Happy but cautious households continue to struggle with wealth growth

Growth in consumer spending continues to motor along at a healthy pace. Nonetheless, there are two deepening conundrums for forecasters of the US consumer. The first is the death of the wealth effect. The prior reliable relationship between gains in wealth and growth in spending has virtually disappeared in recent years. Recent research points to a possible culprit in a staggering continued widening in the distribution of wealth; the vast majority of households haven’t recovered the wealth they lost in the Great Recession while the top 10% have comfortably recovered and exceeded their past position. Wealthy households tend to have substantially higher saving rates which helps explain why record gains in wealth haven’t boosted spending much. The other mystery is why high levels of consumer sentiment aren’t boosting spending. The answer seems to lie in wage growth that continues to be more subdued than in past cycles when sentiment reached these levels. Low wage growth apparently isn’t getting in the way of consumer satisfaction with the world.

Rutgers Center for Real Estate Director Morris Davis and I have long been students and forecasters of the US consumer. Given the consumer accounts for more than two thirds of economic activity, it is a natural area of focus for macroeconomists. As I have pointed out previously, in his time as a Federal Reserve Board economist, Dr. Davis and one of our colleagues penned what became a standard handbook of consumer forecasting.

The workhorse model of consumer spending features two legs. The first is a long-run relationship between net worth and household saving. It is this long-run leg that predicts any wealth effects on consumer spending, increases or decreases that result from unanticipated changes in net worth. The second leg is focused on the short run and brings in the state of the labor market, Fed policy and consumer sentiment, as well as incorporating the wealth effect from the first leg of the model. At the moment there are apparent mysteries in each leg of the model with the result that, while robust, consumer spending continues to run a bit on the cautious side.

Long Run: The Death of the Wealth Effect Has Not Been Exaggerated

The workhorse model of consumers holds that consumers will accumulate wealth in order to smooth consumption over their lives. People may borrow when they are young to finance an education or to purchase a house. Then they accumulate wealth to finance large demands on their resources such as the education of children or their own retirement. Thus, changes in wealth are generally planned and shouldn’t help us predict consumer spending.

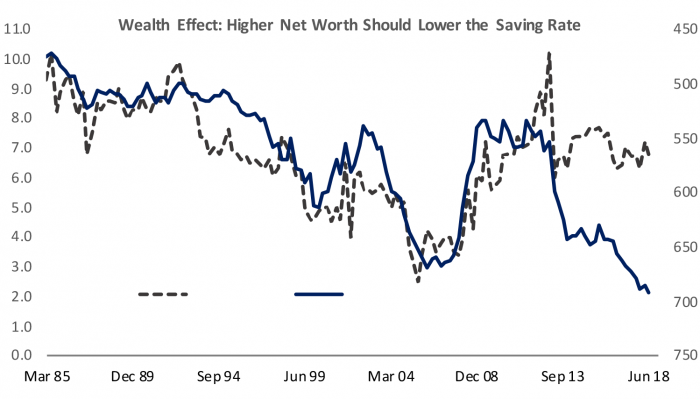

Figure 1: No Sign of a Wealth Effect Despite a Strong Economy

However, history is full of rises and falls in house and equity prices that are above and beyond what consumers expected and can lead households to adjust their spending in response. This is what is commonly referred to as the wealth effect: the impact a dollar of unanticipated gains (or losses) in net worth will have in boosting (or depressing) consumer spending.

It is now widely recognized that the wealth effect is smaller now than it was before the global financial crisis of 2008, likely reflecting a combination of increased consumer caution, a desire to bring down excessive debt loads, and an aging population that by many accounts hasn’t accumulated sufficient resources to maintain their living standards through their retirement years. Yet as the recovery has strengthened, and household net worth reached new records highs, there is no evidence the wealth effect is staging a recovery. Indeed, the wealth effect on consumer spending has all but disappeared. Figure 1 plots the personal saving rate against the inverse of household net worth as a percent of disposable income. Households have not reduced their saving rate at all since the Great Recession despite household net worth reaching new record highs.

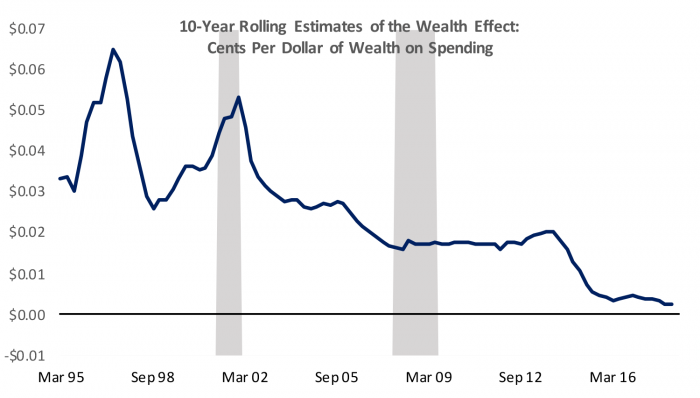

Estimates of the wealth effect from the first stage of the forecasting models confirm what the eye can plainly see in Figure 1. I estimated the model over rolling ten-year windows starting in 1985 to see how the wealth effect has evolved over time. Back in the late 1990s when Dr. Davis and I worked together at the Federal Reserve Board, the consensus in the economics literature was that consumers spend 3 to 5 cents of every dollar of unexpected gain in wealth. The results of rolling regressions are shown in Figure 2 and confirm that the wealth effect has all but disappeared, and has declined even as the recovery has proceeded.

