The risk of a recession is elevated, but it’s not a forgone conclusion

With the breakdown in negotiations between the US and China in recent weeks, the US trade war shows no signs of resolution. Rising tariffs, non-tariff trade actions and retaliation will be an intensifying headwind to the economy just as the current expansion officially becomes the longest since World War II in Q3. Fears of a recession are on the rise and the bond market is pricing in several rate cuts from the Fed over the next year. To date the tariffs imposed in 2018 have mainly been passed on to consumers and modestly dampened consumer spending growth. The trade war has also been cited as a contributing factor behind lackluster earnings in 2019, although the stock market has rebounded smartly from Q4 turbulence. Consumers are likely to face an additional drag on their purchasing power from the recently announced escalation in tariffs, although it isn’t likely to be enough by itself to drive the economy into recession. Another risk comes from equity valuations which may embed unrealistically rosy expectations for 2020 earnings (and beyond) in light of the recent escalation. Only one of three recession models published by the Federal Reserve System, the one based on the slope of the yield curve, is currently flashing red for the likelihood of a recession beginning in the next 12 months. The risk of a recession is elevated, but it is not a forgone conclusion. The road to brinksmanship has come as Presidents Trump and Xi both see themselves as having the upper hand and the risk is that perspective produces further escalation.

A trade war takes shape

The primary front of the trade war is between the US and China. The economies of the two countries are of roughly comparable size, although there is a lopsided trading relationship. The US exports a third of the value of goods and services that we import from China resulting in a trade deficit of $379bn, or 1.8% of GDP in 2018. One of the underpinnings of the current conflict is that the governing frameworks of the two countries are quite different. The US operates primarily as a market economy with regulatory oversight while China is mainly a centrally planned economy with some market mechanisms. For decades policy makers in the US and other advanced countries operated under the presumption that as China integrated into the global economy, it would gravitate toward a market system. That led to tolerance of practices that might otherwise be considered unfair competition including direct support of the many state-owned companies, a required degree of technology transfer from foreign companies investing in China, and a lack of protection for intellectual property rights.

The Trump Administration launched an investigation into Chinese trade policies in 2017. Last year, the US imposed three rounds of tariffs on roughly $250bn worth of Chinese imports. A deal between the two countries appeared to be taking shape in recent months but was scrapped in recent weeks leading the Administration to increase tariffs on $200 billion of U.S. imports from China by increasing levies from 10% to 25% beginning May 10, 2019. The tariffs cover roughly half of imports from China and the Trump Administration is threatening to impose 25% tariffs on an additional $300bn of products, most of the remainder of Chinese imports. China has responded by increasing its retaliatory tariffs on $60bn of US imports from 5-10% to 10-25%. They have also signaled they are digging in for an extended conflict and are not interested in major concessions.

There is a new and important front in the trade war involving technology. The Trump Administration has also barred the Chinese Tech giant Huawei from supplying US markets and has put the company on a list of entities that US chipmakers need permits to supply. The decision is economically significant given Huawei’s sales of $107bn in 2018 (a 20% gain over 2017) and substantially escalates US-China trade tensions. Huawei’s growth could be severely curtailed, but so too could the sales of its many US suppliers.

The confrontation with China is not the only front of the trade war. The US renegotiated NAFTA last year but the resulting USMCA agreement has yet to be ratified by the US, Canada and Mexico. As the stock market was dropping on the escalating conflict with China, Trump announced a deal to lift tariffs on steel and aluminum imports from Canada and Mexico. The deal is a prerequisite for Canada and Mexico to ratify the deal, but Democrats in the US Congress still want to see tighter labor requirements and passage is not a forgone conclusion. Meanwhile the President has been threatening to impose tariffs on as much as 25% of imported cars on the basis that they pose a threat to national security. Once again when the financial markets were dropping in response to developments with China, President Trump announced a 6-month delay in imposing auto tariffs which means they will be revisited in November.

The economic impact: what do the data say?

The US economy is less dependent on trade than most other countries due to the size and diversification of our resources and economy. The Trump Administration has been banking on the relative independence of the US economy as providing an upper hand in negotiations. Yet the tariffs and trade restrictions can still weigh on the economy through a variety of channels. If tariffs lead firms to source imports from second best producers from other countries then there will be a loss in efficiency (something economists call ‘deadweight loss’). Tariffs can lead to a stronger dollar denting US export competitiveness. If US firms pay the tariffs but competitive pressures prevent them from passing the higher costs along to consumers the result will be compressed profits; if they are able to pass them along the result will be higher consumer prices.

The clearest impact of the tariffs to date has been on rising prices for US consumers, which may seem surprising given that overall consumer inflation has remained fairly subdued. Studies published by the National Bureau of Economic Research and the New York Fed conclude there has been a nearly complete pass through of the tariffs imposed in 2018. Monitoring of the aggregate statistics indicates varying but significant degrees of pass through across affected goods. Table 1 highlights that two categories of goods directly impacted by tariffs, furniture and appliances, have seen price gains over the past 15 months that have exceeded the trend on other consumer goods, and that real spending on these categories of goods has also been more subdued. It is also noteworthy that growth in consumer spending didn’t accelerate in 2018 alongside growth in other sectors despite rising wages, record levels of net worth, and buoyant consumer sentiment. Forecasting models of consumer spending predicted an acceleration in spending suggesting the trade war has been a moderate headwind dampening an otherwise robust environment of US households. New York Fed estimates the 2018 tariffs subtracted about 0.3% off GDP growth last year and the round of tariffs just announced could subtract off an additional 0.5% over the next year.

