Markets grapple with the uncertainty of a deteriorating fiscal outlook

In a blog post a few weeks ago we wondered how long the stock market could continue to reach new highs against a backdrop of tightening monetary policy and increased federal deficits that were likely to push interest rates higher. The timing of the blog was unexpectedly prescient, and the stock market has officially moved into correction territory (defined as a decline of at least 10%) in recent weeks. In this blog we ponder what rising federal deficits mean for the economy. Economic theory suggests that deficit-financed fiscal spending will crowd out private activity through higher interest rates, and markets are starting to confirm this prediction. Higher rates may dampen investment in real estate, business fixed investment and consumer spending, at least partially offsetting the intended stimulus from tax cuts and increased government spending. It is reasonable to think the US economy can withstand greater market volatility and register a solid performance, but uncertainty around the outlook has notched up since the start of the year.

Epic Fiscal Debauchery in Washington

Last week Congress passed a spending bill that raises the caps that have been in place to limit federal spending by $300bn over the next two years and provide $90bn in hurricane relief and lift the debt ceiling to accommodate the federal largess. The bipartisan budget deal comes on top of the Tax Cuts and Jobs Act that the nonpartisan Joint Committee on Taxation estimated would add close to $1.5 trillion to the deficit after factoring in any increase to revenues that might result from the resulting boost to growth.

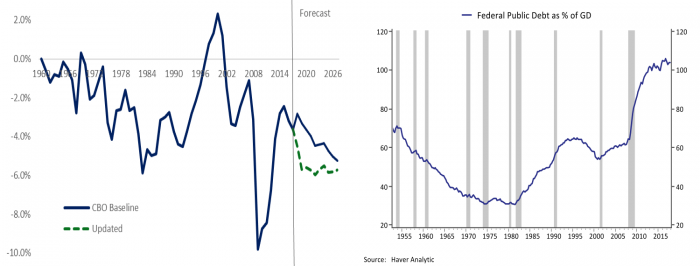

Later this month the Congressional Budget Office will release updated projections for the federal budget deficit that reflects the new legislation. The left panel of Figure 1 plots the current CBO baseline projection under current law. It shows that even before the recent round of fiscal expansion budget deficits were projected to expand from $693bn or 3.6% of GDP in 2017 to $1.5trn or 5.2% of GDP by 2027 as the retiring baby boomers lead to rising deficits in Medicare and Social Security programs. Also included in the graph is my preliminary estimate of how that projection might change under the new tax and spending bills. Under the new legislation, the deficit will likely widen to close to $1trn or 4.5% of GDP this year and to close to 6% of GDP by 2019 where it will stay for the remainder of the 10-year budget window. The US has run larger deficits as a percent of GDP in the past, but only temporarily during deep recessions rather than on a sustained basis. The CBO projects current law on spending and taxes without factoring in a future recession, and so the projections should be seen in some senses as a best case scenario as the public will expect fiscal support during the next downturn.

Set to Deteriorate on Tax Cuts and Increased Federal Spending, Adding to Debt

Another concern with running large deficits over the foreseeable future is that the US already has a large debt burden. The right panel of Figure 1 shows total federal debt outstanding as a % of GDP, which stood at 103.8% at the end of 2017: nearly 50% higher than the federal debt burden at the end of World War II. Total public debt includes Treasury bonds and nonmarketable bonds issued to government trust funds including the Social Security and Medicare trust funds, as well as federal employee pension funds. It doesn’t include the unfunded liabilities of the federal entitlement programs, which will have to be financed by additional borrowing from the public. The federal debt burden doubled through the sustained deficits run during the 1980s, then stabilized with the boom of the 1990s that brought a brief period of federal surpluses, and then grew rapidly with the massive fiscal stimulus implemented during the fiscal crisis. In recent years political gridlock and purported concern about rising federal debt again stabilized growth in the public debt burden. However concerns over fiscal sustainability were apparently purged by the recent election, and the sustained deficits shown in the left panel could add another astonishing 50 percentage points to the federal debt burden relative to GDP over the next decade without even factoring the impact of a possible recession.

