A journey through office space from Babylonian scribes to Milton Waddams to Apple’s ‘mothership’

Office work probably began about 3,000 BCE as Babylonian scribes recorded business transactions on clay tablets; considerably earlier if we include recording transactions using physical tokens. The first written use of the word “office” was circa 1395, when Geoffrey Chaucer wrote The Canterbury Tales. “The Friar’s Tale” relates a meeting between The Friar and a “summoner,” an official who subpoenas persons required to appear before an ecclesiastical court. The Summoner is corrupt and demands bribes from those who would escape such a summons. Enraged that a widow resists his demands, he states that “I would have 12 pence, though that she be wood; or I would summon her unto our office,” i.e., the court. Six hundred years later, corruption is still with us, and so are offices; although the latter have a broader usage and wider applications.

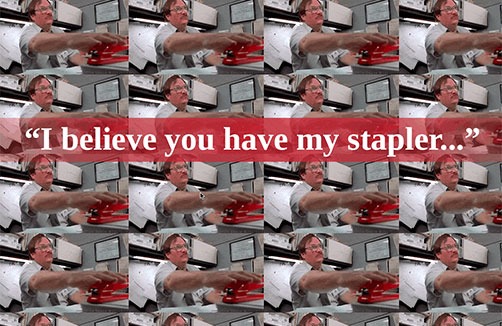

But my first task to prepare for this entry was not anything so highbrow as to read some Chaucer, or even consult data or the scholarly literature. Those activities could come later, after I re-watched Mike Judge’s classic film Office Space. The struggles of Peter Gibbons, Milton Waddams (above, in his ever-shrinking cubicle) and friends against Initech’s management and “efficiency” consultants included plenty of references to the soul-sucking design of the office itself, to say nothing of the evils perpetrated by a certain constantly malfunctioning printer. And I myself remember the days when my own office switched from solid Swinglines to cheap off-brand staplers – a switch that will ultimately drive Milton to his final act of desperation.

It’s well known that all great movies are about real estate, not a few about offices, as I’ve demonstrated elsewhere, and my colleague Austin Jaffe has confirmed. We could spend the entire post discussing offices in movies, literature and art – Bob Cratchit, Bartleby, Bud Baxter, dozens of great paintings of scholars in their studies, to say nothing of Mad Men and not one, but two, versions of The Office.

Quite a bit of this ground is ably covered in Nikil Saval’s superb Cubed: A Secret History of the Workplace. In addition to an entertaining discussion of the office in the arts, Saval provides a well-rounded and concise history of the office building and the design of space, as well as, most to the point, the changing nature of the activities contained therein.

For much of human history there was little if any separation between home and workplace, with the notable exceptions of temples and churches. Around the 17th century, the Dutch, among others, began to distinguish between home and the workplace (Rybczynski); the English began to transact business in coffee houses (Cowan). In the 19th century the economies of the Britain, then the U.S. and other countries began to industrialize (Pritchett). Of course, this led to major shifts from farm to factory, but the new industrial enterprises needed clerks – the first “white collar” workers – as well as those on the factory floor (Buera and Kaboski). Other office space was required for complementary activities such as banking, insurance, shipping and railroads, as well as growing government employment.

Both the office building and the design of the workspaces within evolved along with the scale and nature of the work. Among the best known structural innovations, in 1885 the Chicago Home Insurance Building demonstrated the feasibility of a steel frame supporting non-load bearing walls. Aesthetically, Sullivan and Adler’s Wainwright Building (1891, St. Louis) was a design breakthrough, combining vertical lines with an appropriation of the classical three-part design of a two-story base, 9 floors inspired by fluted classical columns, topped off by a “wedding cake” of ornamentation at the top. Frank Lloyd Wright’s 1904 Larkin Building in Buffalo anticipated many future developments in office buildings, including the atrium and a rudimentary form of air conditioning. Three decades later, a golden age of skyscraper construction peaked with New York’s masterpieces, the Chrysler Building and the Empire State Building. To learn more about the development of some of our most visible office buildings, consult Rutgers own Jason Barr’s Building the Skyline: The Birth and Growth of Manhattan’s Skyscrapers.

