Photo credit: Claudia Totir (gettyimages)

Eliminating SALT deductions may make tax cuts less tasty for the coasts

The House and Senate have each passed a version of legislation that will cut taxes by $1.5trn over ten years. Most of the focus of the legislation is on reducing the corporate tax rate, although there are major changes to individual income taxes as well. Both the House and Senate propose increasing the standard deduction while reducing or eliminating some favored deduction. The House bill limits the mortgage interest deduction (“MID”) and the deductibility of property taxes. The Senate bill keeps the MID but completely eliminates the deductibility of property taxes. Both bills eliminate the deductibility of state and local income taxes. In this blog I examine the motivation for reducing or eliminating these deductions, as well as the possible economic impact. I argue that one of the real economic functions of the MID and state and local income and property tax (“SALT”) deductions is to adjust the tax code for geographic differences for the cost of living. Our tax code is progressive based on the idea of vertical equity; that people should be taxed according to their ability to pay. Yet the tax code doesn’t account for the fact that many people earn higher incomes because they live in high cost of living areas. Limiting the MID and SALT deductions would be progressive changes to the tax code, but they would also reduce the role they play in leveling the playing field of real tax burdens. The burden of this change would be borne disproportionately by Democratic leaning states along both coasts including the tri-state area, as well as a handful of states in the Midwest.

The Current State of Play: A Rush to Move a One-Party Plan Forward

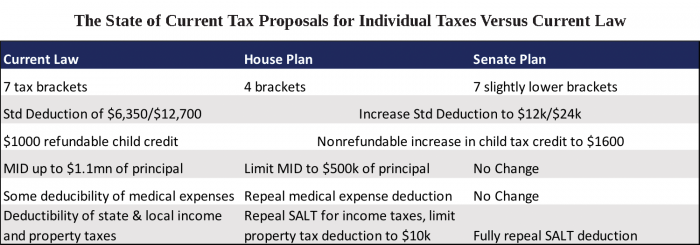

Table 1 shows the major provisions for individuals in the House and Senate plans relative to current law agreed to last week. These plans are scaled back relative to earlier proposals and there are still significant differences between the two versions that need to be reconciled. More than likely passage of legislation will slip into early next year. Passage is more than likely, but not a forgone conclusion depending on how much resistance Congress faces on various provisions. Any move to restore favored deductions would limit the amount of reduction in the corporate tax rate that can be financed under the $1.5trn cap and passage will require the nearly unanimous support of Republican Senators since the bills will likely not garner any Democratic support. As with health care the Senate will hold the key suggesting the provisions of their plan may be more likely to survive reconciliation of the two bills.

New administrations that come to Washington with hopes of implementing changes to tax policy look to a schedule of tax expenditures for potential sources of revenue. Tax expenditures are calculated as the revenues the federal government loses because of various deductions, taking as a baseline a straight application of income tax rates with only the standard deduction and dependent exemptions. The Treasury produces a schedule of tax expenditures every year and it reads like a menu for earnest tax reformers. Expenditures for the deductibility of social security benefits are large ($34.5bn in fiscal year 2017) but considered off limits, while deductions for interest in state and local government bonds ($19.9bn in FY 2017) are generally considered to be protected by the Constitution and therefore are questionable as an “expenditure”.

Among the multitude of tax expenditures, the mortgage interest deduction and the deduction for state and local taxes perennially tempt politicians as they look like low hanging fruit given the large amount of tax revenue their elimination could generate. The MID “cost” the federal government $65.6bn in FY 2017 and is projected to reduce revenues by $1trn over the ten-year budget horizon. The SALT deduction cost the federal government $33.7bn in FY 2017 revenues for the deduction of property taxes and $70.4bn for income taxes, and is worth a combined $1.5trn over the next ten years. Another tempting target is the $86.8bn expenditure for the deductibility of contributions to 401ks and IRA retirement plans. Eliminating deductibility of retirement contributions was included in the Administration’s early proposals but was scrapped.

