Retail battles to keep up with a breathtaking pace of change

In a recent blog we wrote about some of the technological and global drivers of the ongoing disruption and transformation of the retail sector. While this has been dubbed the retail apocalypse, that moniker really applies to the investors and participants in the sector that haven’t kept up with what continues to be a breathtaking pace of change and are left with overleveraged and unprofitable real estate that has driven many into bankruptcy. Meanwhile a healthy consumer and a desire for shopping experiences means the shopping center is alive and well, and construction continues apace alongside record store closures. The retail survivors will likely be increasingly urban omnichannel firms connected to efficient warehousing and distribution, while also maintaining a presence in fun and vibrant shopping centers. How to manage, invest in and price this new model is the focus of ongoing and active exploration.

Consumers are healthy but in a disruptive mood

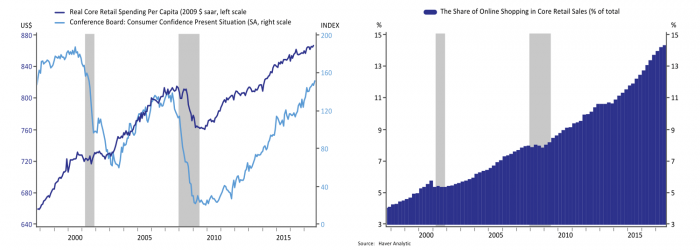

Consumer retail spending is healthy, and consumers are feeling good. The left panel of Figure 1 shows that real consumer retail spending per capita has comfortably passed the highs of the previous business cycle, as has the confidence in their present situation. The labor market is healthy even if wage gains continue to be subdued and rising home and stock values mean household balance sheets are robust. Consumers have money to spend and they are spending it.

As I noted in my last blog on the retail sector, how consumers are spending their money is changing in a fairly rapid and dramatic fashion, however, and that is the crux of the issue for the retail sector. The right panel of Figure 1 shows the rapidly rising share of online shopping in overall core retail spending (core spending includes electronics, sporting goods, clothing, furniture and restaurant meals, but excludes groceries and motor vehicles). Consumers are increasingly spending their dollars from the comfort of their own homes (or even on the train ride home or waiting in an airport on their smartphones). Despite the rapidly growing share of online spending, it is still the case that the majority of dollars are spent in person in a store.

The retail buzzword is omnichannel

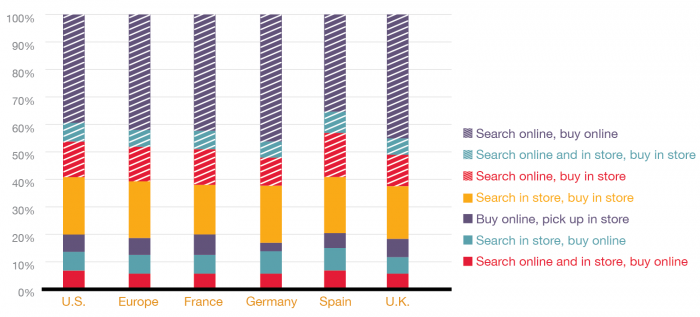

Despite surging online sales, the death of Main Street is greatly exaggerated. The buzz word for retailers is omnichannel, which refers to consumers’ increasingly complex interaction between online and in store searching, buying and returning/exchanging. Figure 2 shows the results of a 2015 survey by Comscore on behalf of UPS that surveyed consumers in the US and Europe on the way they had made their most recent purchases. The majority of purchases involve some kind of digital interaction even as the majority of purchases still occur in store. The reality is that consumers like the interaction and convenience of being able to shift back and forth between the convenience of digital shopping and seeing the items they purchase physically and tangibly. Just as traditional retailers must now establish an effective online presence to compete and survive, so too a rising number of retailers that started online are opening physical stores.

