The lasting mark Hurricane Maria’s devastation may leave on the island

As Puerto Rico and the Virgin Islands grapple with the aftermath of the third and most destructive hurricane this season, we update our estimates of the impact of this damaging hurricane season and provide some detailed background on what will make Puerto Rico a political and fiscal issue for some time. Our main conclusions are as follows:

- Federal hurricane aid should eventually reach more than $100bn in fiscal year 2018. Congress already passed $15bn for Texas in the aftermath of Harvey and we think another package of around $50bn for Harvey, Irma, and Maria should come in October. It won’t be nearly enough to cover rebuilding costs in Puerto Rico and we expect another package in H1 2018. That would still leave substantial losses uncovered by private insurance or federal aid.

- Maria hit Puerto Rico in the midst of a Greece-like fiscal/economic crisis. The island has been operating under the oversight of a federally appointed fiscal oversight board for over a year. Fiscal austerity on top of a decade of recession had only pushed Puerto Rico deeper into a negative feedback loop whereby fiscal cutbacks and a lack of competitiveness had accelerated outmigration and shrinkage of the tax base. Puerto Rico declared bankruptcy under the federal law that had formed its oversight board in May of this year and creditors should expect very little recovery of the more than $70bn in defaulted debt.

- There will likely be philosophical debates about fiscal responsibility versus colonialism and predatory lending as the magnitude of the necessary rebuilding effort is assessed. Philosophy aside, the reality is that the less generous and slower moving the federal rebuilding effort, the greater will be the inclination of Puerto Rico’s citizens to survive through migration to the mainland making the island’s finances ever more unsustainable.

Puerto Rico and the Virgin Islands are not included in measures of US GDP or nonfarm payrolls, although Puerto Rico is included in statistics on weekly jobless claims. The economic impact on US growth will likely be positive and felt through what could be a substantial migration to the mainland. If New Orleans after Katrina serves as a guide, we could see the movement of 1.8mn US citizens from Puerto Rico to the mainland over the next year boosting overall population growth by 0.6% with Florida potentially getting a boost of 3%. A Large and Growing Federal Bill for Hurricane Relief is still in the early stages, but it is safe to say that the total cost of Hurricanes Harvey, Irma and Maria is likely to exceed our previous estimate of $120bn, mainly owing to the devastation of Hurricane Maria. Estimates of insured losses from Harvey are coming in at the lower end of the previously estimated range at around $10bn while the impact from Irma is landing at the higher end of the range at $30-$50bn. While Irma wasn’t as bad as feared and Harvey was much worse, the higher amount of private insured losses reflects Irma’s much larger geographic footprint. Estimates of insured losses in Puerto Rico and the Virgin Islands under Maria are coming in well above those of Irma despite much lower rates of insurance coverage mostly reflecting significant damage to commercial real estate and manufacturing operations.

On the public side the destruction to public infrastructure has already led the State of Texas to dip into its rainy day fund despite passage of a $15bn federal aid package last month, and the Governor is seeking additional federal assistance. Congress understands additional federal funds will be needed in Texas, Florida, Puerto Rico and the Virgin Islands and is aiming at a more comprehensive hurricane relief package in mid-October. The negotiations are being complicated by the real time disaster unfolding in Puerto Rico. The devastation to public infrastructure in Puerto Rico is vast and as discussed below, couldn’t come at a worse time. The magnitude of the funds needed combined with the fact that Puerto Rico is in the midst of bankruptcy proceedings will complicate federal negotiations.

La Isla Bonita

Puerto Rico has been a territory of the United States since 1898. Territories are legally under the control of the federal government. Puerto Ricans are US citizens and enjoy all the rights of citizenship except residents of the island can’t vote in the US general election and they have only one non-voting representative in Congress and no Senators. Nonetheless Puerto Rican residents are protected by and serve in the US military and participate as full citizens in federal fiscal policy. Other territories include the Virgin Islands, Guam and the Northern Marianna Islands. Puerto Rico has autonomy over its local affairs in a similar way to states. However, falling under the control of the federal government means Puerto Rico relies on Federal Emergency Management Agency and the US military in times of distress in the same way as any state.

