Record closings and bankruptcies may signal a changed environment

This year has been dubbed the retail apocalypse by many analysts and observers owing to record numbers of store and mall closings and retail bankruptcies. Yet this doesn’t appear to be a sign of cyclical weakness, rather it is a reflection of transformative changes in how and where consumer goods are made and priced, and how consumers shop and what they shop for. These changes are happening at lightning speed leaving retailers scrambling to adjust. These changes are also disrupting the cyclical economic models we have come to rely on. In this blog we document some of the underpinnings of these changes. In the next blog we will look at what this means for the landscape of retail real estate.

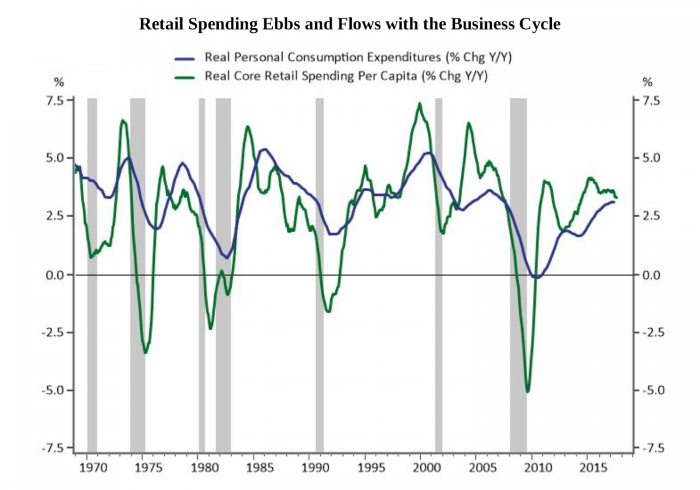

The health of the US economy is largely driven by its consumers as consumer spending accounts for 69% of US GDP. Consumers are also at the heart of the business cycle and are therefore closely watched as a barometer of where the economy is heading. Many things consumers spend the bulk of their money on are relatively fixed and follow stable trends, including housing, education and medical care. The ebbs and flows in consumer spending across business cycle are concentrated in discretionary spending (Exhibit 1). In this blog we will refer to core retail spending, which includes most items consumers can freely choose to spend money on, or not. What we will refer to as core retail spending is a category called retail control group by the Bureau of Economic Analysis. It includes electronics, sporting goods, clothing, furniture and restaurant meals. While it excludes groceries and motor vehicles, it does include some other basic, less discretionary items such as prescription drugs, cleaning supplies, and personal care products.

Since consumers make active choices on core retail spending, it is an industry subject to intense competitive pressures as retailers vie to win the hearts and dollars of fickle consumers. The retail industry has been subject to several major structural changes in recent decades that have intensified of late leading many industry observers and analysts to dub 2017 the “retail apocalypse”. As Exhibit 1 illustrates, it is not the case that consumers are pulling back on retail spending, rather changes in global competition, technology and consumer preferences have evolved faster than many retailers’ ability to change their business models leading to thousands of announced store closures, dozens of mall closures and at least nine major retail bankruptcies in 2017 alone. In a following blog we will focus on the impact of the retail apocalypse on the retail real estate. In this blog we examine what is at the root of changes in how consumers are spending their money.

Globalization and Getting More for Less

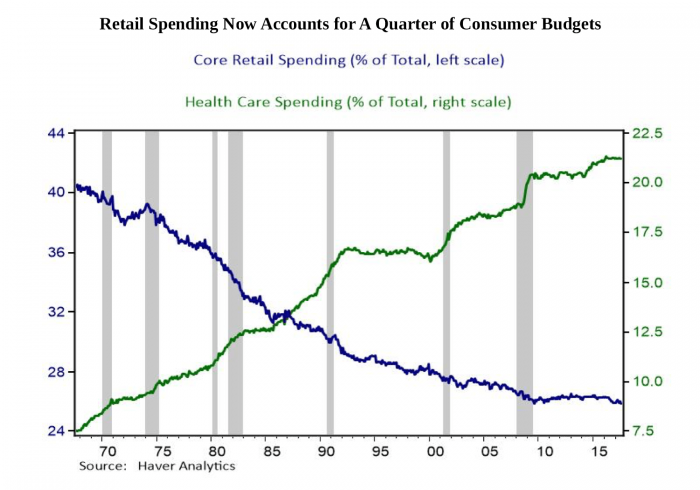

The share of the consumer budget dedicated to core retail spending has declined from 40% to 26% over the past 50 years (Exhibit 2). Offsetting this trend has been a rise in spending on healthcare which has risen from 7.5% on consumer budgets to 21%. Prices have a lot to do with the changing budget shares as the globalization of manufacturing allowed the prices of goods to decline as rising health care costs meant consumers had to spend more to get the same services.

