Where the economy lives: Insights from the recent housing conference

Last week Rutgers’ Center for Real Estate held a conference at the New York Stock Exchange on the outlook for housing that was attended by homebuilders, mortgage bankers, investors, current and former policymakers and academics. The combination and depth of experience yielded valuable insights. Industry participants remain optimistic despite a number of headwinds including rising rates and some reduction in the tax advantages of homeownership. They generally agreed that the biggest problems are on the supply side: Builders can’t source the workers they need to keep pace with demand, and a trend toward increased restrictions and regulations at the local level in the metro areas where people want to live is slowing their ability to keep pace with demand. In this blog I discuss what I learned at the conference about the creative solutions of industry participants to these challenges, as well as other insights gleaned on the disruption from Fintech and the industry’s response to the corporate tax cut, sprinkling in my own macroeconomic view of the world. The housing industry has come through the fire of the housing crisis and appears to have maintained greater discipline and flexibility to respond to continuing challenges.

Construction Industry Laboring to Find Labor

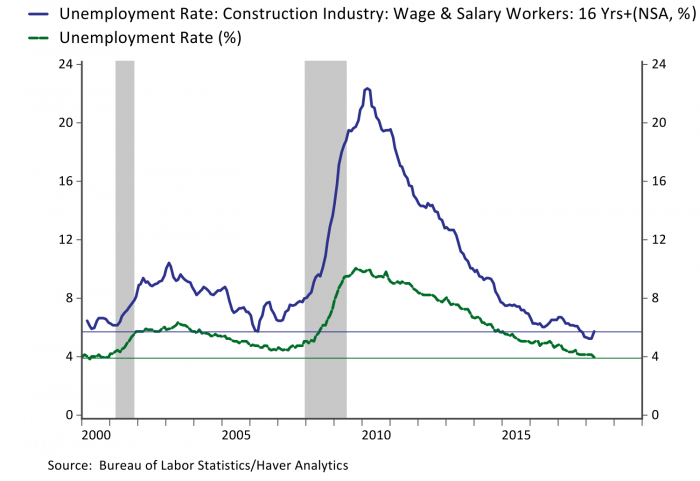

When asked what keeps him up at night, the head of a large national homebuilder responded, “three things: labor, labor and labor.” We know from national statistics and anecdotal reports such as those summarized in the Fed’s Beige Book that the labor market is tight and employers report shortages of workers with the skills they need, and also that these conditions are particularly acute for the construction industry. Figure 1 confirms that the unemployment rate in the construction industry is at levels seen at the peak of the housing boom in 2005. However, the construction industry does not appear to be experiencing greater tightness than other industries; the unemployment rate in construction is generally higher than the national average, and the current gap between the unemployment rate in construction and the national unemployment rate is in line with historical averages after rising far more than other industries during the housing crash.

Figure 1: The Labor Market for Construction Workers is Tight

According to homebuilders at the conference the tight conditions are being felt across regions, and strong labor markets across industries mean it is difficult to source workers from other industries. Business people are reluctant to make public statements on politics, but it was clear from the discussion that the Trump Administration’s immigration policies are exacerbating an already challenging environment, and that they don’t get a sympathetic ear when their concerns are brought to Administration officials.

One public example of more constraining immigration policies has been visa approvals under the H2-B program for seasonal workers. The number of H2-B visas is capped at 66,000, but applications for the program vary systematically with the tightness of the labor market. In 2009-2010 applications were below the cap, but since then applications have been rising and Congress routinely passes temporary increases to accommodate labor demand. In 2015 for example Congress made an additional 198,000 visas available. This year the Department of Labor reported more than 81,000 applications for summer work alone, and the Trump Administration has introduced a lottery system to allocate the scarce visas. While the recent spending bill passed by Congress in March increased the cap to 130,000 for the year, by many accounts these have been slow to be processed, leaving segments of the agricultural, tourism and construction industries short on labor as the summer approaches.

What are homebuilders doing about the worker shortages? Homebuilders reported a number of efforts to enhance the productivity of the construction process, including a dramatic reduction in the number of floorplans sold. One national homebuilder reported reducing the number of floorplans under construction from 3,000 several years ago to just 500 now. In addition, homebuilders are making their designs more modular with an increasing number of components that are manufactured and then brought to site for assembly, which in turn facilitates automation in the manufacturing process. The Bureau of Labor Statistics doesn’t currently publish measures of productivity for the construction industry because the industry is so diverse that it is hard to construct meaningful summary measures. Nonetheless, researchers at the BLS have recently turned their attention to the issue and indeed found evidence of rising productivity in the construction industry, particularly in the multifamily sector.