Is Money Really Free?

Is there a cost to running humongous deficits as far as the eye can see? Any introductory economics textbook teaches that government budget deficits can crowd out private investment and lower the economy’s potential growth rate. The much used textbook “Macroeconomics” by Harvard professor Greg Mankiw discusses how the demand for funding created by government deficits creates competition for the existing supply of saving, or “loanable funds”. Increased demand for loanable funds in turn pushes up interest rates and crowds out some of the private investment that would have otherwise been financed.

There are a number of caveats to the simplest version of crowding out. Mankiw comes from the more conservative, or neoclassical school of economic thought that has tended to cast a skeptical eye on the value of fiscal stimulus. Another classic textbook by more liberal Keynsian economists William Baumol and Alan Blinder concurs that “a larger national debt may lead a nation to bequeath less physical capital to future generations.” The channel is the same; higher deficits mean higher interest rates and less private investment, all else equal. However, these economists also stress one situation in which deficit spending might actually crowd in investment, and that is during a recession. If there is a significant amount of underutilized resources and a lack of confidence in the economy, government spending can help spur growth thereby creating opportunities that in turn spur investment. Even these Keynsians stress limits to deficit-financed stimulus, noting “the crowding-out effect is likely to dominate in the long run or when the economy is operating near full employment.”

Economists Carmen Reinhart and Kenneth Rogoff have documented the limits to deficit financed fiscal policy. In a paper studying financial crises across 44 countries and spanning 200 years of data Reinhart and Rogoff find that there is a threshold of 90 percent of GDP beyond which there is a noticeable dampening of growth as debt levels rise. A prior paper of Rogoff and Reinhart was found to contain a methodological error, and while their results held upon re-examination, the debate around the limits of fiscal stimulus became politically fraught globally in the aftermath of the financial crisis. Germany leaned toward fiscal austerity in light of the dual European financial crises spurred by excessive borrowing by Greece and Spain even as the IMF and other policymakers urged them to use their greater credibility to provide stimulus for the greater good of the Eurozone. In the US Republicans threatened a default on US debt and shut down the federal government to achieve cuts to spending, while the Democrats urged greater stimulus in light of a halting and subdued recovery.

There are different channels through which large debt burdens can slow economic growth. The first is as predicted by the economic textbooks: rising debt burdens reduce investor confidence leading to higher interest rates and sometimes a self-reinforcing spiral between rising rates, rising debt-servicing burdens, and reduced investor confidence. The risks of debt induced loss of investor confidence are most acute for emerging markets and those that are more dependent on foreigners to finance their deficits. The second channel identified by Reinhart and Rogoff is slower moving and can result from an accumulation of debt over time that leads policy makers to engage in unconventional policies to keep longer-term interest rates from rising. Japan is firmly in the latter category with growth, inflation and interest rates all pegged at low levels and the central bank buying as many government bonds as necessary to keep the yield on their 10-year bond pegged at zero. The US is currently attempting to escape these heavy handed monetary policies even as the debt burden is set to ratchet higher.

Who’s Going to Foot the Bill?

If running large deficits runs the risk of crowding out private investment or leading to a breakdown in investor confidence, why are we going down this road? One answer is we haven’t had to pay the price of government deficits in recent years, and fiscal policy makers may have been lulled into complacency on the risks.