But it is always worth remembering that for every large office tower containing up to a million square feet, or two, elsewhere in the metropolitan area – and especially in small cities and towns, and in the suburbs – there are millions of square feet of offices in a range of smaller buildings of varying quality and layout. Florance et al. estimated 2009 total U.S. office space at about 12 billion square ft. and $1.6 trillion in value. Simple extrapolation suggests these might be on the order of 14-15 billion square feet and $2 trillion today.

There was, of course, a corresponding evolution in the layout of workspaces within office buildings. Saval discusses this in more detail than we can here. In brief, early offices had large open plans with armies of clerks and secretaries at desks. Over time, private offices became more common, at least for the higher castes of workers.

The seeds of a revolution were planted in 1964 when Herman Miller’s designer Robert Probst, working with Miller executive George Nelson, unveiled the “Action Office,” which modularized office furniture and space dividers. Probst conceived it as an improvement over the rows of support staff desks lined up in a large open room, not as a replacement for the private offices of managers and professionals. But with the introduction of “Action Office II” Probst introduced flexible vertical panels that could afford more privacy. Once customers figured out the simple geometry of 90° angles – that to maximize workplace density these panels could be formed into rows and columns of identical cubicles, rather than the varying patterns that Probst preferred – the world of Peter Gibbons and Dilbert came into being, for better or for worse.

Cubicles may be a good solution for some office situations, such as call centers; and they are cheap. But cost minimization is not the same as profit maximization, as every student learns in Econ 1. Many users found them stultifying; there’s a reason for the popularity of Office Space and Dilbert. Saval reports that a 1997 Steelcase survey of office workers found that 93 percent of cubical workers were dissatisfied with their digs. George Nelson himself wrote that:

One does not have to be an especially perceptive critic to realize that AO II [the basis for the cubicle] is definitely not a system which produces an environment gratifying for people in general. But it is admirable for planners looking for ways of cramming in a maximum number of bodies, for “employees” (as against individuals), for “personnel,” corporate zombies, the walking dead, the silent majority. A large market.

In due course the wheel of office layout turned another circle. The original open plan, a “bullpen” of desks or tables lined up in a large room, had never completely vanished for some basic support workers, but in the 1990s they began to reappear for “knowledge workers,” e.g. many of my former World Bank colleagues were assigned spaces that combined elements of open plan and “AOII.” In the past decade “open plan” has made a comeback, especially but not limited to firms that view themselves as “high tech.”

Anecdotally, when I’ve visited open plan offices, often on field trips with students, my impression is that they are more popular with designers, some brokers, and management, than with the mass of workers. These observations are not unbiased; I’m sure that I tend to have longer conversations with inhabitants who, like me, find open office more often an impediment to the way I work rather than a facilitation. Partisans of open plan always talk about opening up lines of communication and “breaking silos,” while those with my priors see the Action Office and open plan as enemies of introspection and concentration. Deep thought, privacy and confidentiality go out the window, or rather, all over the room.

While there’s more to learn, several empirical studies provide more systematic evidence on these shortcomings (Kim and de Dear; Leder et al.; Seddigh et al.) Why, then their popularity? Saval puts his finger on the central problem: “office planners and architects tend to imagine that the setup of their own offices should be the way that everyone should work.”

To be fair to open plan and its variants, like any other basic design it can be well executed, or not. Some of the best implementations, such as Bloomberg’s New York headquarters, are very impressive in the range of options offered to employees working at different tasks or stages of projects, with a mix of open and private space available.

The tail can’t wag the dog: all office space is derived demand.

