Navigating the economic expansion may get trickier in 2019

The news flow on the US economy has been very good. The latest GDP report showed growth on track to achieve 3.0% in 2018 underpinned by a healthy and prudent US consumer and a strengthening labor market. Looking ahead growth looks poised to moderate in 2019 as a number of supports fade. Fiscal stimulus is set to be just as supportive. But the global economy has slowed, contributing to a widening trade deficit through fading exports, while strong imports reflect robust domestic demand. The most recent report featured a surprising slowing in business fixed investment despite powerful incentives from the tax bill, which could reflect rising uncertainty related to trade conflicts and rising global tensions. Slower global growth has been accompanied with rising financial market volatility that is finally spilling into the US as the boost to earnings and share buybacks from the tax cut fades and the Fed continues to raise rates. Navigating the recovery to a sustainable pace is likely to become harder for the Fed to calibrate over the next year, and we suspect they may conclude they are at a neutral policy stance (consistent with supporting sustainable growth at the economy’s potential) earlier than they currently expect.

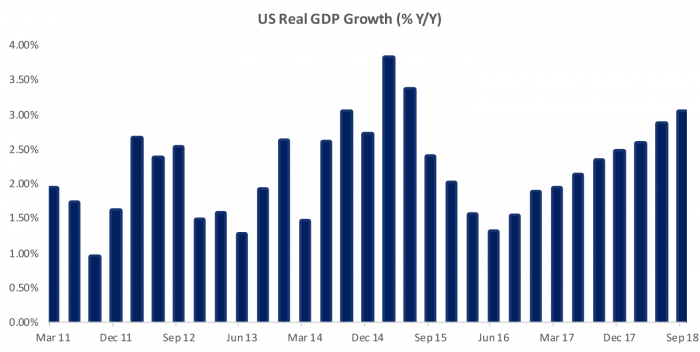

GDP logged a robust 3.5% annualized growth rate in Q3 and is on pace to register a 3.0% performance for 2018 as a whole. The current pace of growth doesn’t match the peak pace of 3.8% y/y reached in Q1 2015; however, Figure 1 shows that after a recovery that proceeded with fits and starts, the US has enjoyed a steady pick up in the past two years. The strong growth performance has helped reveal spare capacity in the labor market. Despite frequent complaints about skill shortages, employers have added an average of 208,000 workers to their payrolls each month, up slightly from the 182,000 pace registered in 2017. The pick-up in job growth came despite the unemployment rate having started the year below nearly all estimates of full employment, and In addition, wage growth and inflation have picked up only modestly despite the unemployment rate falling to lows not seen in 40 years.

Figure 1: Growth Has Steadily Reaccelerated in Recent Years

The stellar performance of 2018 reflects three key factors: a reacceleration and synchronization of global growth after a near hard landing in 2015, an unusually procyclical and sizable fiscal stimulus, and a still accommodative monetary policy. Fiscal policy looks set to be just as stimulative in 2019 as 2018, yet our own and consensus forecasts look for moderation in growth in Q4 and 2019 as the other tailwinds become less supportive and new headwinds come to the forefront. Growth is still expected to clock a pace that is nonetheless above trend leading to further tightening in labor markets.

Global growth is slowing and likely won’t provide as much of a tailwind to exports, investment, and financial conditions as it has over the past two years. In addition, there are early indications that trade conflicts may be starting to crowd out some incentives for investment from the tax cut, and a quick resolution and return to a global political environment supportive of free trade seems unlikely. Monetary policy will continue to tighten. The Fed has been gradually raising rates and its baseline expectation is for another interest rate hike in December followed by three more in 2019. There may still be spare capacity in the labor market, but wage and inflation data are telling the Fed that monetary stimulus is no longer needed. The Fed’s objective will be to navigate the economy toward a soft landing with growth moderating toward its trend pace closer to 2% by feeling its way to a neutral stance on interest rates.

Tailwind from Global Growth Fading

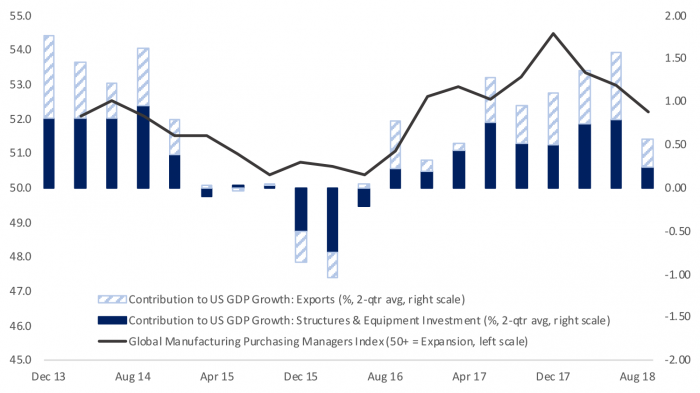

The US economy has become steadily more integrated with the global economy in recent decades as measured by the trade content of GDP. In recent years that integration has deepened with the expansion of the US energy sector; global growth momentum is a key driver of commodity prices that in turn drive investment in equipment and structures in commodity-producing sectors. In addition, global financial markets have become highly integrated and global conditions can affect US markets and financing conditions. Figure 2 is an illustration of the integration of the US and global economy. It plots the contribution to US GDP from investment in equipment and structures and exports against the global manufacturing purchasing managers’ index (PMI), a gauge of global manufacturing activity. Readings above 50 on the PMI indicate expansion.

