Where Warren Buffett goes wrong

Warren Buffett recently started taking an early victory lap on a bet he made nine years ago. The bet involved Buffett putting his money where his mouth is on a longstanding and strongly held view he holds that active investors as a general rule add no value. Buffett offered to wager $500,000 that “no investment pro could select a set of at least five hedge funds…that would over an extended period match the performance of an unmanaged S&P 500 index fund”. Ted Seides of Protégé Partners stepped forward and bet that a group of five fund of funds, funds that invest in multiple hedge funds, would outperform Vanguard’s S&P 500 Index Fund over the ten-year period from 2008-2018. While it may seem like questionable judgement for Buffett to crow early about victory with the S&P 500 close to record highs, Buffett’s compound annual after-fee return stands at 7.1% over the first nine years of the bet versus Seides’ 2.2% such that Seides would have to outperform by roughly 45% to come from behind and win the bet—not impossible but unlikely.

Buffett’s critique conflates active investing with high fees, and high fees with an unhealthy and unproductive culture of greed among “Wallstreeters”. He points out quite logically that active investing requires people to think and make judgements about the market, and people cost money, whereas passive index funds don’t need to hire as many people and can therefore charge lower fees. A number of investment professionals have taken issue with Buffett’s criticism by pointing out that there are plenty of lower cost active managers, and that there are some lower-cost retail actively managed funds as well as actively managed university endowments that have indeed outperformed the market. My critique is the simple lament of an economist; Warren Buffett is ignoring the obvious free rider problem.

A free rider problem in economics is a situation in which those who benefit from resources, goods or services don’t pay for them, a situation that can lead to overconsumption and/or inefficiencies that are not optimal for society as a whole. Examples include public goods like clean air or highways, and an often-cited example in introductory economic textbooks is the tragedy of the commons, in which public pasture land leads to overgrazing and depletion of the resource as it is in the interest of each individual farmer to allow their animals to eat their fill without regard to the common good.

The public good in financial markets are market prices. The model of index investing began as a niche market and relied on the assumption that other investors were doing the job of following individual company results and deciding when a company was over or undervalued. As long as active investors are doing their job well, market prices will be good representations of value and index funds can just come along for the (free) ride. As Warren Buffett so logically points out, investors that don’t have to pay people to do the research and make judgments about valuation can just reap the average market returns at a much lower cost and outperform a good portion of higher cost active investors. It is almost by definition that passive investors will outperform on average.

Too much free riding can hurt the greater good. Over time overindulgence in passive investing can potentially lead to a breakdown of market discipline; a pattern of outperformance can lead investors to increasingly channel their money into lower cost passively invested funds and they become the dominant force setting prices in the market. Index funds by definition unthinkingly chase the market without regard to individual company performance, or in the case of interest rates, prospects for growth, inflation and prospects for monetary policy.

Some researchers have looked into the impact of passive investing at the firm and industry level. Results show that the benefits to companies of being included in an index commonly used in passive investing have led to increased concentration and higher fees and prices in the banking and airline industries.1 Another paper found that financialization of the commodity market, a development tied to the rise of passive index funds, has led to inefficient and unproductive decisions by commodity intensive firms owing to distortions in prices.2 In my previous post I argued that because of inherent uncertainty about the future and market structures that reduce price discovery, market pricing can be driven more by trends and momentum instead of developments in profitability or the economy. The trend toward passive investing clearly belongs in the bucket of factors that reduce price discovery.

Markets that can deviate is a sustained way from fundamental valuations can also create problems and inefficiencies that are meaningful at the macro or aggregate level. Unsustainable upswings in market values can falsely signal to households through what is known as “the wealth effect” that they can save less, only to be rudely awakened by a severe market correction that leads people to try and make up for lost time and save more. More households are exposed to market volatility in their balance sheets; the Survey of Consumer Finances conducted by the Federal Reserve finds that direct and indirect stock ownership has hovered around 50% since the late 1990s, up from a third in the 1980s, and more retirement savings is held in defined contribution funds over traditional defined benefit funds that absorb market fluctuations on behalf of their participants and pay a fixed benefit. As noted in above, firms may similarly react in a less than optimal way to signals from market valuations through their investment and hiring decisions. Valuation swings can thus create a pro-cyclical economic spillover whereby consumers and firms overreact to good times and are overly cautious in a recovery. This pro-cyclicality can leave monetary and fiscal policy makers in the position of chasing these, dare I call them asset bubbles.