The Economics of Tax Expenditures and Tax Reform

Economists generally think the tax code should be as simple as possible so as not to distort incentives. A simple consumption tax is generally embraced as the gold standard by economists of various political stripes because it encourages saving, and therefore investment, maintains progressivity, and is agnostic about what consumers should or shouldn’t buy. Yet the tax code has developed more as an accident of history than the result of a comprehensive planning exercise, and as a result the tax code has developed into a complex morass of provisions that may or may not achieve their stated objective. There have been numerous bipartisan attempts at comprehensive reform through the years but often the roadblock is that the transition to a fairer and more efficient tax system nonetheless involves some people paying a price as the rules change.

The MID has been a perennial target of tax reformers in part because its elimination could raise a significant amount of revenue, but also because it is widely viewed as regressive and ineffective in promoting the goal of homeownership. The nonpartisan Center on Budget and Policy Priorities notes that 77 percent of the benefits of the MID went to homeowners with incomes above $100,000 while close to half of homeowners with mortgages, most of them middle- and lower-income families, receive no benefit from the deduction. Our own Morris Davis has also written eloquently on the topic pointing out that not only is the MID regressive, it does not contribute to the policy goal of homeownership since most of those claiming the credit could afford a home without the deduction. Another objection is that it incentivizes higher debt levels.

While few policymakers or economists would choose the current MID as a way to achieve housing goals, nonetheless its elimination is opposed by housing groups including realtors and builders. These groups believe that the reduction of the subsidies to homeownership though the elimination of the MID and the deductibility of property taxes would likely hurt home prices and potentially dampen demand. The Administration’s answer to these objections is that a larger standard deduction will help offset the hit to middle income taxpayers. Prior tax reform efforts including the bipartisan Simpson Bowles Plan have proposed limiting the hit to housing while improving distributional outcomes and efficiency by converting the MID to a refundable tax credit for mortgage interest, reducing the amount of interest it covers, and making second homes ineligible. The elimination of the MID may not survive in the current go around since it is not included in the Senate bill, and keeping it out may be the cost of achieving the elimination of the SALT deduction for income and property taxes.

The SALT as a Poster Child of the Messy and Unintended Consequences of our Tax Code

The deductibility of state and local taxes has an even longer and more complex history than the MID, one which swings from one side of the political spectrum to the other. The SALT deduction has its roots in the historical tension between state and federal control since the founding of our country. The modern federal income tax didn’t come into existence until 1913. Earlier attempts were fought at the state and local level and was even found to be unconstitutional in the late 1860s. Deductibility of state and local taxes was included from the beginning on fears that federal taxation might usurp resources available at the local level.[1] The SALT deduction was originally the purview of defenders of states’ rights who might question the inclusion of state and local deductibility as a tax expenditure, as it suggests the deduction comes at the courtesy of the federal government rather than the historical reality that it was a compromise that allowed a federal tax to come into existence.