Figure 2: The Global Manufacturing Cycle is Correlated with Investment and Exports in the US

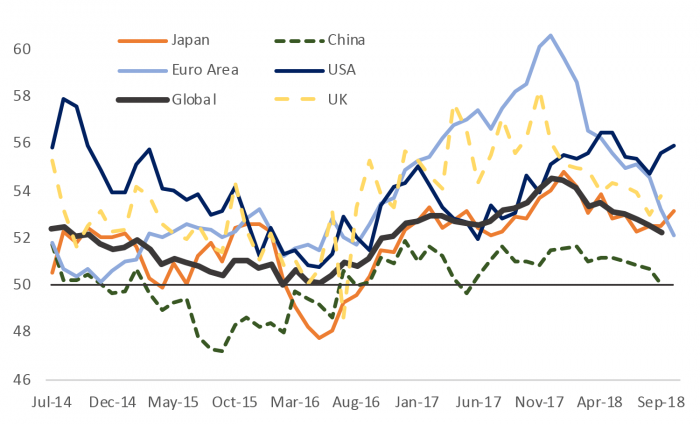

The slowing in US GDP growth in 2015 was closely tied to the slowing in global manufacturing that came with a collapse in oil and other commodity prices and US investment in capacity in these sectors, as well as a decline in exports more broadly. Similarly, the rebound in the global capex cycle, which was led by Chinese stimulus, served as a key underpinning of a rebound in global commodity prices and US growth attributable to investment and exports. The global manufacturing cycle peaked at the end of 2017 and has been slowing steadily even as the September reading of 52.2 is consistent with moderate growth. Figure 3 shows manufacturing PMIs by region and the US has gone from underperforming Europe to outperforming all other regions. Movements in the Chinese PMI understate the associated amplitude in growth and its spillovers to the rest of the world. China and emerging markets account for three quarters of global growth during the current expansions and ebbs and flows have had powerful spillovers (See “The Invisible Recession of 2016”). Currently the fading of Chinese stimulus, combined with an overhang of bad debt, is combining to slow the Chinese economy, and trade conflicts complicate the task for policy makers of managing the slowdown.

Oil prices have risen despite the slowing in global growth, due in part to intensifying political tensions. High energy prices and strong domestic fiscal stimulus have allowed US manufacturing to remain resilient to the global slowdown so far, but the details of the Q3 GDP report provide grounds for concern. A widening trade deficit reflecting declining exports and a rebound in imports subtracted 1.8 percentage points from Q3 GDP growth. Trade is volatile from quarter to quarter, but stimulus fueled US demand with an economy near full employment combined with a slower global economy suggests trade is likely to continue to be a drag on US growth in coming quarters. More worryingly, despite lower marginal tax rates and temporary full expensing of investment included in the tax bill, business fixed investment ground to a halt in Q3 after notching a 10% pace in the first half of the year. Structures investment declined sharply, equipment investment was essentially flat while intellectual property investment slowed to a still healthy 7.9% from 12.3% growth in H1. An early fading of capex may suggest that uncertainties from global tensions and trade conflicts are starting to weigh on the willingness of firms to make long-term decisions on business plans and may also reflect somewhat higher funding costs. If the slowdown in investment persists it will be harder to conclude that the potential growth rate in the US is on the rise and would increase the risks of a harder landing as the boost from fiscal stimulus fades.

Figure 3: Global Manufacturing Purchasing Managers’ Indexes (50+ = Expansion)

Financial Spillovers Meet with Fading Stimulus to Tighten Financial Conditions

The pioneering work that Helene Rey showed overturned a long-held theory of global finance, that of the trilemma (see summary here). The trilemma held that a country could not simultaneously have a fixed exchange rate, free movement of capital and an independent monetary policy. In other words, if policy makers in a given country wanted to control domestic financial conditions in a world of free capital movements, they had to accept a flexible, market-driven exchange rate, otherwise they would effectively import US monetary policy regardless of their domestic situation. Rey showed that global capital flows have become sufficiently powerful that monetary policies are highly integrated even if a country has a market determined exchange rate. Mainly it implies the US exports monetary policy to other countries; however, the US also imports global financial conditions through the accumulation and deployment of dollar reserves.