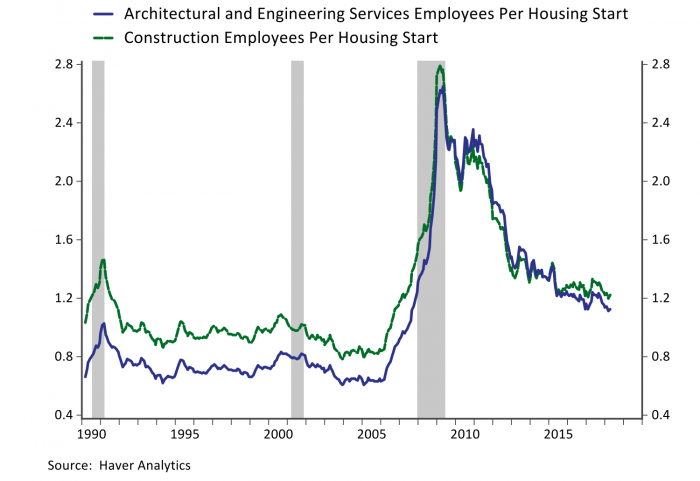

Figure 2: The Number of Workers Engaged Per Housing Unit Started is Declining

Figure 2 plots a crude measure of productivity in residential construction by dividing the number of workers employed in construction, as well as those employed in architectural and engineering services divided by the total number of single and multi-family housing starts. This measure shows a dramatic deterioration in the number of workers employed per housing unit started during the Great Recession and housing bust reflecting a decline in construction activity far greater than the number of workers employed followed by a steady decline. This crude productivity metric hasn’t yet reached the norms of the 1990s and 2000s, suggesting there may still be the possibility for the construction industry to reduce the number of employees engaged per housing start as they continue to expand activity.

Optimism on Demand Housing Despite Growing Headwinds

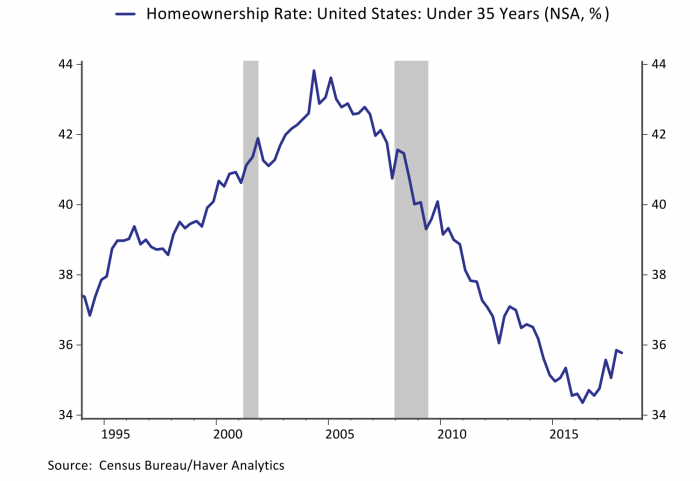

Homebuilders reported seeing strong demand from first-time homebuyers and retirees, and they expect that demand to remain robust despite rising mortgage rates. Genworth Mortgage Insurance has been tracking data on first-time homebuyers which confirm that the share of first-time homebuyers has risen from an average of around 28% early in the recovery to just shy of 40% in H2 2017. Figure 1 also confirms that homeownership among households under the age of 35 started to rise last year after a decade of decline. The improvement in demand reflects both the facts that millennials are aging and their economic prospects are improving. There was general agreement among builders and those working in mortgage finance that millennials aren’t different than prior generations, but that their development has been delayed by the depth and severity of the Great Recession. There was optimism that they can catch up to the homeownership norms of other generations if the economy continues to run strong.

Figure 3: Millennials are Starting to Move into Homeownership

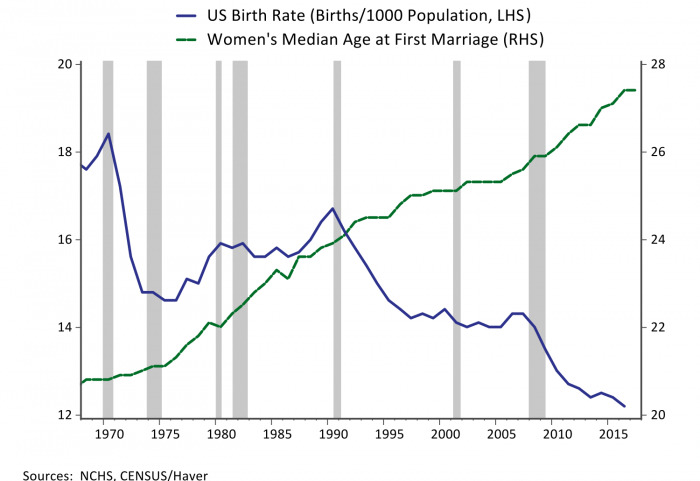

There are dimensions where the millennials differ from prior generations in a way that will continue to affect their housing decisions. The median first age of marriage for women which has been on an upward trend for decades (Figure 4), but the pace of that trend accelerated in the aftermath of the Great Recession. An even more striking acceleration occurred in the pace of decline in the US birth rate, which had stabilized from the mid-1990s through 2007 and has since plunged to new lows despite aging and increasingly prosperous millennials. While homeownership may be on the rise, the size, types, and locations of the homes desired by the younger generation may differ in important ways from their predecessors.

