Maybe not as much as Wall Street thinks.

Every day news reports seek to ascribe meaning to the day’s market moves. In a market wrap up in February with the stock market registering yet another new high the Wall Street Journal concluded that “investors have been betting that potential tax cuts and fiscal stimulus under the Trump administration will boost corporate profits and keep stocks moving higher.” There was no economic data of note that day, and no news on policy. Why weren’t expectations about the impact of the Trump Administration’s policies already priced in? Why did the stock market register nine new record highs in February with no new developments on fiscal policy? If anything, the news in February was that stimulus might take longer than initially expected.

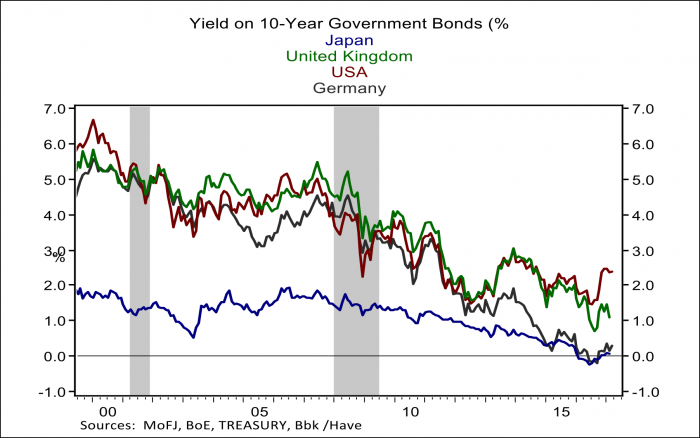

In a recent presentation in New York, Hyun Song Shin, an economist form the Bank of International Settlements warned against “the temptation to anthropomorphize the market and endow it with foresight that is misplaced.” His research looked at the dive in German bond yields in 2014 with bonds out to 10 years trading at times with negative yields. You will not find a discussion of bonds with negative yields in finance textbooks as it doesn’t make sense that investors would pay for the privilege of lending money. Shin’s research finds that the way a market is structured and regulated can push valuations away from what might seem sensible from a fundamental perspective. In the case of the German bond market a large presence of insurance companies and pension funds have fixed liabilities that are structured very much like bonds. These companies are required by regulations to match their liabilities with similar bond-like assets. When market interest rates fall, these institutional investors must follow almost mechanically buying bonds that match their new liability structure. Insurers and pension funds are so dominant in the European market that an initial drop in yields driven by low inflation and a policy of bond buying from the European Central Bank became a self-sustaining drive to ever lower bond yields. Shin concludes that extremely low bond yields may not be telling us very much about investor expectations about future growth and inflation.

Shin’s insight about the lack of signaling power in market pricing is useful but not new. John Maynard Keynes understood that we shouldn’t view “the market” as representing a sensible analyst with a reliable forecast. Writing in 1936 Keynes penned his now famous beauty contest analogy in which he pointed out that the market is not a beauty contest in which each participant picks the face they find the prettiest, but a contest in which participants choose the face they think the greatest number of other participants will find attractive. Longer run returns are necessarily subject to many unknowns and uncertainties such that investors need to speculate about the future. At the same time, investors must also speculate about what other market participants are speculating to correctly anticipate market direction. No stranger to investing, it was Keynes who coined the phrase “the market can stay irrational longer than you can stay solvent.” Apropos of our current situation, Keynes noted that increased uncertainty may make the market even less reliable, noting that “in abnormal times…the market will be subject to waves of optimistic and pessimistic sentiment, which are unreasoning and yet in a sense legitimate where no solid basis exists for a reasonable calculation”. Last year brought Brexit and the surprise election of Donald Trump and there is an ongoing transition in China that will have ramifications for the global economy and any future returns, yet the chart below shows that real uncertainty about economic policy is globally at the highest level in 20 years while the stock market also hovers near all-time highs. Investors must put money to work and make reasoned judgements about the future at a time when there is so much that is impossible to know.

Since the inception of modern capital markets asset valuations have been the reflection of the interaction of many different investors with different expectations. Owing to uncertainty about the future, markets are necessarily subject to waves of speculation. While we have been aware of the shortcomings of markets for a long time, many economists were seduced by the tantalizingly neat and clean predictions of the efficient market hypothesis that was put forward when economists fell in love with mathematical models. The efficient market hypothesis holds that markets efficiently process all available information at any given moment. Yet collectively markets have been very wrong about the future on many occasions. Keynes was writing in the aftermath of the stock market crash and Great Depression when the awareness of the fallibility of markets was acute. Another example is the early 1980s when the yield on the 10-year Treasury bond reached nearly 16% as investors seemingly expected double digit inflation into the foreseeable future just as inflation was poised to embark on a secular downtrend that led to a three-and-a-half-decade decline in yields. The NASDAQ stock index appreciated 165% in the year leading up to the peak in February 2000 only to lose 55% of its value over the following year. What was the NASDAQ high in 2000 signaling about the future? In the event, it coincided with the peak of the economic business cycle and an impending recession. The Wall Street Journal assessment in February was probably correct in ascribing that the recent stock market rally reflects to some extent expectations for policies that will boost corporate valuations, however as Keynes pointed out this is an inherently imprecise and uncertain endeavor that can lead to self-perpetuating market dynamics that bear little relation to, or signal about the eventual reality.

Keynes’ insight was about the role uncertainty about the future plays in limiting the efficiency of liquid capital markets. Dr. Shin’s insight is that the structure of financial markets may also have a lasting influence on asset valuations above and beyond economic fundamentals. He focused on the role of large institutional investors in European bond markets, but there are also issues with changing market structure in the US. Individual investors have for very rational reasons increasingly invested in passively managed mutual funds that by definition unthinkingly chase the market. Passive investing is attractive because it features lower fees and makes perfect sense from an individual perspective, but collectively it means there is less discipline from active investors deciding when valuations have become divorced from realistic return expectations. The Volker Rule implemented under Dodd Frank may have added to this trend by precluding active investing by banks, which reduces the degree to which broker dealers step in and slow market momentum when they perceive an opportunity based on some notion of realistic or fair valuation. Technological advances have also given rise to high frequency trading firms that also trade on momentum over fundamentals. These changes in the structure of markets may produce market dynamics that are dominated by momentum trading until the tension with fundamentals becomes sufficiently intense that markets rapidly reprice in a way that is also amplified. One example of this was the flash crash in Treasury yields on October 15, 2014 that produced market dynamics so unprecedented and severe it led to an extensive study by five regulatory agencies. The agencies released a joint report that concluded that the combination of an increasingly dominant presence of high frequency trading firms and reduced market making by broker dealers contributed to a violent whipsaw in the most liquid market in the world in a manner that had very little to do with economic realities.

All of this leads me to conclude that what has become known as the Trump rally may not be telling us much about the future. Liquid capital markets are the messiest and most inefficient way to allocate capital, except for all the other alternatives. Modern markets bring many benefits, but they are far from perfect. In the next blog post I will explain why I think Warren Buffet may be giving us bad advice.