Figure 2: Results of a Regression Estimating Wealth Effect Over 10-Year Windows Confirms its Demise

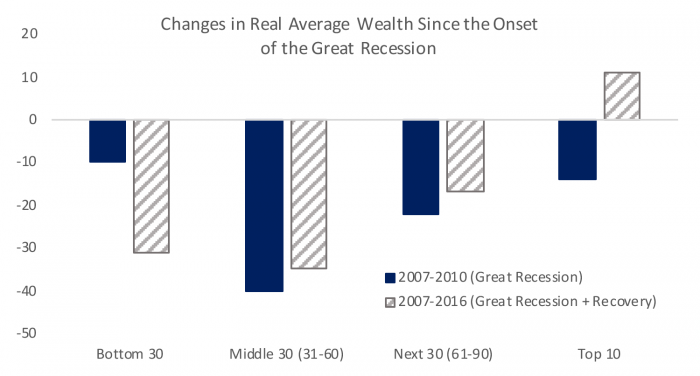

In a recent blog post we did a checkup of household balance sheets and found them to be sound, although we noted rising inequality. Recent research from a group of economists at the Federal Reserve Board documents the sobering dimensions of the widening inequality in wealth, and it appears the findings can likely help explain the mystery of the disappearing wealth effect on consumption. The article, titled “A Wealthless Recovery? Asset Ownership and the Uneven Recovery from the Great Recession” uses detailed household-level data from the Fed’s Survey of Consumer Finances (SCF) to explore the evolution of net worth among the top 10% of the income distribution and the bottom 90% divided into three groups equal to 30% of the population.

The researchers find that the vast majority of households had not yet recovered the wealth lost through collapse in housing and stock market values that occurred during the global financial crisis as of 2016, the most recent years for which the SCF is available. Only the top 10% had seen their net worth increase, and the lowest 30% of households have seen a continued deterioration in their wealth despite an ongoing recovery in the housing and stock market. The researchers dug into the drivers of their findings and found that the bottom 60% of households saw substantial declines in homeownership rates that means many of these households haven’t benefited from the recovery in the housing market. Indeed, rising home values only makes entry or re-entry into home ownership more expensive. In addition, ownership of equity is already low for these lower-income households, but it has declined since the Great Recession, where it is close to 100% for the top 10%. In addition, the researchers found that households in the top 10% also owned substantial amounts of other assets, including direct ownership of businesses and alternative assets that may have provided increased diversification and rates of return.

Figure 3: Most Households Still Haven’t Recovered Wealth Lost in the Great Recession

It has been well established that wealthy households have substantially higher saving rates than middle and lower income households. So to the degree the recovery in household net worth has been highly concentrated among the top 10% of income earners, it is not surprising to see the wealth effect on consumption whither away in the aggregate forecasting models.

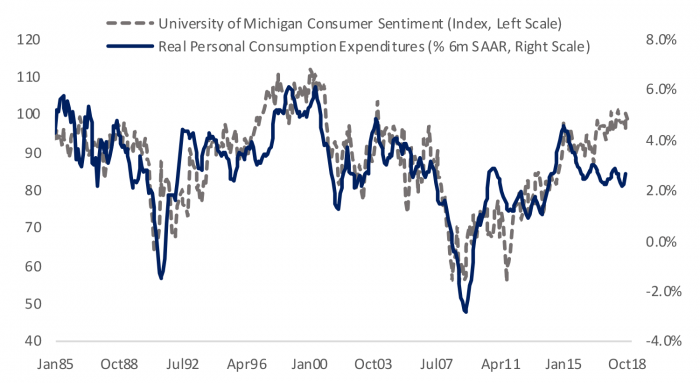

Tired: Happy Consumers Binge on SUVs. Wired: Happy Consumers Stay True to Their Budgets

The second leg of the consumer forecasting model incorporates current conditions including the unemployment rate, the real fed funds rate and the level of consumer sentiment. One seeming conundrum is that consumer sentiment has continued to improve, reaching levels exceeding the norms of the prior expansion. Yet as shown in Figure 4 this has not been accompanied by an acceleration in the growth of real consumer spending, which has remained steady at a still healthy 2.5-3.0% pace, down from the peak this recovery of 4.5% reached in 2014. Consumer sentiment is not always a reliable predictor of what households actually spend. But the track record is pretty reliable over time and the disconnect in recent years stands out.

The errors on the short-run leg of the forecasting model are not currently as large as one might presume from Figure 4. The fact that wage growth has been more subdued in the current cycle means that real income growth, the cornerstone of consumer spending, has been more subdued than in past cycles when sentiment has reached current levels. Consumers are seemingly unperturbed by the more subdued gains in purchasing power and are reporting a high degree of satisfaction with the world.

Figure 4: Consumers are Feeling Good About the World but Spending Cautiously

Of the two conundrums, the death of the wealth effect due at least in part to increasing wealth concentration appears to be the most structural, and the most disturbing. A more modest pace of consumer spending may mean a lower potential growth rate of the economy. This isn’t inherently a problem, but the inability of a majority of households to accumulate wealth may lead to problems with financing education or retirement, or the ability to weather shocks such as unexpected spells of unemployment. The US economy faces a Catch 22 with housing values: any successful efforts to increase affordability for those mainly at the bottom of the income distribution will adversely affect the net worth of current homeowners. Housing values are a lasting hangover from the Great Recession that continues to deepen the already widening levels of inequality.