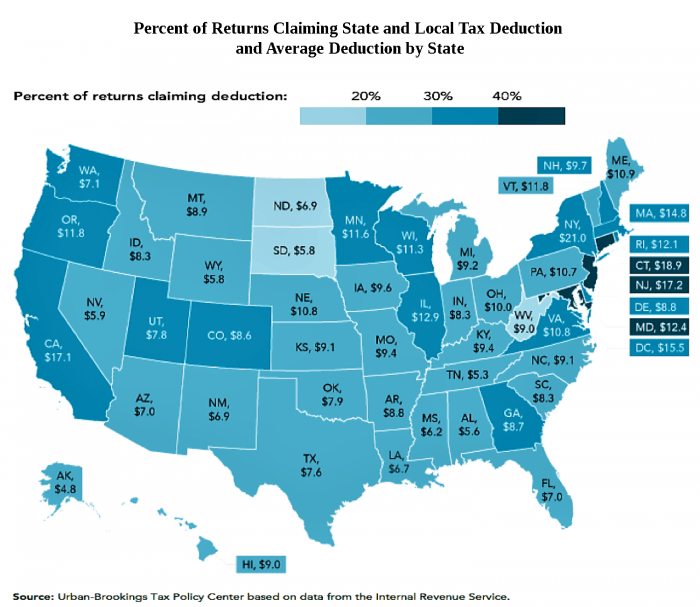

In the current legislation, Republicans, typically defenders of states’ rights, are pushing for the elimination of the SALT deduction. It is very much a political strategy given that the bill will pass along party lines and the tax payers that will pay higher taxes as the result of the removal of the SALT deduction are concentrated in high tax states that predominantly vote Democrat. The map in Figure 1 shows the percent of tax returns claiming the SALT deduction and the average amount claimed by state. Roughly 30% of filers itemize deduction nationally, and nearly all that do claim the SALT deduction. Figure 1 confirms that Democratic leaning states will bear the disproportionate burden of the elimination of the SALT deduction.

The economics of the SALT deduction are complicated, and ultimately intertwined with the MID. Economist David Albouy described in a seminal research paper that ideally the tax code wouldn’t distort people’s incentives about where to live.[2] A tax applied to nominal incomes without taking into account the cost of living means the federal tax burden is disproportionately borne by people in high cost of living areas. This would meet the standard of vertical equity, the idea that people are taxed relative to their ability to pay, if productivity of the local economy were the primary driver of differences in nominal across geographies and therefore represented real differences in economic well-being.

In reality there are significant differences in cost of living that are unrelated to real economic well-being, and this has been an ongoing issue in discussions of tax reform. New York Senator Chuck Schumer is fond of pointing out that an annual household income of $250k might make you rich in Mississippi, but much less so in New York. For decades there have been discussions about indexing the tax system for cost of living, however this would be extremely complicated logistically. The calculation of cost of living would be scrutinized by politicians and it is not clear what level of geographic granularity in indexes would be appropriate. The optics of granting larger cost of living offsets to Democratic strongholds would also complicate implementation of such an approach regardless of its merits.