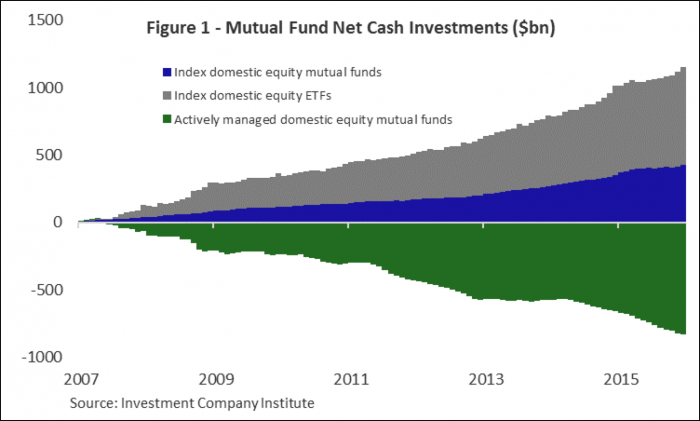

Do we already have a tragedy of the commons in US financial markets in which passive investing is eroding market discipline? Measuring the degree of active versus passive investing is not clear cut. In my last blog I showed the Investment Company Institute’s (ICI) data on outflows from active funds and into index and exchange traded funds which I include again in Figure 1. The ICI data don’t tell the whole story as hedge funds and other active managers are not included. Active investing itself is not a clean label as many actively managed funds lower fees by utilizing computer algorithms that often look a lot like passive investing in that they are aimed at momentum and trend following rather than evaluating fair value based on fundamentals. The Financial Times recently conducted research with Morningstar that found passive investing now accounts for a third of the equity market, up from a quarter just three years earlier and growing steadily.

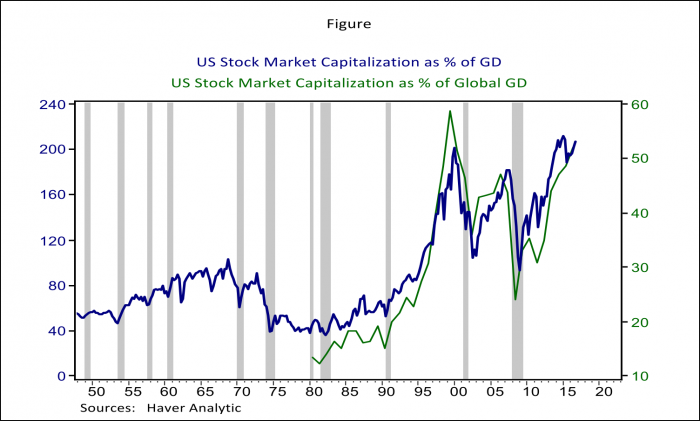

There are any number of metrics for evaluating market valuations, but most of them show that markets have become more procyclical over time. Figure 2 shows total stock market capitalization economy as measured by the Federal Reserve’s Financial Accounts of the United States relative to the US and global economy’s Gross Domestic Product (GDP). The collective value of all firms in the economy should bear a relationship to the economy’s growth prospects and the chart shows that the valuation of all corporations has more than doubled on average as a percent of US GDP in the period since 1995 relative to the prior fifty years and US corporate value as a percent of global growth has also jumped up in a persistent fashion since the late 1990s. Higher valuations may be justified by an increasing the fact that the share of national income going to corporation has risen over time, or the fact that longer-term interest rates have declined. What is more striking from the point of view of market dynamics is that prior to 1995, large swings in equity markets were not a prevalent feature of US business cycles. The largest market swings were around the two recessions in the early 1970s, but the peak to trough decline in valuation as a percent of GDP were less than half on average than we have seen in the past two business cycles. The recessions of 2001 and 2007 led to average market declines worth 93% of GDP. These booms and busts in asset valuations seem hard to reconcile with GDP growth that has become less volatile over time.