While some statistical agencies collect data on Puerto Rico, the island is not included in US GDP or estimates of employment and unemployment released each month. The most likely impact on US growth and employment may actually be positive over the coming year reflecting what we expect to be significant outmigration from the island to the mainland.

The Storm Before the Storm: The State of the Puerto Rican Economy Heading into Hurricane Maria

Puerto Rico is not as prosperous as the 50 states. Median household income in Puerto Rico was $20k in 2016, less than half of the median $57.6k for the United States, although it grew a robust 6.7% for the year. The lowest median household incomes in the States are in West Virginia and Mississippi at $43k and $42k, respectively. In 2016 43.5% of the population in Puerto Rico lived below the poverty line. That was a notable improvement from a 46.1% poverty rate a year earlier but still more than double the rate of the poorest state, Mississippi, where the poverty rate stood at 20.8% in 2016. The national poverty rate is 14.0%. The public sector has been the largest employer, accounting for 30% of employment for decades before fiscal pressures kicked in in recent years. Government employment averages around 16% of employment in the 50 Unites States. Outside of the public sector Puerto Rico has a large pharmaceutical sector and a solid manufacturing base, with smaller contributions from tourism, health care and agriculture. The unemployment rate in Puerto Rico has been hovering around 10% this year, more than double the national rate although an improvement from their peak in this cycle of around 17%.

Source: Bureau of Economic Analysis, Haver Analytics

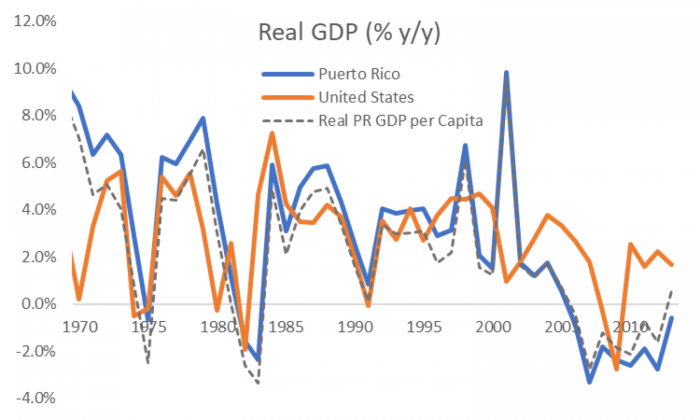

Puerto Rico has been in a recession for more than a decade. Figure 1 shows that while economic growth in Puerto Rico ebbed and flowed with that of the US over most of the post-war period, it contracted an average 2% per year between 2005 and 2013. There have been no published data on GDP since 2013 owing to government cutbacks, however data on employment are collected by the US Bureau of Labor Statistics and suggest that the economy has continued to contract by probably around 1% annually since then.

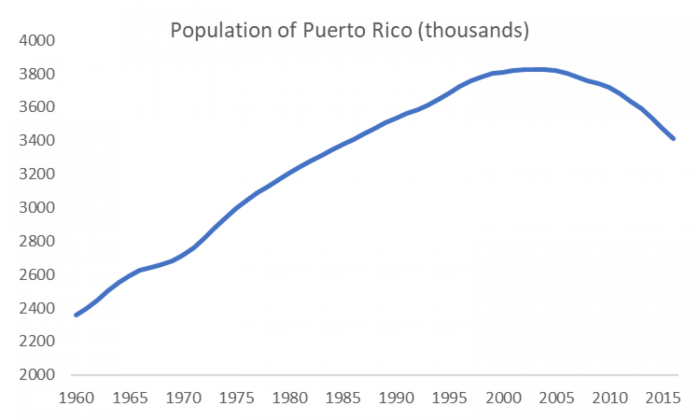

The economic decline in Puerto Rico is structural and demographic rather than cyclical with a combination of outmigration and a precipitous decline in birth rates contributing to a shrinking population. Roughly 20k people per year were leaving Puerto Rico in the 1960s, however a relatively high birth rate meant the island still had a growing population overall, as shown in Figure 2. Between the 1970s and late 1990s net outmigration slowed to 6k a year which offset the dampening effect of a declining birth rate leaving population growth in positive territory. Two things happened in the late 1990s, birth rates in Puerto Rico dropped below the US average, and well below the rate of 2 births per woman and the pace of outmigration picked up to 25k people per year. The population of Puerto Rico peaked at 3.83mn in 2004 and has been declining an average of 1% per year since.

