Companies’ efforts to soften trade war impact will help guide Wall Street

A trade war has moved from a risk to a reality as tariffs and counter tariffs are starting to take effect. The duration and extent of the trade war is unknown, although a definitive resolution is not in sight. A few weeks ago, we explored the channels through which a trade war could dampen the recent robust economic momentum, including higher prices for consumers and/or compressed profit margins, as well as delayed investment and hiring. Another likely channel would be through a tightening in financial conditions as investors demand greater compensation for rising risk. Financial conditions in Asia, Europe and a number of emerging markets have indeed been tightening on the back of some loss of economic momentum as well as recent policy developments that will have a larger impact on countries more dependent on trade. Financial markets in the US have been largely resilient, in part reflecting the impact of the recent tax cut in boosting shareholder value. We look at analyst earnings expectations and find there has been little factoring in of any possible loss of profitability due to trade conflicts. Company guidance during the Q2 earnings season will provide valuable assessments of how companies are managing the realities of the trade war and the resulting impact on their bottom line. We suspect that risks are to disappointment as the year unfolds and the trade war continues.

While there is still plenty of bluster and noise on trade policy, two things are becoming increasingly clear: First, the prospect of rounds of tariffs imposed by the US and counter-tariffs imposed by our trading partners have moved from being a threat to a reality. Second, there will be no quick resolution. Trade negotiations are likely to drag on for months leaving some firms and industries managing the reality of tariffs and possibly other actions that affect their ability to do business and manage global supply chains.

Several weeks ago we wrote that a trade war could dampen the recent robust economic momentum through a squeeze on consumers through higher prices and/or a squeeze on profits as firms are unable to pass higher costs along to consumers and possibly weaker investment as the operating environment that firms are making decisions in becomes increasingly clouded by policy changes. In his recent press conference announcing the latest increase in interest rates, Fed Chairman Powell acknowledged that “concerns about changes in trade policy are rising” among the Fed’s business contacts, although while policy makers are “beginning to hear reports of companies holding off on making investments and hiring people” he also notes that “right now we don’t see that in the numbers at all. The economy is very strong.” Chairman Powell’s assessment strongly suggested that the Fed is likely to continue raising interest rates as planned for now unless and until the economic data start to show signs the trade war is having a real impact.

At a recent conference hosted by the European Central Bank, Reserve Bank of Australia Governor Philip Lowe called recent development on trade policy “incredibly disturbing.” He noted that “as to the tariffs themselves, I don’t think are going to derail the global expansion, but I can think of two mechanisms where the expansion could be derailed.” One channel was the potential drag on investment and hiring from rising uncertainty outlined by Fed Chair Powell. The second channel of transmission Lowe is keeping an eye on is “through financial markets because they’re very good at telescoping future events to today.” Lowe noted that “so far, the financial markets have taken a relatively benign interpretation, but that could change very quickly, and so we could see a lot of turbulence.”

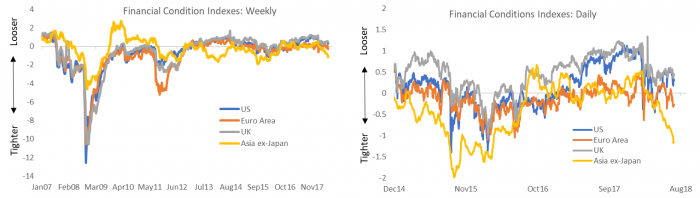

Financial markets are forward-looking by design and as Governor Lowe noted, should be early to parse out the various impacts of trade policy. One way to gauge the support or headwind to the real economy from changes in financial markets is to construct financial conditions indexes that factor in asset prices and volatility across asset classes, including equity markets, credit spreads, interest rates and the shape of the yield curve. Bloomberg compiles comprehensive, normalized indexes of financial conditions for the US, the UK, the Eurozone and Asia ex Japan and these are plotted weekly for a longer horizon and daily for a shorter horizon in Figure 1. When these indexes are positive, then financial conditions are a tailwind supporting above-trend growth, and when they are negative they are a headwind to growth. My own forecasting experience suggests that after controlling for the degree to which changes in economic conditions impact financial conditions, changes in broad financial conditions indexes can be a significant and leading indicator of economic growth. As Governor Lowe noted, financial conditions can change very quickly, particularly when moving lower as was seen in the US housing crisis in 2008, the European debt crisis in 2011 and to a lesser extent the China led global slowdown in 2014-2015.