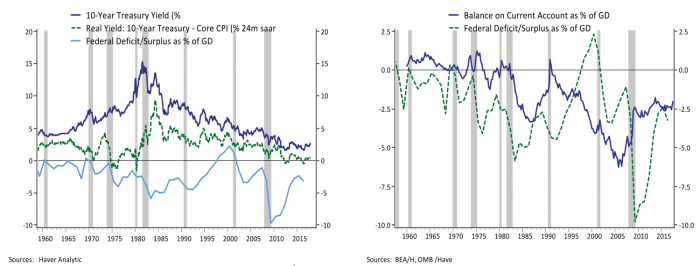

In the 1980s policy makers, investors and economists grappled with the idea of twin deficits, and that phrase has started to make a comeback with the most recent market turmoil. When a country runs a fiscal deficit, they may have to rely on foreign investors for financing. Interest rates rise to attract investors which leads the currency to appreciate, which in turn can lead to a widening trade deficit. Figure 2 highlights that that this was a plausible hypothesis in the 1980s but hasn’t been as clear cut in recent decades. The left panel shows that expanding deficits in the 1980s were accompanied by rising nominal and real interest rates, and the right panel confirms this was also a period of rapidly expanding trade deficits. However, the 1990s saw widening trade deficits despite a government surplus, and the trade deficit narrowed in the financial crisis despite a record federal deficit. The San Francisco Federal Reserve published a nice summary of the research and evidence around twin deficits, and like all good economic analysis the answer to whether widening fiscal deficits will lead to an expanding trade deficit is, “it depends”.

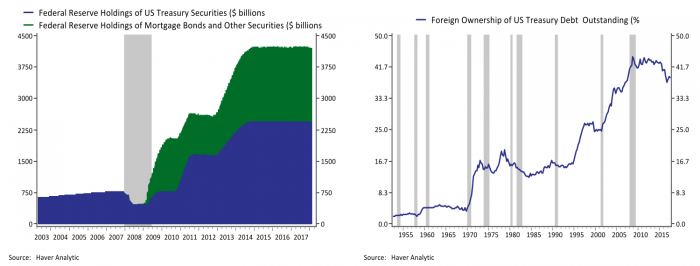

At the risk of oversimplifying, the 1990s featured surging productivity that in turn created growth strong enough to close government budget deficits, even as strong demand widened trade deficits. The combination of strong productivity and narrowing budget deficits delivered a delicious combination of low inflation and low interest rates—it was the best of times. The 2000s saw the return of twin deficits. The return of federal deficits alongside the entry of China into the global trading system meant record trade deficits. However, a seemingly insatiable demand by foreigners for Treasury bonds kept interest rates low. This is the global savings glut that I referred to in my prior (and previous) posts and is illustrated in the right panel of Figure 3 with the share of Treasuries financed by foreign investors nearly doubling between 2000 and 2007. The deficits that came with the financial crisis were financed with the help of the Federal Reserve, which purchased roughly $2 trillion in Treasury bonds and a slightly smaller amount of mortgage bonds and other securities in a bid to keep long-term interest rates low and support the recovery (Figure 3).

While it is barely perceptible in the left panel of Figure 3, the Federal Reserve has already started to reduce its holdings on Treasury bonds and other securities. Since November the Fed has cut its Treasury holdings by $29.5bn and plans a further reduction of roughly $200bn this year and more than $250bn in 2019. This comes at a time when Treasury issuance will more than double and has led markets to start finding a new equilibrium where private foreign and domestic investors are willing to finance federal deficits. The yield on the 10-year Treasury has risen to its highest level since 2014, although it is still low by historical standards.

Rising rates have rattled equity markets that had been supported in part by a Goldilocks scenario of strong growth and low interest rates. The safest thing to say is that there is more uncertainty around the outlook than was appreciated by markets around year end. In the near term, rising interest rates look poised to crowd out at least some of the fiscal stimulus recently put in place. Interest-sensitive sectors like residential and commercial real estate will feel the effects of higher rates, and higher rates will offset some of the recent boost to business investment incentives from the tax cut. Perhaps the more important question is how a rapidly deteriorating fiscal outlook will impact the confidence of the foreign investors that finance a significant portion of US deficits, and at what price they are willing to fund our riskier profile.