The macroeconomic impact is still moderate but quickly intensifying

A recent report issued by the Trump Administration highlights the intensifying disruption to human and economic activity from climate change. It is no longer a question of whether the earth’s temperature is rising, but how quickly it will continue to rise and how disruptive and costly it will be to human activity and well-being. The US report comes on the heels of a UN report, both point to a direct tradeoff between the cost of efforts to mitigate the causes of climate change and the disruption to human welfare and the economy from the impacts of a warming planet. Coastal regions will be most impacted and a wide range of industries including agriculture, tourism, international trade, and real estate will be significantly disrupted. We look at data that show the increasing cost of disaster response is already a rising fiscal challenge that federal and state and local governments don’t adequately budget for. Consumers face rising risks of loss of life and property and rising insurance costs, investors and firms face an increasing risk of “stranded assets”. Work by Nobel prize winning economist William Nordhaus provides a framework for thinking about the tradeoffs. Rising costs of building and development, insurance, and risk of loss will likely lead to innovation in building practices and business models and shifting preferences and populations. To date the macroeconomic climate change is still moderate, but is quickly intensifying.

A warming planet will alter our way of life

On Black Friday the Trump Administration released an extensively peer reviewed report written by scientists at 13 federal agencies that concludes the impact of global warming is outpacing previous projections and that “neither global efforts to mitigate the causes of climate change nor regional efforts to adapt to the impacts currently approach the scales needed to avoid substantial damages to the U.S. economy, environment, and human health and well-being over the coming decades.” The US report follows on the heels of a UN report published in October that also concludes the earth’s temperature is rising more rapidly than previously predicted and will lead to increasing floods, fires, food shortages and human displacement within our lifetimes absent a transformation of the global economy that the report concludes is politically unlikely.

It is no longer a question of whether the earth’s temperature is rising, but how quickly and how disruptive and costly it will be to human activity and well-being. The latest US report discusses options for mitigation to reduce emissions and reduce the pace of warming, as well as preparedness for and adaptation to the increasing frequency of natural disasters and disruptive changes to our environment, including a warming and rising ocean, drier soil, and deteriorating air quality. Coastal regions will be most impacted and a wide range of industries including agriculture, tourism, international trade, and real estate will be significantly disrupted.

Looking at the issue through an economic lens

Scientists aren’t the only ones focused on climate change. Yale economic professor William Nordhaus was co-awarded the Nobel Prize in economics this year for his pathbreaking work in “integrating climate change into long-run macroeconomic analysis.” Nordhaus’ early work was born out of concerns in the 1970s that the world would run out of resources. He concluded that as resources become scarce, they become more valuable, leading to rising prices, exploration and further discoveries of additional resources, as well as innovation in using resources more efficiently and substituting scarce resources for more plentiful ones (a summary of Nordhaus’ contributions by one of his students and co-authors can be found here). Increasing energy efficiency, development of renewable resources, ebbs and flows in oil prices and the US shale revolution are clear vindications of Nordhaus’ prediction that people are clever and will respond to the shifting incentives implied by increasingly scarce resources.

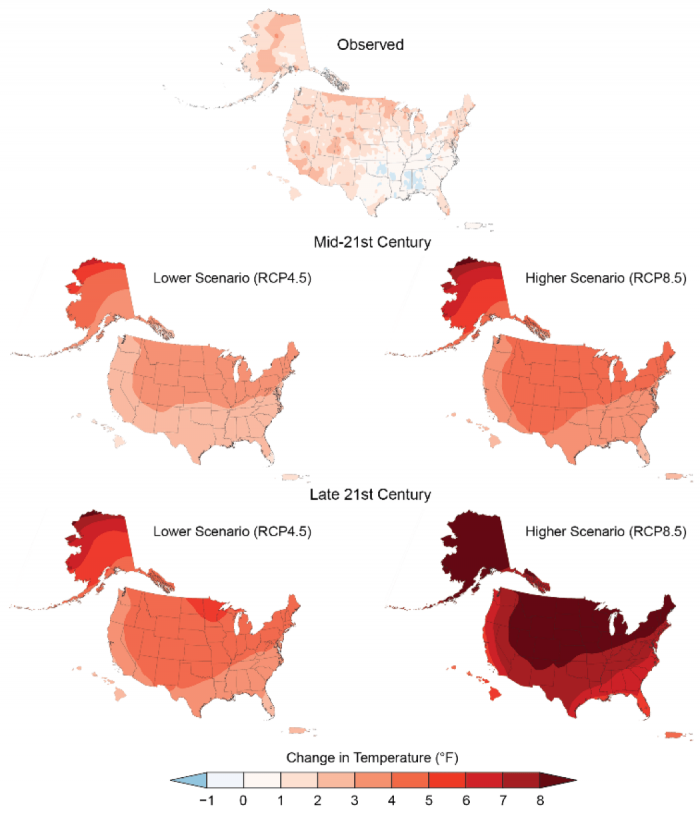

Figure 1: The average temperature is rising and will continue to rise

In recent decades Nordhaus and his colleagues tackled the unintended effects of human activity on the environment through carbon emissions and climate change. Nordhaus developed an early groundbreaking dynamic model that captured the feedback between economic activity and the climate that captured how activity today can reduce future growth potential and well-being. These models have been hugely influential in spawning a growing body of research and policy proposals.