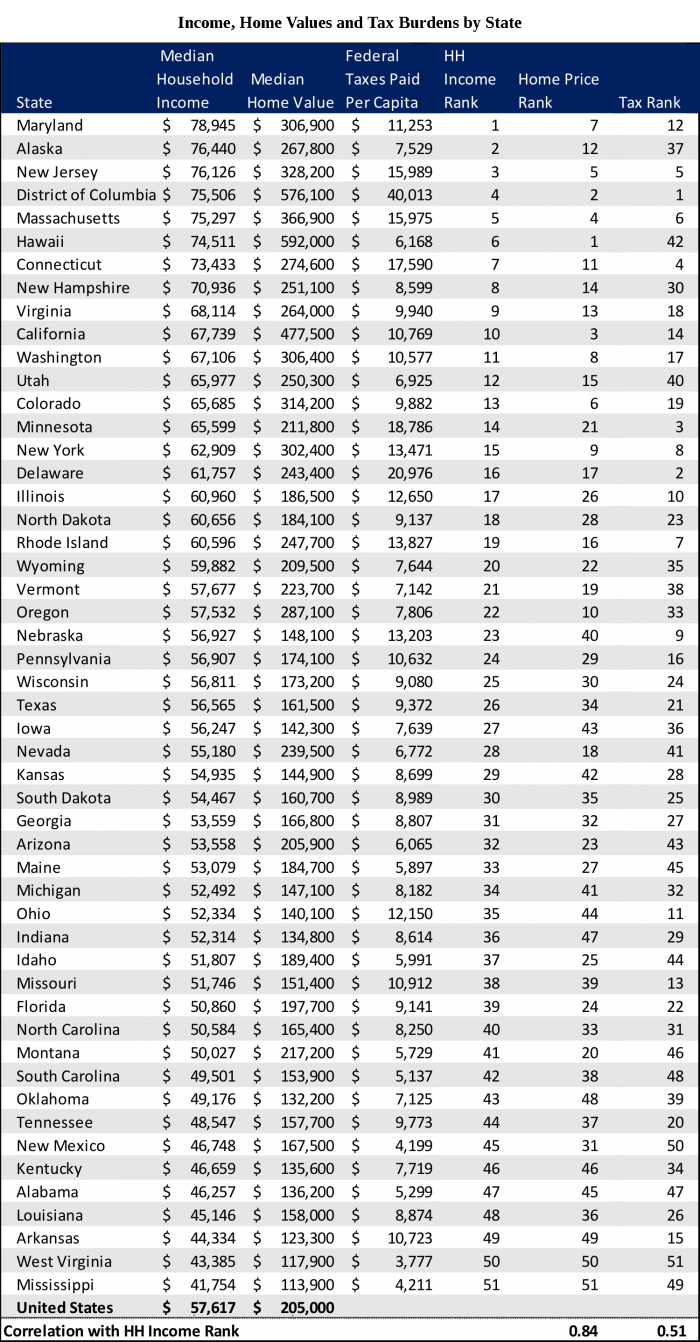

The MID is not particularly effective in achieving housing policy goals, and the SALT deduction is a reflection of how the US developed as a nation, but the two deductions combined effectively act as a cost of living adjustment to the federal tax code. This can be seen in Table 2 which shows median income, home values, and federal taxes per capita by state. There is a large dispersion in median household incomes across states with the median income in Maryland nearly twice that in Mississippi. That dispersion is also reflected in home prices with the median home price in Maryland 2.5 times the Mississippi value, and while not uniform the correlation between median income and home value is 84% suggesting that a considerable portion of the variation in incomes indeed reflects cost of living and not differences in the real standard of living. The table also shows federal taxes paid per capita by state, and while there is a correlation between taxes paid per capita and median household income, it is just over 50% suggesting that some of the deductions available to households effectively adjust for differences in cost of living. Some of the remaining correlation could reflect that higher income cities and states are more productive and better off in a real sense and therefore subject to the progressivity of the tax code.

The elimination of the SALT deduction would disproportionately offset the other provisions of the tax cut in New York and New Jersey. New Jersey has the fifth highest marginal income tax rate in the country and New York the eighth highest. Meanwhile New Jersey also has the highest property tax rates in the country and New York has the eleventh highest rates. The think tank New Jersey Policy Perspective calculated that 1.8 million New Jersey households deducted a cumulative $17 billion in state income or sales taxes from their federal taxes, while 1.6 million New Jersey households deducted $14.9 billion in local property taxes. Eliminating the SALT deduction would skew the benefits of the tax cut to low tax states and could result in tax increases for many households.

The federal tax code is a complex and capricious beast and both political parties have attempted to simplify and reform ever since the last real tax reform in 1986. Instead the tax code has gotten more complex and laden with provisions that attempt to achieve social policy outcomes through tax policy, but can end up in a potpourri of deductions and credits that interact with and at times offset each other. The proposals currently on the table are a rushed single-party effort that would result in a tax cut, but not real tax reform as the bills themselves are a mishmash that leave much of the complexity in place and whose provisions phase out after ten years. The MID may survive in its current form or face a small reduction in the limit. The SALT deduction looks to be more at risk since it is included in both bills. Eliminating the SALT deduction is undeniably progressive as only high-income households that itemize their deductions claim it. However it also raises the federal tax burden in higher cost of living areas, a change that could incentivize people to relocate to lower cost of living jurisdictions over time.

[1] See Walczak, Jared, “The State and Local Tax Deduction: A Primer”, The Tax Foundation, March 15, 2017.

[2] Albouy, David, “The Unequal Geographic Burden of Federal Taxation,” Journal of Political Economy, vol. 117, 2009.