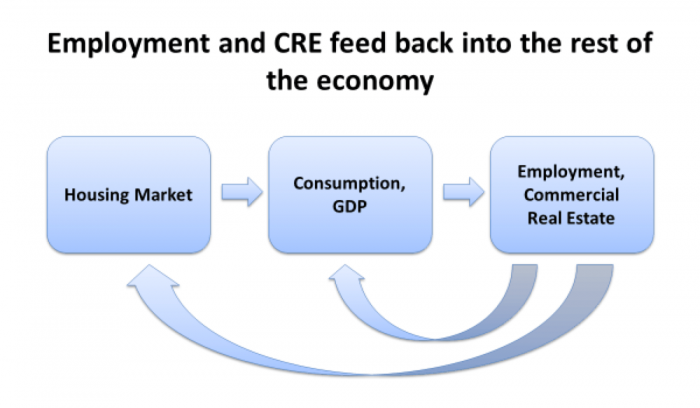

We’ve seen Exhibit 1 before:

To reiterate, in a business cycle, a common pattern is for housing investment to “lead” the cycle. Housing investment itself is part of GDP, so obviously when housing investment slows, GDP growth slows. As residential construction workers are laid off, people cut back on the purchases associated with house sales like furniture, lawnmowers and so on, the economy slows further. House sales slow down, and prices start to soften. Consumer confidence may erode. Consumption starts to fall.

Consumption is almost 70 percent of GDP, so that falls. As firms see their sales fall, employers slow hiring, and increase the pace of layoffs. Employment falls. So forget about investing in that new store, or warehouse – or office space. Commercial real estate then declines. If the CRE decline is large enough, it can begin to feed back into a further decline in housing investment, consumption, and GDP.

At some point, normally, the dearth of new homes means prices start to rise, the housing market starts to right itself. Sales increase, along with furniture… the process works in reverse. Housing leads the economy out of the recession, GDP grows again, and office and other CRE get back on track.

For many firms, their real estate – lots of it office space, especially for service firms – is their second largest operating cost, after labor compensation. But it’s usually a distant second. For example, Brill and Weidman surveyed over 100 service firms and found that on average employee compensation was 82 percent of firm costs; technology costs were another 10 percent; and 8 percent of costs were real estate, of which 3 percent comprised operations and maintenance costs, and 5 percent the facilities themselves.

Thus, if open plan – or any other design – is viewed simply as a cost-cutting measure to reduce spending on real estate by reducing square footage, without carefully analyzing design in light of the firm’s particular workplace requirements and the productivity of their major asset and cost center (i.e. their people), cutting real estate costs the wrong way may lead directly to bottom-line losses. Ex ante analysis of space needs must carefully consider layout, furnishings and equipment, effective integration of technology, and quality, as well as square footage. And the job isn’t over once everyone’s moved in. If management doesn’t monitor and evaluate the effectiveness of space design and utilization, and use this information to inform midcourse corrections, then it will be the world of Office Space and Dilbert all over again.

Supply and demand for office space at the metropolitan level

So far, we’ve considered office space from a very micro view, discussing workers and firms. What does the office market look like once we go a little bit macro, up to the metropolitan level? Here we undertake some exploratory data analysis.