Figure 4: Women are Marrying Later and Having Fewer Babies

Another “aha” moment I enjoyed at the conference was when a senior executive from one of the large mortgage originators discussed the new generation of homeowners and how they are much more likely to be non-white, and/or Hispanic. One challenge this presents to mortgage lenders is that many of these potential homebuyers live in multigenerational households with multiple earners. Figure 5 shows an often-cited trend of the increasing share of adult children aged 25-34 living with their parents. Economists have largely discussed this trend in the context of the Great Recession and the devastation to the labor market that came with it. However, the upward trend in cohabitation began well before the Great Recession and has continued apace despite the improvement in the job market. A deeper parsing of the statistics would be necessary to draw firm conclusions, but it is possible that this trend is more cultural than economic and therefore more likely to continue.

Figure 5: The Trend of Adult Children Living at Home Continues Despite a Strong Economy

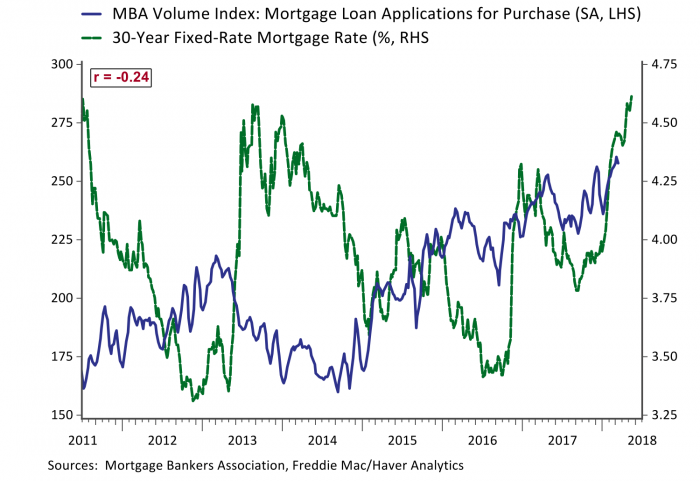

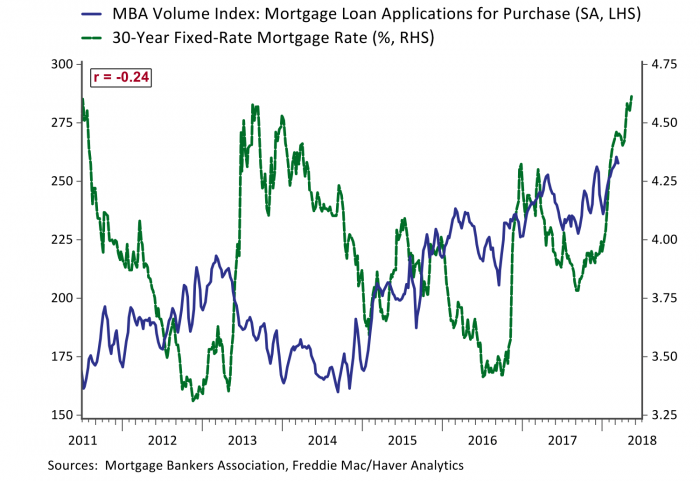

Industry professionals were optimistic that housing demand would continue to grow despite mortgage rates that rose last week to their highest level in seven years. One homebuilder suggested mortgage rates could rise from their current level just north of 4.5% to as high as 5.5% or 6.0% without significantly denting demand. Figure 6 confirms that, in contrast to the taper tantrum in interest rates in 2013, applications for mortgages for the purchase of a home continue to trend higher despite rising rates. Not surprisingly, the same cannot be said for refinancing activity, which dropped precipitously and has continued to decline as rates rose in late 2016. Mortgage originators confirmed that the shifting mix of demand for mortgages and the uncertain outlook for interest rates left them making tricky decisions about how much overall origination capacity to maintain.

Figure 6: Housing Demand Has Continued to Improve Despite Rising Rates

Technology Disruption Comes to the Mortgage Industry

An Executive from one of the large banks that originates mortgages confessed that Quicken Loans has grown their market share faster than expected. They didn’t think customers would be comfortable or satisfied with an online-only mortgage origination process. To use a buzzword from retail, the response of bankers is to go “omnichannel” and compete by offering both online and branch services. They are finding customers appreciate having both options. Increased options for consumers has meant more competitive pricing of mortgage origination services.

Tax Cut Mainly Being Returned to Shareholders

Housing industry executives at the conference indicated that share repurchases and dividend increases were at the top of the list as uses of the gains from the recently enacted corporate tax cut. Capital investments are the result of complex decisions in a highly competitive industry. There is likely to be some increases in investment at the margin, but homebuilders stressed they are mainly sticking to their plans and their disciplined investment process. S&P Dow Jones Indices estimate that share buybacks hit a record $178bn in Q1 and could total up to $1trn in 2018 in addition to a rising number of companies announcing increased dividend payouts. Returning value to shareholders directly in this manner is accretive for equity valuations but suggests less of a boost to GDP growth.

Overall, the conference featured a disciplined and creative group of industry participants that have to stay on their toes given the fierce competition in this highly cyclical industry. The industry has learned from the past and has thus far successfully tackled the changing economy and uncertain outlook and are optimistic they will continue to do so.