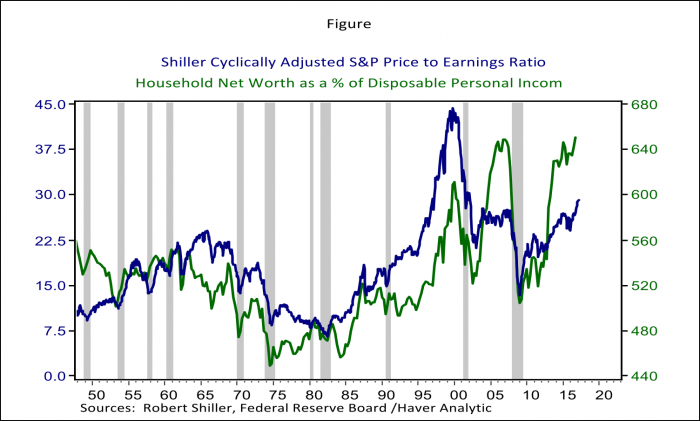

Corporate valuations depend on many factors other than GDP, and many other asset values matter to the macroeconomy other than equity prices. The blue line in Figure 3 shows the cyclically adjusted price earnings ratio for the S&P 500 stock developed by Robert Shiller in his book Irrational Exuberance. Shiller’s CAPE ratio adjusts earnings for inflation and smooths through the cycle by taking ten year averages of earnings. Valuations rose in the 1960s, fell in the 1970s, then rose again in the 1980s and 1990s with the ebbs and flows in productivity. The measure confirms much greater cyclicality in valuations since the late 1990s. The green line in Figure 3 shows household net worth as a % of disposable income the Federal Reserve’s Financial Accounts of the United States. Net worth includes all the financial and real assets held by households and normalizes it by their income. The boom in this measure in the 2000s reflects the housing price boom and illustrates that the greater cyclicality in asset values since the mid-1990s is a broad-based phenomenon.

It is unlikely that passive investing is the root cause of greater cyclicality in markets and asset values, but it may be one contributing factor. It seems clear from a simple thought experiment imagining a world in which all investment is in an index fund that a market with no investors dialing into quarterly investor calls, poring over company results and imposing market discipline on firms through their buying and selling, or investors gauging whether interest rates are consistent with expected trend in growth and inflation would be problematic for the functioning of capital markets.

The solution to a free rider problem recommended by economics is often a tax that imposes a cost on those enjoying the free ride; we can tax polluters to force them to bear the health cost they are imposing on the population thereby reducing the amount of the harmful activity. We can impose tolls on busy roads that force drivers to bear the cost of maintenance, reducing usage and traffic snarls that weigh on the productivity of the community. Yet imposing a tax on index funds and ETFs for the free ride they are enjoying on the back of the work of active investors seems like outright heresy. Thanks to the strong advocacy from the likes of Warren Buffett and the investment advising community, index funds have become as American as Mom and apple pie, while celebrating the value created by the hard work of active investors just isn’t cool. It is hard to argue that the recommendation that, for any individual investor, low cost index funds offer great value isn’t sound advice, but the very definition of a free riding problem is that no one is keeping track of the greater good, which in this case is the healthy and balanced functioning of financial markets. In the current environment, we seem destined to continue letting this trend run its course and see where it takes us. I do wish that Warren Buffett would draw a distinction between active investing and unreasonable fees; A healthy negotiation over fees is a positive for market functioning, but so is a balance between active and passive investment. After all, Buffett himself is a low fee active investor.

1 See Azar, José and Raina, Sahil and Schmalz, Martin C., Ultimate Ownership and Bank Competition. Ross School of Business Paper No. 1235 (2016) and Elhauge, Einer, Horizontal Shareholding. Harvard Law Review vol. 129, no. 5 (2016).

2 See Brogaard, Jonathan and Ringgenberg, Matthew and Sovich, David, The Economic Impact of Index Investing (March 28, 2017). NBER Market Microstructure Meeting Paper (2015).