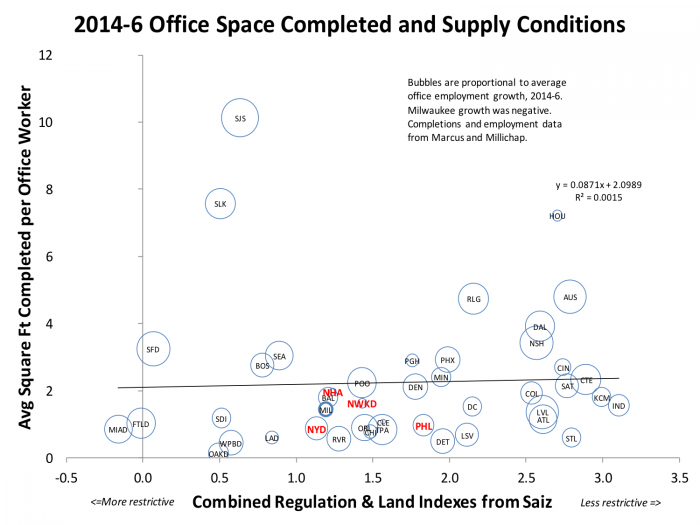

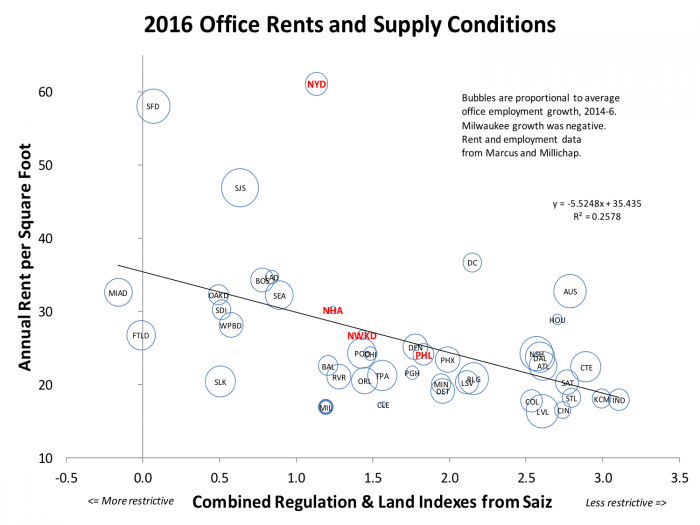

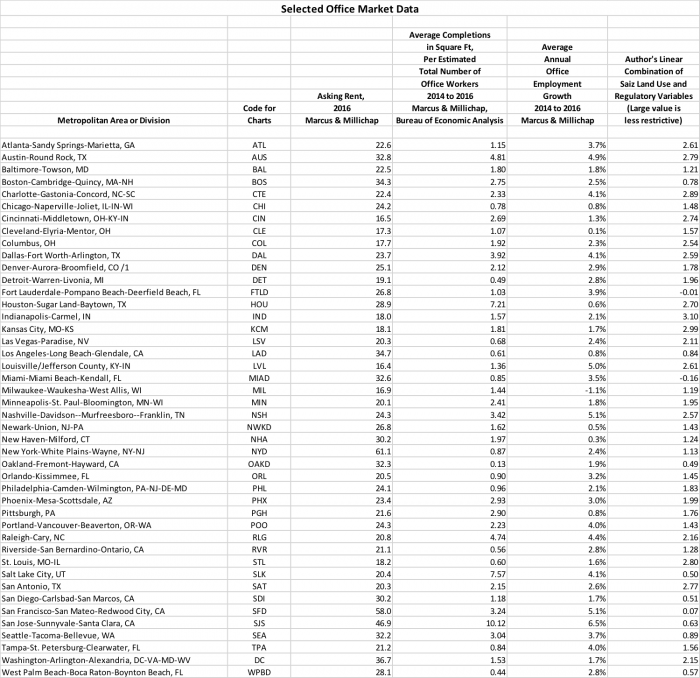

The next two exhibits will examine some basic office space production and rent data for 44 large metropolitan areas and divisions. These include several from our region, the Newark metropolitan division, the New York City metropolitan division, the Philadelphia metropolitan area, and the New Haven metropolitan area. Exhibit 2 examines office space completed, and supply conditions.

Our measure of office space completed comes from Marcus and Millichap. To smooth out fluctuations we average the office square footage completed in each metro area over 2014 to 2016. We then divide this by my own estimate of the number of office workers using metropolitan data from the Bureau of Economic Analysis. This variable is presented on the vertical axis.

On the horizontal axis we have a measure of combined development regulation and physical constraints on land use constructed from indexes provided by Albert Saiz. Land supply is a variable that directly affects all property types, including office; but the regulatory index is based on rules for residential development. We don’t have such measures for office space, per se, although it’s likely that restrictions on housing development are correlated with restrictions on office development.

A larger value of the index means the market is less supply constrained so markets such as Indianapolis (IND), Kansas City (KCM), Austin (AUS) and Houston (HOU) are less constrained than markets at the other extreme such as Miami (MIAD), Fort Lauderdale (FTLD) San Francisco (SFD) and the number of other California markets. Each market is indicated by a letter code that can be found at the table at the end of this entry. A “D” as the fourth letter of the code means the data are for a metropolitan division, otherwise they are for a metropolitan area. The sizes of the bubbles are proportional to Marcus & Millichap’s average annual estimate of office employment growth during the 2014 to 2016 period. One of the locations, Milwaukee, actually had negative office employment growth according to these estimates; Milwaukee’s bubble is bolded.