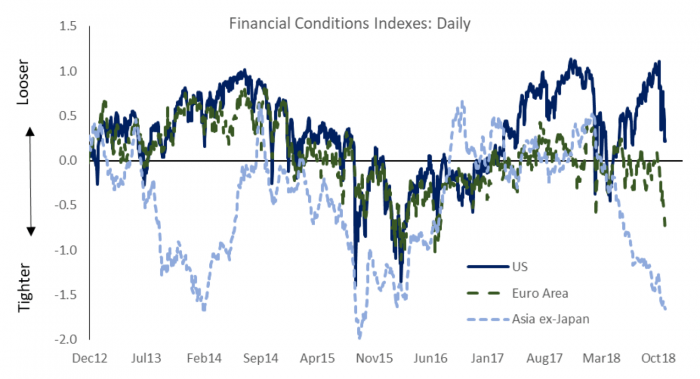

When the US started raising rates in December of 2015 against the backdrop of a weak global economy, it contributed to a rapid tightening in global financial conditions that included a rapid appreciation in the dollar. The Fed has to readjust its policy plans as the US felt the effects of the global slowdown and market volatility. As the global economy accelerated in 2016 the Fed was able to get back on track with its plan to raise rates, and it could do so without dollar tightening due to the US underperformance. As the Fed continued raising rates in 2018 an outperforming US economy has also come with a 5% strengthening of the trade-weighted dollar. Figure 4 shows Bloomberg’s indexes of financial conditions for the US, Europe and Asia. The indexes include asset prices and volatility across a wide range of assets including equity, credit, interest rates and foreign exchange. Positive values indicate easier conditions supportive of growth and negative values point to market headwinds. The tightening in global financial conditions began early this year in tandem with slower global growth, yet the US rebounded smartly from the Q1 correction even as Asian markets continued to see lower asset prices and rising volatility. Only recently have US financial conditions once again come off their highs.

Figure 4: Global Financial Conditions Tightening Reflecting Slower Global Growth and Fed Tightening

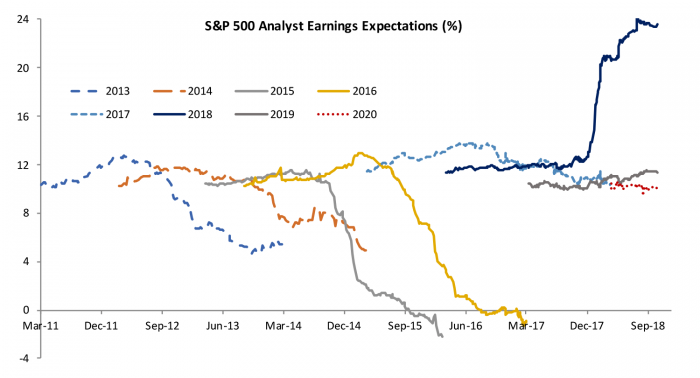

As with the broader economy, the fiscal stimulus may have insulated US financial markets from the global tightening. Figure 5 illustrates that S&P 500 companies are enjoying a year of record earnings due to the tax cut, which have also come with record share buybacks providing a powerful offset to trade conflicts and moderating global prospects. The chart plots analyst earnings expectations for growth in earnings in each year before the year begins and then follows how expectations evolve through the year until final earnings are reported. The chart illustrates that the sugar rush of tax cut fueled earnings is expected to end in 2019 with earnings falling back to a more normal performance. Meanwhile the earnings realizations in the global slowdown of 2015 and 2016 provide a cautionary tale. While the decline in earnings was tied to the sharp drop in commodity prices and the hit to the energy sector in those years, trade conflicts and tariffs could take more of a bite out of earnings than analysts currently have factored in. Indeed, as companies report Q3 results and start adjusting their guidance for 2019, markets have started to reprice the rosy outlook.

Nailing the Soft Landing

The news flow on the economy has been very good. US consumers are spending at a healthy clip financed by gains in jobs and wages rather than debt or dipping into their savings. The repricing in US financial markets to date falls more in the realm of a healthy correction to realistic expectations than a tightening that threatens the expansion, and since consumers are not leveraged to equities or housing like they were in the past, they can easily prove resilient to rising volatility. While posing a number of risks to longer-term sustainability, fiscal stimulus will continue to be a tailwind in 2019. Since there still seems to be some additional labor market capacity and inflation has remained subdued, a soft landing with growth moderating toward trend seems within reach. Yet a number of shifts in the environment suggest it will be trickier for the Fed to navigate the next phase of monetary policy, that of guiding the US steamship safely into sustainable waters. Slower global growth and an outperforming US economy likely means Fed rate hikes may be accompanied by increased volatility and tightening in financial conditions, and the fading momentum in business investment bears watching. If it persists it could be an indicator of uncertainty and concern related to rising geopolitical tensions and trade conflicts that could spill over into willingness to hire. I suspect tighter financial conditions will tell the Fed that it is closer to a neutral monetary policy stance earlier than it currently expects. I have two more rate hikes penciled in before the Fed stops to assess the landscape.