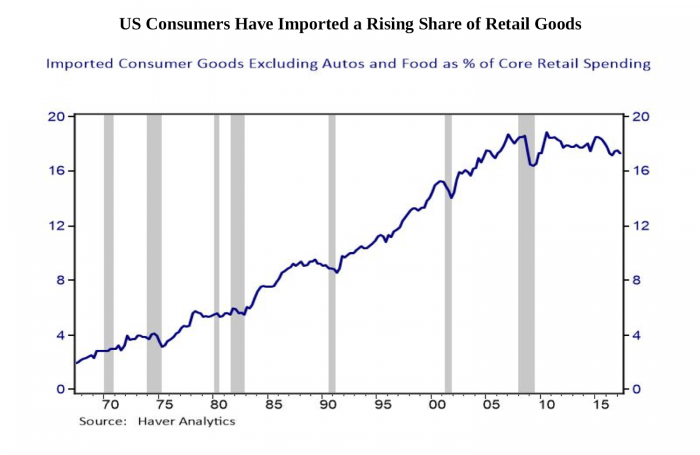

The rise in the share of consumer goods coming from abroad increased steadily from the late 1960s through the years just prior to the Great Recession (Exhibit 3). Since 2007 the share of imported goods has been relatively steady around 18%, although that share understates import content since many consumer goods feature imported parts that are then assembled domestically.

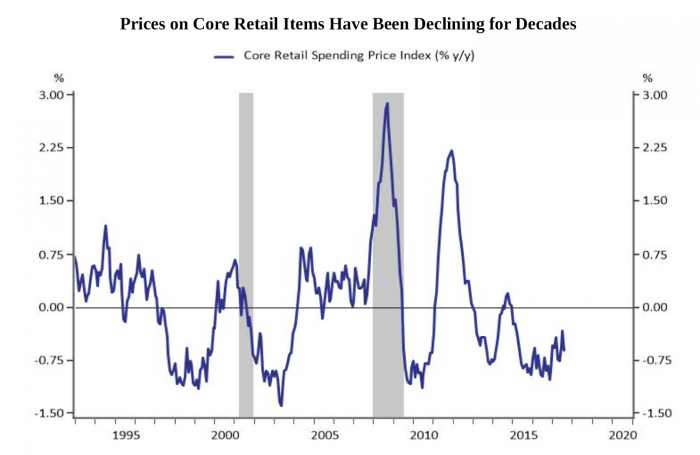

The rise in the imported share of consumer goods was fairly steady over several decades. However, the entry of China into the World Tarde organization in 2001 opened up a sizable frontier of lower cost production. Exhibit 4 shows the annual pace of price increases on all core retail spending. In recent decades falling prices for many consumer goods has been the norm, including prices for clothing, electronics, sporting goods and furniture as cheaper international production allowed consumers to enjoy more for less. Prices of clothing are 2% lower than they were in 2001 even as consumer prices excluding food and energy are nearly 70% higher. Consumers own more televisions, computers, and cellphones per household even as the share of their budget devoted to spending on these items has declined. While the falling prices associated with globalization of production has allowed consumers to consume more for less for decades, Exhibit 2 highlights that the share of the consumer wallet going to core retail spending has been pretty steady for a decade. The current retail apocalypse has more to do with how consumers spend their retail dollars.

The Digital Revolution

The globalization of production is one mega trend that has affected where consumer goods are produced and how they are priced. Another trend that has occurred nearly simultaneously is technology and computerization, which has facilitated a significant degree of automation in production as well as the optimization of communication and production processes.[1] Even as the process of the globalization of production to lower cost producers has slowed as we close in on reaching the full potential benefits, the impact of technology has accelerated of late and has begun to transform not only how we produce goods, but how we shop for them.

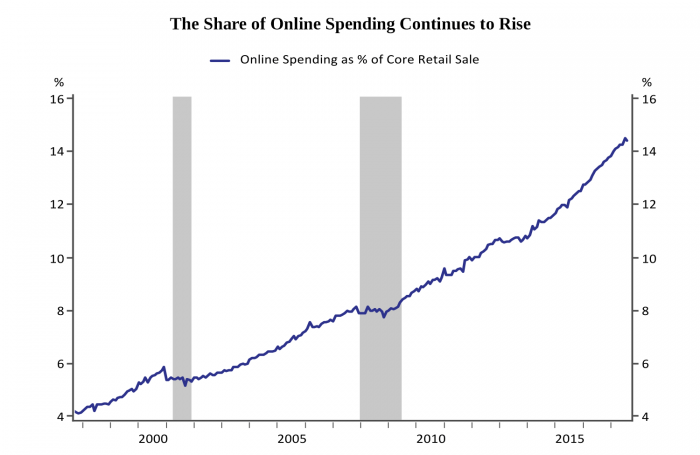

Exhibit 5 shows how the share of online shopping in core retail sales has risen over time, and there is no indication that this transformation in how consumers obtain the goods they want is slowing. The penetration of smartphones not only allows consumers to purchase the items they want online, but they can easily comparison shop and seek the best deal so that technology is yet another force taking away pricing power from retailers and allowing consumers to get more for less. Retailers have struggled to adapt by beefing up their online presence or making the in-store experience more enjoyable for consumers, but many have struggled to keep up leading to the acceleration in bankruptcies and store closures this year. These types of events in the past would be taken as a sign of cyclical weakness in the economy, yet Exhibit 1 highlights that consumer spending remains robust suggesting that this is instead a structural transformation in consumer preferences facilitated by technological change.