In this exploratory analysis we find that our region’s markets – Newark, New York, New Haven, and Philadelphia – are in the middle of our measure of supply conditions, i.e. the combined regulation and land indexes. This is somewhat of a surprise since New York is often cited as a very restrictive regulatory environment (Glaeser, Gyourko and Saks). It’s only a partial explanation to note that Manhattan is the most oft-cited case of restricted development, and our indexes cover the entire metropolitan area (Manhattan has an especially large share of New York’s office space, but as noted above Saiz’s indexes, the best at hand, are for housing).

In the event, we see that our local markets are not among the leaders in per worker office space development, at least for these three years under consideration. San Jose, Salt Lake City, and Houston are seeing booms in office construction during this period, compared to the other 41 metro areas. There is no apparent correlation between office completions and this particular measure of supply conditions. Of course, this exploratory data analysis is far from the last word in analysis of office construction, but it’s still surprising. As academics are trained to say, parrot-like: further research is needed!

Exhibit 3 is nearly identical to the previous Exhibit, except that the dependent variable, the vertical axis, is now annual rent for office space. We don’t bother to average rents, because the data show that changes in rent from year to year are smooth – too smooth, in fact. Webb and Fisher have demonstrated that asking rents are very crude measures of market conditions. As Webb and Fisher demonstrated to other academics, but any broker or user of space could tell you, most of the action in rent changes within a market from year to year appears in concessions given (or not), such as months of free rent, the size of tenant improvement allowances, amenities and operating expenses. Accurate data on effective rents adjusting for these side payments is not readily available, at least for public use. To the extent this is a problem, this excessive smoothness introduces error into the relationships between measured rent, and fundamentals. Despite this we see something of the expected negative relationship between a less restrictive development environment, and rent per square foot.

The future of offices: Apple’s ‘Mothership,’ or a seat at Starbucks?

The office building getting a lot of buzz as I write is Apple’s new $5 billion (reported), 2.8 million square feet headquarters about to come online in Cupertino. When 12,000 workers move in, it will provide 233 square feet per worker – high by current standards, especially for high tech firms – at a cost of about $1800 per square foot. Amenities reportedly include a 100,000 square-foot fitness center, 2 miles of walking and running paths, underground parking plus acres of planted areas. A thousand bicycles will be available on site for staff use as well as a limited number of electric golf carts and other shuttles. (With a market cap of $750 billion and a cash reserve a third of that, Apple can presumably afford it).

Designed by star architect Norman Foster, others dub it “The Spaceship;” I think of it as the Pentagon with the corners rounded off. It will contain four stories and reportedly all the offices will be open plan. MacWorld reported that a number of employees are unhappy with the design, including the open plan –

particularly a powerful senior vice president of hardware technology who responded to the floor plans with a series of F bombs (see MacWorld for the quotes); in the end his team was mollified with their own building on the side of campus built to their own specifications. Other managers expect to lose some staff based on antipathy to open plan.

Open plan, if done right – as a component of a portfolio of space designs, for workers to use when a premium is placed on collaboration among a large and/or variable group of people – can be successful in the right situations. That would almost always require the availability of options that provide quiet and privacy when needed.

Apple has gone open plan, but they have bucked the trend to shrinking space per worker. Some sources argue that 200 square feet per person is a typical provision, but that tech firms, with their predilection for open office, are often closer to 150. Norm Miller has studied these trends, and reports some alternative findings. Using a national survey of large markets and CoStar data, he finds that space per worker is highly cyclical, rising during recessions and shrinking during expansions – hardly surprising, but nicely documented. His most recent data at time of the study was from 2011, and space per worker came in at something over 350 square feet, trending down from a max of 370 at the worst of the Great Recession. Also unsurprising, there was substantial variation by market; but the nature of the variation is surprising. According to Miller’s compilation of CoStar lease data for 15 large markets, square footage per office worker ranges from about 200 square feet per worker in Honolulu and Tampa, to over 450 square feet in Houston and (surprise!) San Francisco; New York and Boston were also over 400 square feet per worker. There was no apparent correlation between space per worker and rent, which was surprising but may be put down to the plethora of confounding variables, e.g. whether firms in fast growing markets or industries are leasing space in anticipation of hiring over the next year. Space per worker also varies with industry, with call centers providing less than 150 feet for each worker, and law firms the most generous.