Puerto Rico’s shrinking population is one component of deeper challenges. Even accounting for the shrinking population, Figure 1 shows that the economy of Puerto Rico has been shrinking on a per capita basis since 2005 with 2013 being the first year of positive per capita growth. The New York Fed has estimated a roughly flat performance since 2013. In 2012 the New York Federal Reserve published a report on the challenges facing Puerto Rico’s competitiveness. The challenges included: 1) a high degree of bureaucracy that makes it difficult to do business and contributed to a large informal sector that erodes the tax base; 2) overreliance on the shrinking pharmaceutical industry; 3) relatively low levels of available financing; and, 4) labor force education and training.

Source: World Ban

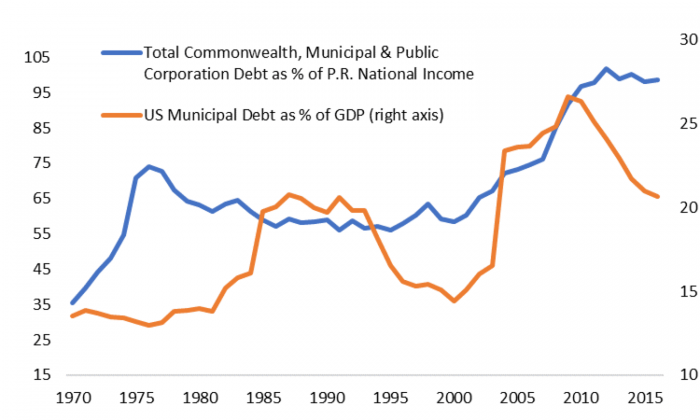

Despite structural challenges and a deteriorating economic performance, capital markets provided the funds for the Puerto Rican government to go on a borrowing spree that picked up steam in 2005 and has culminated in bankruptcy. Puerto Rico enjoys the same tax-free treatment as other states and municipalities. Researchers have documented how the island steadily expanded and created new bureaucracies and public corporations that have borrowed for both productive and unproductive uses. The government employee pension funds are also deeply underfunded. Yet Puerto Rico also was granted unfettered access to US capital markets given the demand for tax free returns from US institutional investors.

Figure 3 shows that Puerto Rico has always carried a much higher debt burden than most other state and local governments in the United States. The island’s debt burden was fairly stable as a percent of GDP growth for three decades between the mid-1970s and mid-2000s. Municipal borrowing in Puerto Rico and elsewhere accelerated during the credit boom years that preceded the Global Financial Crisis. In addition to the flood of foreign capital in search of dollar assets that Former Fed Chair Ben Bernanke has labeled the global savings glut, there was a feedback loop between housing and borrowing for many state and local governments. Rising tax receipts from inflated house prices were mistaken as permanent improvements in credit worthiness by investors, facilitating the buildup of unsustainable state and local debt burdens. As with housing, neither government officials nor investors engaged in sober due diligence about municipal debt burdens during those years.

Concerns about the ability of Puerto Rico to collectively repay its obligations have grown steadily over the past few years. Because municipalities can’t legally declare bankruptcy in the same way companies can, President Obama signed into law the Puerto Rico Oversight, Management, and Economic Stability Act (PROMESA) in June 2016. PROMESA created a federally appointed oversight board to ensure Puerto Rico got on a fiscally sustainable path while protecting the government from creditor lawsuits. Fiscal austerity has contributed to a negative macroeconomic feedback loop given the prominence of the public sector in the economy, and in May this year Puerto Rico initiated bankruptcy proceedings under PROMESA that promises to produce years of complex legal wrangling between the island government and its creditors.

Source: Marc D. Joffe and Jesse Martinez. “Origins of the Puerto Rico Fiscal Crisis.” Mercatus Center at George Mason University 2016. Haver Analytics.

Where do we Go from Here?