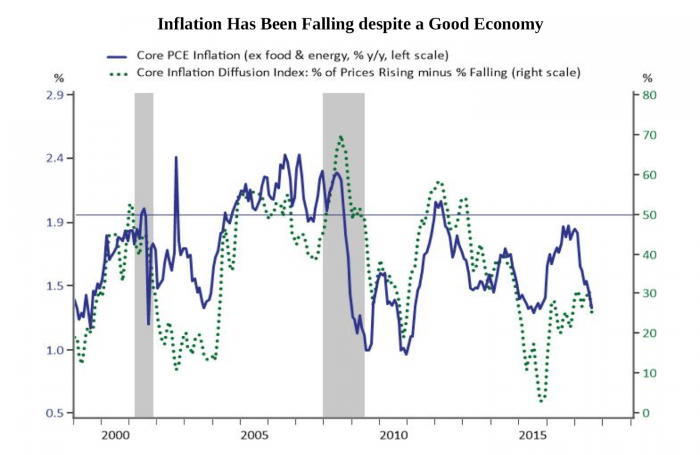

The weakness in retail pricing has also posed a conundrum for central bankers. Typically as the labor market heats up and wages start to rise, albeit very gradually in the current cycle, the pricing power of producers would improve leading the Fed to raise rates to head off inflationary pressures. Yet Exhibit 6 illustrates that core inflation has surprised the Fed by falling back to just a 1.3% annual pace through August, and the diffusion index showing the net of prices rising versus falling indicates an absence of broad based price increases.

Fed Chair Yellen puzzled over surprisingly low inflation in a recent speech. Yellen noted that “the growing importance of online shopping, by increasing the competitiveness of the U.S. retail sector, may have reduced price margins and restrained the ability of firms to raise prices in response to rising demand.” However Yellen also confronted another conundrum, namely that “the economy overall appears to have become more concentrated and less dynamic in recent years, which may tend to increase firms’ pricing power.” By many estimates Amazon accounts for roughly half of all online sales, yet there is no evidence this is leading to greater purchasing power. For now, the Fed seems poised to raise rates again in December, but is watching inflation developments to try and gauge how far interest rates need to rise. The buzz work in the technology world is “disruptive technologies”, by disrupting how people buy things and how producers price them, technology is disrupting the very economic models policy makers look to in making their decisions.

The Disruptive Generation

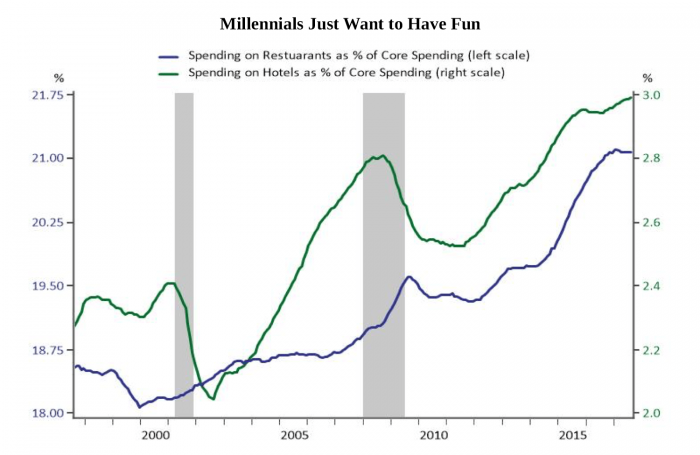

Technology isn’t the only factor disrupting the retail sector, the tastes and preferences of the millennial generation appear to be different from prior generations. Retail analysts frequently discuss the preferences of millennials for experiences over things in contrast to the consumerism of the baby boom generation. A recent poll found that more than 3 in 4 millennials (78%) would choose to spend money on a desirable experience or event over buying something desirable. Exhibit 7 documents this shift by charting the share of core retail spending going to restaurants and hotels, both of which are on strong upward trends and are at, or close to all-time highs even as the share of retail spending on clothing has hit an all-time low this year. The fact that there is an observable shift to experience spending in the aggregate suggests the shift may not be unique to millennials. This shift has left retailers scrambling to figure out and deliver what the millennial generation wants as they enter their maximum consumption years. Will millennials revert to more traditional spending patterns as they marry, buy homes and have kids, or will this phase of life be a new frontier of preferences that continue to challenge retail business models?

With major shift in where and how consumer goods are made and priced, and in the way consumers consume, the retail sector is scrambling to reinvent itself. In the next blog we will examine what this means for retail real estate.

[1] A recent extensive international project has produced a variety of papers and analysis looking at the effects of the rise of China on the economy and society. Researchers led by David Autor, David Dorn, and Gordon Hanson have looked at the separate and joint impacts of technology and globalization on production and labor markets.