Many firms are moving to or considering sharing beyond open plan, e.g. by “hoteling” or assigning space on a weekly or even daily basis. Others are adopting the ideas of the “sharing economy” by utilizing coworking spaces such as those provided by WeWork. Originally thought of as space for startups, coworking is beginning to be adopted by larger firms seeking flexibility and swing space. While still small as a share of the market, Green Street Advisors predicts coworking will comprise 2 or 3 percent of the market within a dozen years (Grant).

There are other ways in which office markets are changing. Norm Miller has made the point that traditional “food groups” in real estate will be blurring and merging. He predicts more urban space will be combined work-live arrangements and that as retail space shrinks significantly in response to online competition, some existing retail will be converted to office. Office buildings will require much less parking as ridesharing and autonomous vehicles continue to come to market; more drop-off areas will be required. The office of the future will reflect the city of the future, and vice versa. There is no silver bullet in office layout and organization or office design. Form will again follow function.

I am living a few of these changes myself, in my second year of working without a separate office as such. Much of the time I fantasize I’m one of those 16th-century Italian scholars who had small studies in their villas (Thornton). In reality, I share my workspace with the TV and the futon. Some days I work in one of my area’s excellent libraries; since most of my readings are online or downloaded to my tablet, that’s mainly for a change of scene. In other times I’m an 18th-century Englishmen, hard at work at the coffee shop. Of course, in today’s world there’s less conversation than in Samuel Johnson’s day; only rarely am I chatting with fellow coffee enthusiasts, mostly we all have our noses in our laptops and papers. But we are out and about, with a change of scene; and in my favorite shop the Wi-Fi is a little slow, but the coffee is very good.

References, and Further Reading

Barr, Jason M. Building the Skyline: The Birth and Growth of Manhattan’s Skyscrapers. Oxford University Press, 2016.

Barro, Robert J, and Jong‐Wha Lee. “International Data on Educational Attainment: Updates and Implications.” oxford Economic papers 53, no. 3 (2001): 541-63.

Bilandzic, Mark, and Marcus Foth. “Libraries as Coworking Spaces: Understanding User Motivations and Perceived Barriers to Social Learning.” Library Hi Tech 31, no. 2 (2013): 254-73.

Brill, Michael, and Sue Weidemann. Disproving Widespread Myths About Workplace Design. Kimball International, 2001.

Buera, Francisco J, and Joseph Kaboski. “The Rise of the Service Economy.” The American Economic Review 102, no. 6 (2012): 2540-69.

Butts, Robert Freeman. Public Education in the United States: From Revolution to Reform. Holt, Rinehart and Winston, 1978.

Cairncross, Frances. The Death of Distance: How the Communications Revolution Is Changing Our Lives. Harvard Business Press, 2001.

Clapp, John M. Dynamics of Office Markets: Empirical Findings and Research Issues. Urban Institute Press, 1993.

Coase, Ronald H. “The Nature of the Firm.” Economica 4, no. 16 (1937): 386-405.

Cooper, Gail. Air-Conditioning America: Engineers and the Controlled Environment, 1900-1960. JHU Press, 2002.

Cooper, Helen, ed. Chaucer: Canterbury Tales: Wiley Online Library, 1989.

Cowan, Brian. The Social Life of Coffee: The Emergence of the British Coffeehouse. Yale University Press, 2008.

Danielsson, Christina Bodin, and Lennart Bodin. “Office Type in Relation to Health, Well-Being, and Job Satisfaction among Employees.” Environment and Behavior 40, no. 5 (2008): 636-68.

Economist, The. “Technology Firms and the Office of the Future.” April 29, 2017 2017.