The recent reports on climate change confirm that the main culprit in a warming planet is greenhouse gas emissions. Emissions are a classic case of a negative externality in which there is a cost to an economic activity that is borne by a third party instead of the producer or consumer. A public utility produces and sells electricity to households, but no one is charged for the deterioration in air quality that results from the production of electricity resulting in overconsumption. Policy proposals to address negative externalities usually involve setting a price on the unintended consequences of economic activity.

Carbon taxes on the production and consumption of fossil fuels are one way to capture the third party impact of emissions, thereby discouraging consumption. Alternatively, under a cap and trade program a number of emission allowances are issued that can be auctioned off and traded among utility producers so that high polluters must buy more permits and everyone is incentivized to reduce costs by polluting less. Economists tend to favor policies that address incentives and encourage innovation and efficiency over rule setting such as mileage standards, although mandates also affect incentives and can spur innovation. Usually feasibility and political considerations influence the policies that are ultimately adopted. The US has a range of federal and state and local carbon taxes and California and a group of Northeastern and Mid-Atlantic states (that include New York and Connecticut but not New Jersey) have implemented cap and trade programs to reduce emissions at power plants. The US has achieved progress with these polices. The Trump Administration report reports that greenhouse gas emissions in the US in 2016 were at their lowest levels since 1994; however negative externalities don’t recognize borders. One of the most complicated issues regarding climate change is that effective policies necessarily involve international coordination.

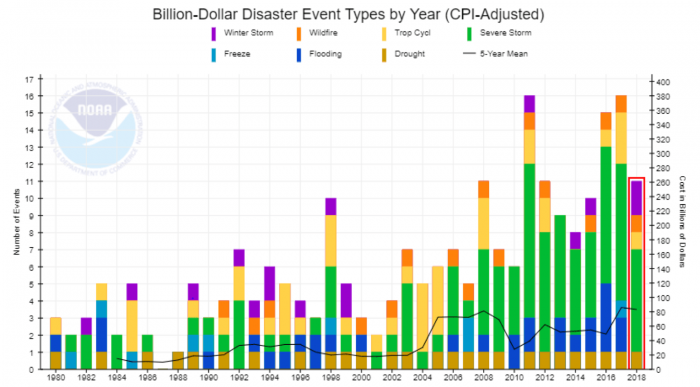

Figure 2: Costly natural disasters are becoming an increasingly regular occurrence

Climate change is a rising fiscal challenge

Most of the policies developed and discussed by economists address mitigation of the causes of climate change. However, the impact through response to and recovery from increasingly frequent extreme weather events already represents an unfunded and increasing demand on fiscal resources at the federal, state and local levels. Figure 2 shows data through October 9 on the number of billion dollar plus natural disasters (color bars), as well as the five years average estimate of their total cost. The frequency of all kinds of extreme and costly weather events has risen sharply, and the average annual cost has more than quadrupled in real terms from just over $20bn at the start of this millennium to more than $80bn today. The total cost is spread between the federal, state and local governments, private insurers and individuals. It is still modest at less than 0.5% of annual GDP, but the pace of increase in the cost of weather events combined with the trajectory of warming presented in Figure 1 suggest the trend is likely to continue and become more of a burden and a disruption to human activity.