Table 1 – Changes in Tariff Affected Consumer Prices and Spending

The other potential dimensions of economic impact outlined above have been less studied and aggregate data to date are less conclusive. While there has been nearly a 6% appreciation of the real trade weighted dollar since the beginning of 2018, the US share of global exports actually nudged up a touch suggesting no notable loss of competitiveness, although the impact may simply not have shown up yet. Any impact of tariffs on profit growth in 2018 was overwhelmed by the large corporate tax cut which led to a record year in S&P 500 earnings. New York Fed researchers found a notable degree of deadweight loss from trade diversion to second best suppliers, yet aggregate nonfarm business productivity growth in the US economy rose 2.0% over the past five quarters, a stronger performance than in recent years.

What are recession indicators saying?

The US economy has weathered the trade war reasonably well to date and an additional 0.5% drag isn’t enough by itself to drive the US into recession. But the challenges to the outlook are stacking up given the likelihood the escalation in tariffs will be met with retaliatory actions, the positive impulse to corporate earnings and the economy from the tax cut is fading, and there is a growing sense that the rules of the road are unlikely to be clarified any time soon which could put a chill into spending and investing decisions. Fears of a recession are on the rise and the bond markets are pricing in several rate cuts from the Fed over the next year.

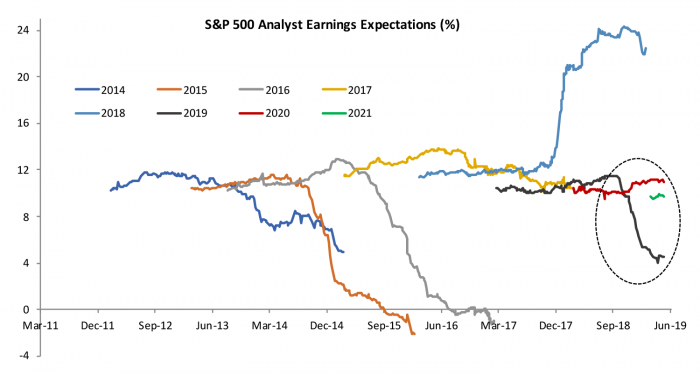

Despite these fears the stock market has recovered quite well from a rocky Q4, in part because of a Fed pivot to patience on interest rates, but markets have struggled to digest recent news on trade. Companies have guided expectations for 2019 earnings lower citing pressures from the trade war. Figure 1 highlights that after months of downgrades, earnings guidance for S&P 500 companies for 2019 stabilized in the Q1 reporting season. However, expectations for 2020 seemingly embed a recovery in global growth and expansion in earnings that could be overly optimistic if the trade war continues to escalate and takes a toll through compressed margins or reduced consumer spending. Companies start to provide more concrete guidance on earnings for the following year with the Q3 reporting season that kicks off in October. The Q4 reporting season will be a test of current optimistic valuations despite the intensifying trade conflict.

Figure 1: Earnings Expectations for 2020 May be Too Optimistic for a Trade War

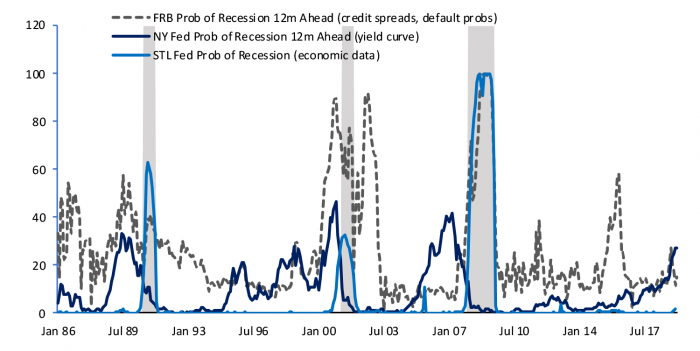

Models that estimate forward looking probabilities of a recession are giving mixed signals. Figure 2 plots the output of three recession probability models developed by researchers in the Federal Reserve System. The New York Fed’s model is based on the slope of the yield curve, specifically the difference between 10-year and 3-month Treasury rates which captures the historical regularity that the market starts pricing in Fed rate cuts well before the Fed actually cuts rates in response to recession dynamics taking root in the real economy. The model currently has the highest probability of the three at 27.5% probability of a recession starting in the next 12 months as of April. The model was at a similar level a year or two ahead of the last three recessions and hasn’t given many false signals of this magnitude. A model based on default probabilities and risk spreads on corporate bonds developed at the Federal Reserve Board estimated a 15% probability of a recession starting in the next 12 months, down from a 27% probability in December when the markets were more turbulent. This model has been at the current level for much of the current expansion and at various times in the past expansions suggesting only moderate risk. The St. Louis Fed model is based on economic data instead of market signals and estimates only a 2% probability of a recession given that the data flow has remained robust. This model’s track record is mainly as a concurrent rather than leading indicator of a recession, however.

Figure 2: Recession Models Giving Mixed Signals

Overall the risk of a recession is elevated, but it is not a forgone conclusion. The fate of the current recovery likely rests in the hands of the Trump and Xi Administrations, and to a lesser degree the responses of their central banks in responding to the risks. The road to brinksmanship has come from both leaders seemingly seeing themselves as having the upper hand. President Trump believes the more robust and independent US economy is in a better position to weather the impact of the trade war than the Chinese economy which has already slowed sharply over the past year and is more dependent on trade. Xi sees Trump as more vulnerable to democratic forces he doesn’t have to contend with, as well as an economy that is more directly influenced by financial market volatility. Both perspectives have merit, and there is a risk their respective views produce continued escalation. Economic and market responses to the recent escalation could force the two sides back to the negotiating table, but clouds have gathered over the outlook.