Debating whether a tax cut on corporate profits will boost worker wages

In case you missed it, there is a very public and somewhat acerbic debate occurring among otherwise boring economists about whether a cut in the tax rate on corporate profits will boost worker wages. In some circles the link between the tax rate on corporations and worker wages is called “trickle down” economics, in which a tax cut benefitting the owners of capital (presumably, the rich) is assumed to raise the income of workers (presumably, the less well-to-do).

For the time being, ignore the fact that trickle-down economics has implications for income inequality, which explains some resistance to cutting capital-income taxes. You might wonder instead if the trickle-down theory has any intellectual merit. It turns out that there are three key assumptions for the trickle-down theory to hold and these assumptions happen to be embedded in almost every modern macroeconomic model.

The first assumption is that capital markets are competitive. If the tax rate on corporate income falls, the after-tax rate of return on capital will increase. If capital markets are competitive, more capital will be put to work in the United States as capital owners will increasingly invest in the United States to earn these higher after-tax returns.

The second is that labor becomes more productive as capital is added to the economy. Think about a worker that has to dig a sizeable hole with either his hands, a shovel, or a large back-hoe. In which scenario is the hole dug the fastest? It is obviously the scenario with the back-hoe.

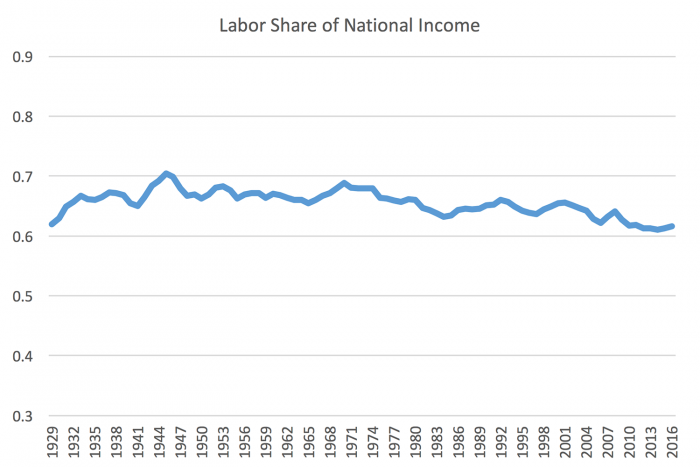

The third and final assumption is that wages paid to labor rise at the same rate as worker productivity. This assumption is the most controversial, as I’m sure you have read the many reports that argue that worker salaries have been flat for two decades, when salaries are measured for the median worker and are adjusted for inflation. National accounting statistics show that aggregate total compensation paid to laborers (inclusive of wages, salaries and benefits) claims roughly 65% of aggregate total output since 1929, which is as long as the data have been collected. I show an estimate of this “labor share” for the US Economy in the graph below. The figure shows that the share of income flowing to labor hasn’t wildly gyrated over time but has fallen by about 4 percentage points over the past 40+ years. If we are willing to conclude that the labor share will continue to range between 60 and 70 percent, then going forward output/worker — which is average worker productivity – should increase at roughly the same rate as compensation/worker, which is the average wage rate. Economists do not know why since 1980 the average real wage has increased and the median wage has stayed flat, and (related) are also not sure why the labor share of income has fallen by a few percentage points. These are both important observations and we return to these points later.

If we take as given these three assumptions then there is merit to the theory of trickle down and we can study the magnitudes implied by the theory. The total percent change in wages per worker for a given change in the corporate tax rate can be computed using this simple equation: change in wages per worker = (a) x (b). In this equation, (a) is the change in the capital stock for a given change in the corporate tax rate and (b) is the change in average wages per worker for a given change in the capital stock. Serious economists try to separately estimate (a) and (b) over both the short and long run.

For the purposes of this blog, I use some back of the envelope calculations that are consistent with the theory. Let’s start with (b), the relationship of changes to capital and changes to wages. This one is easy. The fact that labor compensation has recently been equal to 62% of total output implies that capital income has been equal to 38% of total output. What this implies, ultimately, is that for every one percent increase in the capital stock, total GDP rises by 0.38 percent. But since wage compensation is a roughly constant fraction of GDP, average wage per worker also rises by 0.38 percent.

So this leaves us with (a): How much extra capital should we expect if we reduce the corporate tax rate? Constructing this estimate is difficult because a lot of capital income — interest paid on debt — is currently shielded from corporate taxes. If a company has enough debt, it will have enough interest payments to be able to avoid paying corporate taxes. In 2014, the Congressional Budget Office (see here) published an estimate that a reduction in the top corporate tax rate from 35 percent to 25 percent would reduce the effective tax rate on capital income by 3 percentage points, from 18 to 15 percent; a simple extension of this math suggests a reduction in the top corporate rate from 35 to 20 percent would reduce the tax rate on capital income by 4.5 percentage points, from 18 to 13.5 percent. Given this estimate and a few other important but less controversial assumptions, a fifteen percentage point decline in the tax rate on corporate income at current levels will boost the capital stock by about 8.6 percent. I will spare you the details about how I got this, but it uses the fact that capital income taxes fall by 4.5 percentage points and the expected increase in the capital stock for every one percentage point change in capital income taxes is 1/(1-0.38) = 1.61 percent. (Of course 1.61 x 4.5 = 7.2. There is a mathematical adjustment factor related to natural logarithms that boosts the estimate to 8.6 percent).

Putting it all together: If we reduce the top corporate tax rate from 35 to 20 percent, this should be expected to boost the capital stock by 8.6 percent. This increase in capital will then boost GDP and wages per worker by 3.3 percent (note that 3.3 = 0.38 x 8.6). In 2016, average wage compensation per household, when allowing 62 percent of proprietors’ income to be considered as wage compensation – a standard adjustment – was approximately $87,000. The back-of-the-envelope analysis I’ve done suggests a reduction in the top corporate tax rate will boost average wages per household by about $2,850 per year. If we assume real GDP per worker grows 1% per year in addition to the growth induced by changes to the corporate tax, then by 2027 the boost to average wages per household after adjusting for inflation will about $3,150; if real GDP growth is 2% per year plus the change induced by the cut to corporate taxes, the estimate increases to $3,500 per household.

Note that the headline estimate of the impact of cutting corporate taxes on wage income per household from the Council of Economic Advisors (CEA) to the President is $4,000 per household. In their report the CEA lists a range of possible outcomes depending on assumptions and the range includes our estimate: See page 18 of the report. Of course, there are many details and dynamics we did not discuss: The model speaks to “long-run” calculations after capital has had a chance to adjust to the change in taxes since capital-allocation decisions are not made immediately and the transition period in response to the change in the tax code might take years. Additionally, market participants must believe the change in the tax code to be long-lived and not undone by some future administration. For example, if people think tax rates will revert in to their old levels in 5 years they may not bother installing long-lived capital now.

Finally, we have not discussed fairness. As mentioned, in the past two decades (i) average wage per worker has not been increasing at the same rate as GDP/worker and (ii) real wages for the median worker have been flat. This combination of facts means that capital holders have received disproportionate gains of GDP and that the top income earners have earned an ever-increasing share of total income. In this light, a tax cut to capital income can be viewed as largely benefitting high income earners. High income earners also own most of the capital, and thus they directly benefit from the tax cut. Additionally, given recent trends for high income earners to absorb an ever increasing share of aggregate income, we expect them to experience the largest wage gains as a result of any new capital inflows. This is likely the real source of resistance to a tax cut; it is not that the theory of “trickle down” lacks merit—increasing the capital stock will create a bigger economic pie—rather, there are questions about the distribution of the gains and the fairness of the cuts.