, and former Chairman of the Governing Board of the Swiss National Bank Phillipp Hildebrand advocates for the creation of a standing fiscal facility financed by “helicopter money”, that is financed by the Fed through money creation instead of borrowing. This is precisely the mechanism that has led to hyperinflation and currency crises in small, emerging market countries throughout history, however the authors argue that it is more appropriate and manageable in the low growth, low inflation environment advanced economies find themselves in. They recommend the fiscal facility only be deployed only when interest rates hit the zero lower bound and that continued use of inflation targeting will ensure the use of such a facility is limited.

Figure 3: Interest Rates Have Fallen Around the World

These are challenging times for the economy and economic policy, but history is full of continued policy innovation that begets improved economic management and performance. The Blackrock paper notes that the essence of helicopter money is to put central bank created money directly in the hands of spenders, whether they be households, businesses or the government, rather than relying on indirect stimulus through interest rates and financial conditions more broadly. Configurations other than the one they suggest are also possible and should be discussed before the next recession is upon us to ensure monetary policy remains above the political fray and focused on the medium term interests of the economy.