Politics, partisanship and Fed independence

President Trump has made a habit of publicly lambasting the Fed and making bombastic recommendations for monetary policy. In addition, pending background checks, he intends to nominate two men whose main role in recent years has been as political commentators for the Republican party. These overt attempts at political influence on monetary policy raise the question of whether the Fed’s independence is at risk. In this post I explore the nature of Fed independence. The Fed is a political institution beholden to Congress and the link between monetary and fiscal policy has ebbed and flowed over the past century. In recent decades Fed policy makers have gone about their work in a primarily nonpartisan way focused on medium-term objectives. The approach of making monetary policy decisions independently of fiscal policy has on balance bolstered the confidence of the public and investors and the reputation of the US in global financial markets. While political pressure on the Fed by politicians is nothing new, confirming overtly partisan policy makers would increase conflicting signals from Fed speakers and second-guessing of policy decisions in the near term, and could do more lasting damage to the stability of the US and global economy over a longer horizon should partisanship begin to influence decision making.

What exactly is Fed independence?

Fed independence is a moniker that refers to both statutory design and policy traditions. One of the unique features of central banks is seigniorage, or the profit made by issuing currency. Since the Fed “prints money” it doesn’t depend on the annual budget process controlled by Congress and in fact transfers profits excluding its own operating costs to the Treasury each year. Not being subject to the Congressional appropriations process serves to keep the Fed out of the political fray.

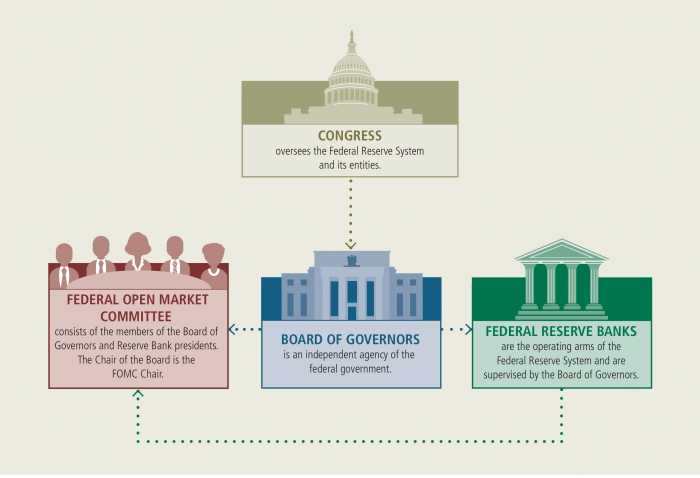

Figure 1: The Federal Reserve System Answers to Congress

The Fed was also designed by Congress to make decisions in a manner less fettered by political influence. The Federal Open Market Committee (FOMC) that sets interest rates consists of twelve members – the seven members of the Board of Governors in Washington DC, the president of the Federal Reserve Bank of New York, and four of the remaining eleven Reserve Bank presidents, who serve one-year terms on a rotating basis. The governors are nominated by the President and confirmed by Congress but serve 14-year staggered terms, so decision makers are not on the electoral cycle. The Chair serves a four-year term staggered across the presidential cycle and is simultaneously named to a governor opening so can serve out their term even after their tenure in leadership. The reserve bank presidents are even less tied to electoral politics and are named by boards comprised of members of the private sector. The Fed is authorized by law to make decisions about monetary policy and bank regulation without seeking approval by Congress, although they are required to report on their decisions and assessments of the economy to both houses of Congress semi-annually.

Fed independence also refers to a policy tradition that has been in place for several decades by which decisions on monetary policy are made in a manner that is deliberately independent of decisions about fiscal policy and debt financing. In his book The Power and Independence of the Federal Reserve, University of Pennsylvania legal scholar Peter Conti-Brown describes how the concept of monetary policy independence was crafted by senior staff at the Treasury and Fed to settle a dispute between the Truman Administration and Fed Chair Marriner Eccles. Truman wanted the Fed to keep interest rates low to help finance the Korean War while Eccles was worried about inflation. The Fed Treasury Accord of 1951 was little more than a nonbinding statement issued jointly by the Treasury and the Fed that they would set policy to pursue “their common purpose to assure the successful financing of the government’s requirements and, at the same time, to minimize monetization of the public debt.” The nonbinding statement nonetheless established a powerful precedent that monetary policy should be set independently of fiscal policy for the greater medium term good of the nation’s economy. This precedent has largely stood the test of time, with some deviations.

All public institutions are political

The practice of pursing monetary policy goals independently of fiscal policy doesn’t mean the Fed is an institution free of political influence. Conti-Brown suggests the notion of the Fed’s role as resisting temptation and being the adult in the room willing to take the punch bowl away rests on an assumption that politicians will be prone to systematically mismanage fiscal policy with an undesirable inflationary bias and that the Fed will always be staffed by responsible technocrats acting in the public’s interest to tame inflation pressures. He suggests the world has always been more complex than that and that the Fed has felt political pressure to be both more and less accommodative depending on the economic and political environment and whose decisions are influenced by the composition and political ideologies of its leadership. I am sympathetic to his view that Fed independence is better conceived of as a delicate balance between democratic accountability, technocratic expertise, and the value judgements of the policy makers on the FOMC at any given time. Current Fed Chair Powell seems aware of the delicate balance he must strike. In the wake of shaken confidence in the Fed in the aftermath of the financial crisis and ongoing public frustration with sluggish wage growth and widening income inequality, Chair Powell has emphasized both increasing communication with Congressional representatives of both parties and explaining their policies to the public that acknowledges ongoing aspects of public dissatisfaction with the economy.