Eichholtz, Piet, Nils Kok, and John M Quigley. “Doing Well by Doing Good? Green Office Buildings.” The American Economic Review 100, no. 5 (2010): 2492-509.

Ford, Martin. Rise of the Robots. Basic Books, 2016.

Gause, Jo Allen, Mark J Eppli, Michael E. Hickock, and Wade Ragas. Office Development Handbook. Urban Land Institute, 1998.

Glaeser, Edward L, Joseph Gyourko, and Raven E Saks. “Why Is Manhattan So Expensive? Regulation and the Rise in Housing Prices.” The Journal of Law and Economics 48, no. 2 (2005): 331-69.

Hill, E Jeffrey, Maria Ferris, and Vjollca Märtinson. “Does It Matter Where You Work? A Comparison of How Three Work Venues (Traditional Office, Virtual Office, and Home Office) Influence Aspects of Work and Personal/Family Life.” Journal of Vocational Behavior 63, no. 2 (2003): 220-41.

Kelly, Kevin. The Inevitable: Understanding the 12 Technological Forces That Will Shape Our Future. Viking, 2016.

Kolko, Jed. “The Death of Cities? The Death of Distance? Evidence from the Geography of Commercial Internet Usage.” The Internet upheaval: Raising questions, seeking answers in communications policy (2000): 73–98.

Leder, Solange, Guy R Newsham, Jennifer A Veitch, Sandra Mancini, and Kate E Charles. “Effects of Office Environment on Employee Satisfaction: A New Analysis.” Building Research & Information 44, no. 1 (2016): 34-50.

Levy, Frank, and Richard J Murnane. The New Division of Labor: How Computers Are Creating the Next Job Market. Princeton University Press, 2004.

Lewis, Frank D. “Explaining the Shift of Labor from Agriculture to Industry in the United States: 1869 to 1899.” The Journal of Economic History 39, no. 3 (1979): 681-98.

Marcus & Millichap. “2017 U.S. Office Investment Forecast.” 2017.

McDonald, John F. “A Survey of Econometric Models of Office Markets.” Journal of Real Estate Literature 10, no. 2 (2002): 223-42.

Miller, Norman G. “Blurred Lines, Disruptions and the Future of Real Estate.” Presentation to MIT Real Estate Price Dynamics Platform Launch Event, 2017.

———. “Workplace Trends in Office Space: Implications for Future Office Demand.” Journal of Corporate Real Estate 16, no. 3 (2014): 159-81.

Pritchett, Lant. “Divergence, Big Time.” Journal of Economic Perspectives 11, no. 3 (1997): 3-17.

Quinan, Jack. Frank Lloyd Wright’s Larkin Building: Myth and Fact. Architectural History Foundation, 1987.

Rybczynski, Witold. Home: A Short History of an Idea. Viking New York, 1986.

Saiz, Albert. “The Geographic Determinants of Housing Supply.” The Quarterly Journal of Economics 125, no. 3 (2010): 1253-96.

Schmandt-Besserat, Denise. How Writing Came About. University of Texas Press, 2010.

Schwab, Klaus. The Fourth Industrial Revolution. Crown Business, 2017.

Spreitzer, G, P Bacevice, and L Garrett. “Why People Thrive in Coworking Spaces.” Harvard Business Review 93, no. 7 (2015): 28-30.

Sullivan, Louis H. “The Tall Office Building Artistically Considered.” Lippincott’s Magazine 57, no. 3 (1896): 406.

Thornton, Dora. The Scholar in His Study: Ownership and Experience in Renaissance Italy. Yale University Press, 1997.

Webb, R Brian, and Jeffrey D Fisher. “Development of an Effective Rent (Lease) Index for the Chicago Cbd.” Journal of Urban Economics 39, no. 1 (1996): 1-19.

Weber, Lauren. “As Workers Expect Less, Job Satisfaction Rises: Minimal Raises and Lean Staffing Have Redefined What Makes a Position Good.” Wall Street Journal, September 1, 2017 2017.

Weber, Lauren, and Stephanie Stamm. “Then and Now: The Big Shift at Work.” September 2, 2017 2017.