The US doesn’t have too many stores, it has the wrong stores

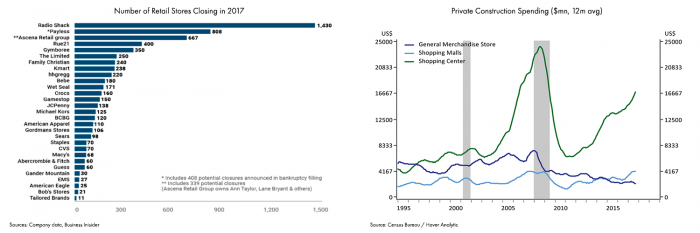

The retail apocalypse generally refers to the record number of retail store and mall closings and the bankruptcies of some longstanding companies. The left panel of Figure 3 shows Business Insider’s compilation of retail store closings this year and more are expected in 2018 (a haunting series of photographs of dying or abandoned malls in America can be found here). There is a narrative that the real estate boom of the past cycle left the US dramatically overstored, but the reality is more complex; Census data show that the net number of retail establishments has been rising since mid-2016 after declining through much of the recession and current recovery. The right panel of Figure 3 confirms that spending on the construction of shopping centers has been growing at a robust pace for the past five years after crashing during and after the recession, even as outlays for the construction of general merchandise stores continues to decline and mall construction remains modest. The type and geography of profitable stores is still undergoing rapid transformation yielding an apparent contradiction between continued store closings and retail distress and a healthy rebound in consumer spending and the construction of new retail outlets.

The retail sector both reflects and contributes to a shifting economic landscape

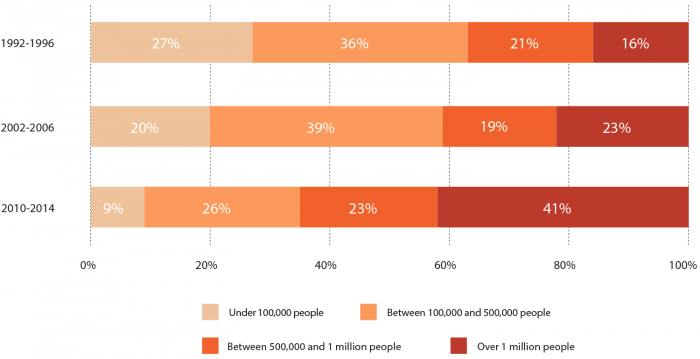

The economic recovery has been characterized by an ongoing shift of activity from the rust belt states in the Midwest to the sunbelt states and intensifying urbanization. The geographic shift of economic activity implies a shift in profitable square footage of retail space even before factoring in the implications of an omnichannel shopping world. Figure 4 shows that counties with a population over one million in population have accounted for more than twice the share of job creation relative to the prior two expansions and data show that unemployment rates, rates of labor force engagement and the pace of business formation have been notably higher in urban areas than rural areas during the current expansion.[1] For the retail sector this has meant properties in the Midwest and less urban areas have become unprofitable even as thriving economies in the West and cities more generally have stimulated the construction of new shopping centers.