Figure 1: Financial Conditions Have Tightened in Asia, Europe, Less So in the US

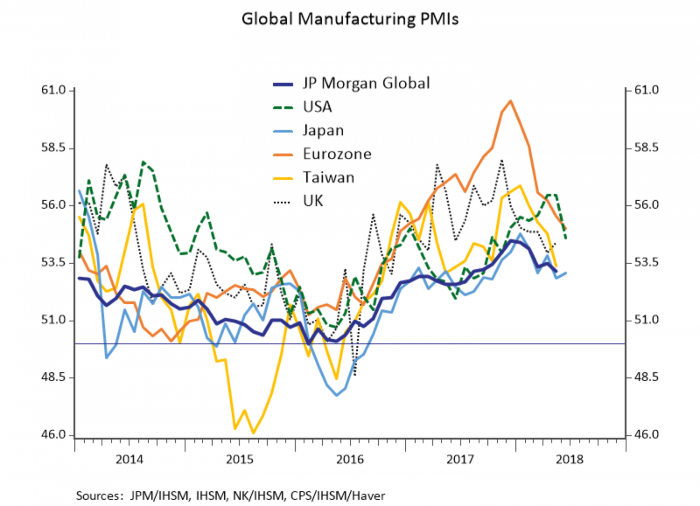

In addition to some seemingly idiosyncratic crises in smaller developing countries like Turkey and Argentina this year, financial conditions have been tightening fairly rapidly in Asia ex Japan, with modest tightening in the Eurozone while the US and UK have seen financial conditions become somewhat less buoyant but remain accommodative. Financial conditions in Europe and Asia have been buffeted by the combination of some slowing in economic activity and threats to the outlook from US trade policy. Figure 2 plots some global indicators of manufacturing activity. Purchasing manager indexes are constructed to be above 50 when the manufacturing sector is growing and below 50 when it is contracting. The chart shows that momentum in manufacturing activity in the Eurozone, UK, Taiwan and Japan have all slowed notably this year after surging to new highs for the current expansion in 2017. At the same time these countries are more reliant on trade and so face a greater threat from a global trade war and the market has responded by increasing the risk premia in asset prices for many countries in these regions. Meanwhile US indicators have remained resilient with manufacturing still running close to cycle highs and GDP tracking above 4% in Q2.

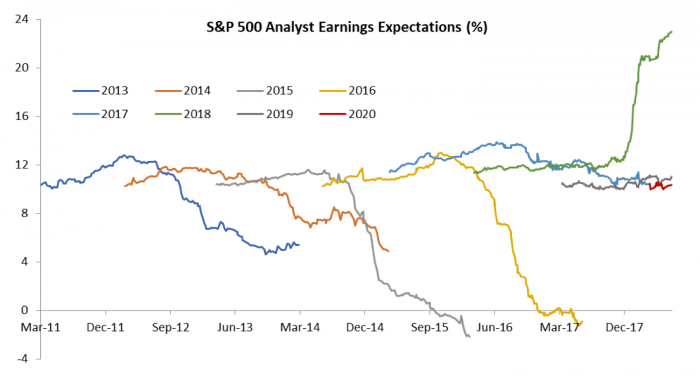

The US economy is less exposed to trade than other countries, even as it is far more integrated with the global economy than in prior cycles. In addition, the US is starting to feel the effects of a sizable deficit-financed fiscal stimulus that is poised to juice up the economy over the next year or two. The impact of the tax cut on financial conditions is far more direct than its impact on the real economy since shareholders see benefits regardless of whether firms spend their tax windfall on increased investment and capacity or on share buybacks and dividends. This is strikingly illustrated in analyst earnings expectations for companies in the S&P 500, plotted in Figure 3. The chart plots how analyst expectations for the 500 firms in the aggregate evolve by year until that year has been reported.

Analyst expectations tend to start with an expectation for earnings growth of just over 10% as a baseline. Prior to 2017, earnings mainly disappointed expectations to some degree, particularly in 2015 and 2016 when the China-led global slowdown contributed to a collapse in energy prices dragging down the burgeoning US energy sector that had driven a sizeable portion of total earnings growth through the current expansion. Figure 1 confirms that these earnings disappointments were reflected in tighter financial conditions owing to wobbly and volatile equity markets and widening credit spreads.

Figure 2: Some Slowing in Global Manufacturing After a Synchronized Boom

Figure 3 also illustrates the powerful impact the tax cut has had on earnings expectations for 2018. Instead of declining on trade fears in recent months, analyst expectations for corporate earnings have been rising on guidance from earnings announcements reaching a high of 23% in mid-June. After 2018 analysts largely expect corporate earnings to once again grow roughly 10% per year. It seems safe to say that the data on analyst expectations give no indication that compression in profit margins or longer term reduction in efficiency owing to disruptions in global supply chains that result from trade wars have been factored into projections for earnings to date. Company guidance during the Q2 earnings season will provide valuable assessments of how companies are managing the realities of the trade war and the resulting impact on their bottom line.

A recent high profile announcement by Harley Davidson that the company would move some production to Europe to avoid retaliatory tariffs from the European Union is an early shot across the bow and only the companies themselves can shed light on how the competitive forces in their industries lead them to respond through changes in prices, margin reduction and other resulting strategic investment and production decisions. I suspect the risks to the current rosy outlook are to the downside. As Australia’s Governor Lowe noted in response to a question about global trade developments; “Can any of us think of a country that’s made itself wealthier and boosted productivity growth by building walls? Probably not.”

Figure 3: Equity Analysts Expect Record Earnings Growth This Year on Tax Cuts and Solid Growth Thereafter