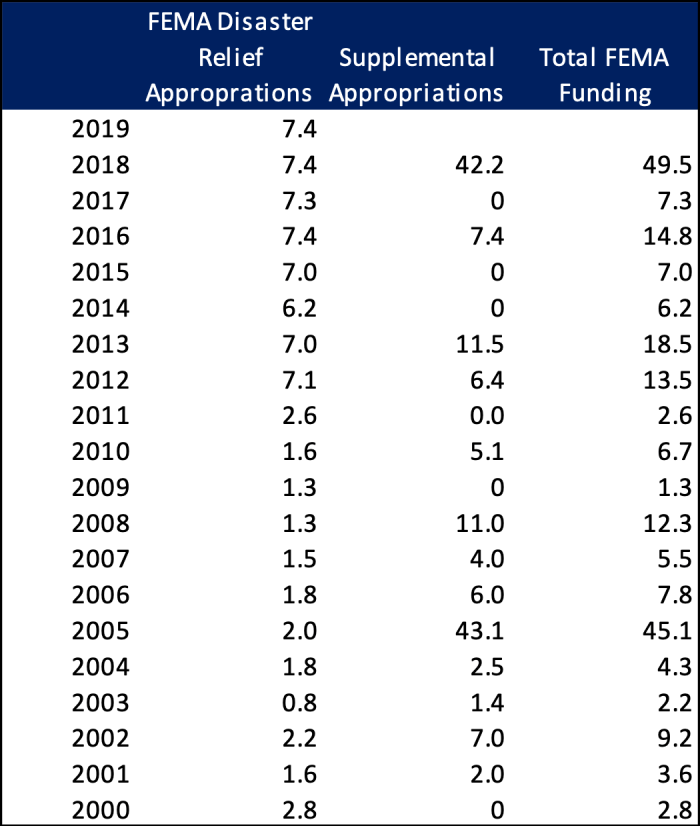

The federal government has a well established method for assisting with disaster recovery efforts primarily through the Federal Emergency Management Administration (FEMA), with additional programs housed in the Department of Housing and Urban Development and the Small Business Administration. Figure 3 shows how the annual appropriations for FEMA have evolved since 2000. The table shows that Congress approves an annual appropriation for the Disaster Relief Fund that has nearly quadrupled to an average $7.1bn in the past eight years relative to $1.8bn in the prior twelve years. The increase in funding came after many years when supplemental appropriations were required to finance the increased demands for disaster relief. Despite the increased funding, an average of $14.5bn in supplemental appropriations were required in five of the past ten years. Pew estimates that when federal spending on disasters across all agencies is taken into account the federal government has spent an average of $25bn per year since 2005. That is still relatively modest at just over 4% of discretionary nondefense federal spending, but the majority of it isn’t budgeted and adds to a trend of widening deficits.

Figure 3: Federal Emergency Management Funding ($ billions)

Much less is known about what state and local governments are spending on disaster relief. Pew conducted a detailed analysis and survey and found that the complexity of interactions between state and local governments during times of extreme events means that spending isn’t carefully tracked, monitored or budgeted for. The increasing federal burden has led to pressure on states to bear more of the costs, and to implement more preparedness programs to limit losses. Pew concluded that how state and local governments manage mitigation, preparedness, response and recovery varies widely and there hasn’t yet been any effort to establish best practices. It is probably safe to conclude that in light of the rapid rise in frequency of costly disasters, state spending is rising alongside federal funding at a time when states are facing increased budget pressures from an aging workforce.

Consumers bear a significant portion of the financial burden when natural disaster strikes, particularly since most homeowners lack flood insurance. Some losses are insured and rates on homeowners and vehicle insurance have been rising 50% and 300% faster than overall consumer inflation, respectively, over the past ten years even as insurance remains a small share of overall consumer budgets.

Climate change and stranded assets

The speed of climate change has led to an increased focus among investors and academics on the possibility of stranded assets. Climate change will bring disruption to business models and potentially require write-downs as some assets become obsolete, or even lead to defaults. Ben Caldecott of Oxford defines stranded assets broadly as “assets that have suffered from unanticipated or premature write-downs, devaluations, or conversion to liabilities.” Stranded assets are not unique to climate change and are a regular feature of any disruptive process, including globalization or technological change. Climate change will likely continue to imply increased and changing regulations over time as governments and people seek to slow the destructive forces and spread the costs. The most obvious candidates for stranded assets are in the fossil fuel industry. Firms in this industry will naturally fight for survival and constitute a headwind to implementing regulation to address climate change. However a growing number of industries will be affected as the impact of climate change spreads in sometimes unpredictable and interconnected ways. Investors and policy makers will need to remain vigilant to monitor the additional risk.

Impact on the tri-state area

The US report speaks favorably of policy efforts undertaken in the tri-state region. The Regional Greenhouse Gas Initiative is the first mandatory market-based program in the United States to cap and reduce CO2 emissions from the power sector through a cooperative effort among Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New York, Rhode Island, and Vermont and has successfully achieved a meaningful reduction in emissions. In addition, the report cites the Climate Change Adaptation Task Force created in New York in the aftermath of Hurricane Sandy that brought together stakeholders across government, industry and academia to develop an appropriate set of proposed responses related to infrastructure.

Nonetheless, as noted above the effects of climate change know no borders. Witness the wildfires raging across California, one of the most aggressive states on climate change policy. The Northeast is expected to experience increasingly intense precipitation episodes, warming sea levels will disrupt local ecosystems and a rising ocean level will continue to erode the shoreline and bring larger storm surges during increasingly intense storms. Urban areas are most at risk for damage to infrastructure and complicated evacuations. The report notes that much of the infrastructure in the Northeast, including drainage and sewer systems, flood and storm protection assets, transportation systems, and power supply, is nearing the end of its planned life expectancy. Financing the replacement and upgrading of aging local infrastructure is notoriously difficult in states like New York and New Jersey where the tax burden is already among the highest in the country.

Just as William Nordhaus predicted when looking at the possibility of increasingly scarce resources in the 1970s, the rising cost of building and development, insurance and risk of loss will likely lead to innovation in building practices and business models and shifting preferences and populations. Inland and higher elevations may gain value at the expense of coastal properties and there may develop a premium on local resilience over efficiencies from interconnected supply chains subject to interruption. While the impact of climate change has thus far been relatively modest at the macroeconomic level, it will intensify and there is a direct tradeoff between the cost of efforts to mitigate the causes of climate change and the disruption from the impacts of a warming planet.