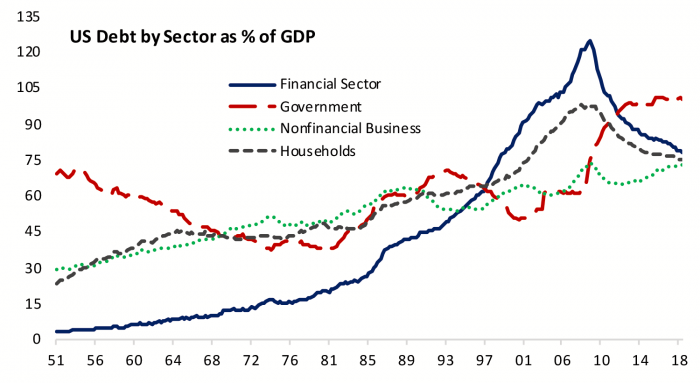

Figure 2: Fed Policy has a Greater Impact in an Indebted World

The practice of monetary policy independence from fiscal policy was not a founding principle of the Federal Reserve System, and political pressure to coordinate fiscal and monetary policy has been as prevalent over the Fed’s short history as independence. The Fed has also been subject to Congressional reform when it has been perceived not to be serving the public interest. The first incarnation of the Federal Reserve in 1913 was in response to the devastating financial crisis of 1907 (and a longer history of financial crises before that). The Federal Reserve Act of 1935 increased centralized control in response to the perceived failures of the Fed during the Great Depression. The First Chair of the newly created Board of Governors, Marinner Eccles, worked closely with President Roosevelt to coordinate monetary and fiscal policy in support of the recovery from the Great Depression and then the financing of World War II.

Only later under Truman with a strong economy did Eccles start to worry about inflation and work to establish policy independence. Monetary policy independence from fiscal policy broke down again under President Johnson who wanted the Fed to facilitate financing of the Vietnam War and continued under Presidents Nixon and Carter who wanted to run the economy hot. Only when stagflation intensified did President Carter select Paul Volcker, knowing he intended to do what was necessary to tame the inflation beast. Coordination of monetary and fiscal policy was largely effective in the recovery from the Great Depression but came with undesirable consequences in the 1970s. Since President Reagan the ideal of monetary policy independence was reestablished and has prevailed even through the devastation of the 2008 financial crisis. Quantitative easing during the Great Recession and subsequent recovery can be seen as monetary accommodation of fiscal policy; however, the policy decisions were made independently.

Political does not mean partisan

The Fed is a creation of Congress and its most powerful decision makers are political appointees with party affiliations and associated ideologies on appropriate economic policy. Many Fed chairs and governors including Alan Greenspan, Ben Bernanke and Janet Yellen held political posts prior to their leadership of the Fed. However, in the current era of monetary policy independence that has prevailed since the 1980s, political affiliations have not implied partisan decision making on policy. In another recent book The Myth of Independence, authors Sarah Binder and Mark Spindel write that “institutions are political not because they are permeated by partisan decision making, but rather because political forces endow them with the power to exercise public authority on behalf of a diverse and at times polarized nation.” Indeed, elected officials in Congress and Fed officials tend to be well aware that one of the roles of Fed independence is to make difficult and sometimes unpopular decisions and take the heat when the economy goes south. The Fed’s role of scapegoat of public dissatisfaction can serve the interests of elected officials concerned with reelection.

By respecting the Fed’s policy independence and staffing it with policy makers with technocratic expertise in economics, banking and regulation, politicians have hoped the Fed will achieve its mandates of stable prices and full employment even as they sometimes publicly bash the Fed. In my experience as a staff economist at the Federal Reserve Board of Governors the vast majority of Fed appointees of both political parties were earnest and disciplined in making decisions in the best interest of the economy. While views on appropriate policy are partly influenced by political leanings, decisions haven’t made with partisan objectives in mind.

Figure 2 highlights that in a world with higher debt burdens across sectors, the Fed’s policies and influence are more powerful than ever. This is true globally with rising dollar denominated debt around the world and international trade still largely financed in US dollars. It is noteworthy that despite the Fed’s regulatory failures ahead of the financial crisis and some associated increase in regulatory requirements and reduction in emergency powers under Dodd Frank, the Fed retained its independence in setting monetary policy as there was a recognition in Congress that it generally serves the economy well. Potential nominees for Fed governor Herman Cain and Stephen Moore defy the tradition of recent decades as neither has expertise in regulation or banking and both have shown themselves to have overtly partisan views on appropriate monetary policy in the sense that their views of what constitutes sound policy shift with the party in power. Both were critical of easy monetary policy during the Obama Administration and yet are advocating easy monetary policy now even with the economy operating much closer to full employment. Few economists on either side of the political aisle concur with these assessments. Harvard economist Greg Mankiw who was head of the Council of Economic Advisors under the second President Bush and advised Mitt Romney’s presidential campaign has gone so far as to publicly urge the Senate to reject Moore. Their confirmation in the near term would likely increase the volatility of the policy message coming from Fed officials which could make it harder for financial markets to interpret policy decisions. Over a longer horizon there could be a breakdown in the model of monetary policy independence should partisan nominees increase in number and influence, with unknown consequences for global financial markets, inflation and the US economy. The Fed is a creation of Congress, and the current Congress is faced with making the decision about what sort of institution serves its own and the publics’ interest best.