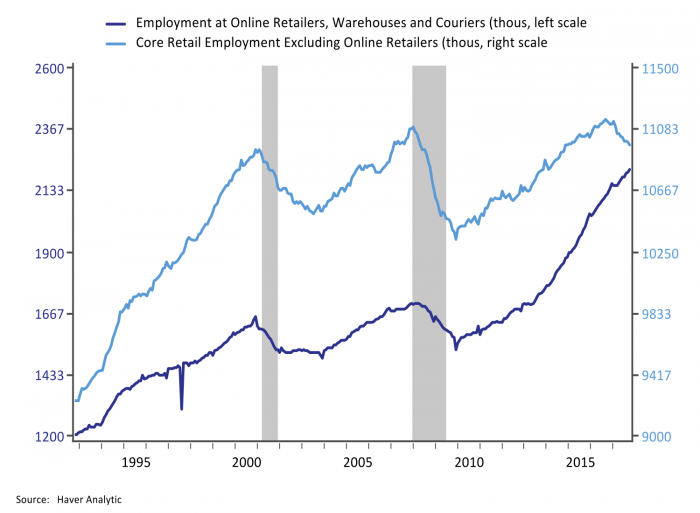

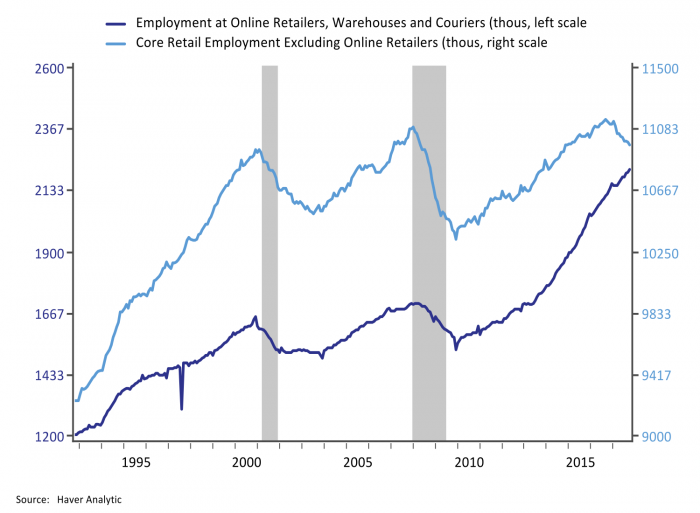

Employment in the retail sector is also undergoing a dramatic shift in geography and composition. Figure 5 illustrates the compositional shift with jobs at retail outlets declining nationally over the past two years while employment by online retailers, warehouses and couriers has been rising rapidly even before employment at bricks and mortar retailers started declining. The two lines in Figure 5 are on different scales, total employment at retail shops is much larger and on balance total employment in these sectors has declined 0.65% this year through October as the intensely competitive retail landscape demands strict cost control and the ongoing search for efficiencies. The geography of retail employment follows national shifts in overall activity, but that shift is intensified by a world with more online shopping as warehouses and couriers need to be located close to the densely populated urban areas to offer the rapid delivery consumers demand. A recent study by economists at the New York Fed found that 80% of counties have lost retail employment in recent years on net even after accounting for rising employment in online retailers, warehousing and delivery. The largest net gainer was King’s county; that includes Seattle, reflecting Amazon’s growing dominance.

Disruption is also happening in retail leasing

While consumers still want to go shopping in physical stores, they want their trip to be a complete experience. Malls and shopping centers are increasingly focused on attracting tenants that offer entertainment and practical services including gyms, doctor’s offices, nail salons, a greater number of sit down restaurants, movie theaters, painting centers, children’s play centers, and a variety of other options. Stores are now offering both pick up services for online orders, and delivery services for in store shoppers who want to drop their bags off and enjoy the entertainment options.

The disruption in the retail business model is leading to a sea change in the leasing relationship between retailers and property developers and managers. Property developers and managers are less focused on anchor tenants and traditional retailers, and the decline in the dominance of traditional department stores means specialty retailers who want smaller square footage and a shopping center that attracts their target demographic through its mix of entertainment options.

The traditional 20-year lease with a fixed base rent and a variable payment based on store sales is becoming obsolete. Sales can no longer be easily attributed to a particular store and both parties want shorter leases and greater flexibility and accountability. Recent studies from the International Council of Shopping Centers have found five to ten-year leases are becoming increasingly common, and that there are a number of leasing structures being experimented with, including using technology that can capture online sales within a geographic region. The omnichannel world makes it more difficult to attribute sales to particular sales people and locations making it difficult to structure leasing and compensation to provide efficient incentives that optimize sales. The dust has not yet settled, and retailers and property developers are still very much in search of the new equilibrium. The disruption in leasing models also means it is challenging for real estate investors to find relevant metrics for evaluation in making capital allocation decisions.

Leverage is a part of every good real estate story

A recent analysis by Bloomberg argued that the rising store closures and bankruptcies are not just a function of rapidly changing business models, but also low interest rates and easy financing conditions that allowed firms that weren’t keeping up with the times to buy time with increased leverage. Much of the debt taken on in recent years was through the issuance of riskier, non-investment grade bonds which are maturing in the next few years. Figure 6 shows that just $100 million of high-yield retail borrowings matured in 2017, but that will rise to $1.9 billion in 2018, and average almost $5bn per year from 2019 to 2025. The increased maturities will come as the credit quality of these bonds has deteriorated owing to the structural challenges facing the sector, and a tide of rising maturing high-yield debt from other sectors will also need to be refinanced at a time when the business cycle is maturing, and the Fed is raising rates. In addition to high-yield bonds, there are $152bn in retail leveraged loans and bank loans concentrated in smaller banks.

The apocalypse side of the retail story likely isn’t over, with more store closures and distress among certain retailers expected to continue into 2018, even as the innovative side of retail charges ahead with new store openings and continued transformation in the business model. The sector isn’t for the faint of heart.

[1] See Lael Brainard “Why Persistent Employment Disparities Matter for the Economy’s Health”, September 2017 for an overview and discussion.