Disaster Assistance

The first order of business in the aftermath of any hurricane is providing assistance to people who have lost their homes and can’t access clean food and water. The effort in Puerto Rico has unfolded painfully slowly even as the needs are particularly acute given the total destruction of the island’s electric power grid and geographic isolation. The delay in recovery assistance seems to tragically reflect a combination of the complications stemming from Puerto Rico’s state of fiscal distress going into the storm, the lack of recognition by some policymakers that Puerto Rico is under US federal jurisdiction, and the fact that the island has only one Congressional representation to apply political pressure.

Many individuals and institutions In Puerto Rico own generators but delivery of gasoline and other supplies were initially delayed by the Jones Act which requires all ships docking in American ports be American made and staffed. The Act was finally waived more than a week after Maria made landfall. In addition, it took almost a week for FEMA to waive the usual requirement that governments receiving aid must provide matching funds for any disaster assistance, something a government in bankruptcy simply cannot agree to. The wheels in Washington D.C. have started to turn and a larger operation and package of aid are being contemplated, although time is of the essence and the scale of the aid needed has yet to sink in.

Rebuilding

As we noted in the last blog on hurricane impacts, the main economic impact is the destruction of public and private property and it becomes a political issue of who bears these losses and finances cleanup and rebuilding. The destruction of Puerto Rico’s infrastructure is staggering. The island is very much in the midst of a humanitarian disaster and it will take time to assess the costs of rebuilding. Politics will ultimately determine who bears these costs. Hurricane Katrina is probably a conservative approximation of the potential cost of damages and rebuilding. The National Oceanic and Atmospheric Administration estimates total losses of $160bn with federal aid covering $77bn.

Puerto Rico confronts the challenge of financing a massive rebuilding effort at a time when it is in the midst of negotiating a bankruptcy process on more than $70bn in prior obligations. Creditors should probably expect very little recovery on prior obligations. Because Puerto Rico doesn’t have access to bond markets, the federal government will have to play a central role in financing the recovery. The most straightforward route would be for the federal government to foot the bill for rebuilding backed by the general taxing authority of the United States, which would imply no additional obligations for the island. However more than likely, the size of required funds, perceived issues of fairness by other areas hit by hurricanes this year, past fiscal irresponsibility and lack of political representation may inhibit the political appetite for full federal funding.

The federal government could contemplate structures that would bring in private capital. One example of such a program was Build America Bonds (“BAB”), which were created in the Great Recession to support borrowing by state and local governments at a time when financing in bond markets was hard to come by. These bonds provided federal tax credits and subsidies to reduce the costs of borrowing for governments and enhance the return for private investors. The BAB program ran into the issue that offering subsidies generous enough to attract private capital becomes very expensive quickly. If the federal government stops short of full funding they will need to create a structure with a fairly generous subsidy to attract private capital, including taking the first position on losses in light of the island’s limited ability to repay.

Source: Pew Charitable Trusts

Migration

With the prospect of no electricity and limited running water for months, many Puerto Rican residents will likely choose to move at least temporarily to the continental United States. The less generous and more delayed is the rebuilding effort, the greater and longer lasting the migration is likely to be. There are more Puerto Ricans in the 50 states than on the island so that most island residents have networks of friends and family to turn to. Using Hurricane Katrina as a guide, the New Orleans metro area lost more than half its population in the year following Hurricane Katrina. While the population of New Orleans has since been growing, it is still 15% below where it was the year before Katrina. If Puerto Rico sees a similar outmigration as New Orleans after Katrina, there could be an exodus of around 1.8mn people to the mainland.

As noted above Puerto Rico has seen an accelerated structural outmigration over the past decade. One factor limiting that migration is the high homeownership rate in Puerto Rico. Despite relatively low household income the latest data from the Census showed that the homeownership rate in Puerto Rico averaged 69% between 2011 and 2015 as compared to 65% for the 50 states over that period. Puerto Rican homeowners tend to have lower levels of debt on their homes and housing assets have served to attenuate outmigration. However, there is also a lower degree of insurance coverage, and the combination of property destruction from the hurricane with the limited ability to earn income for reconstruction due to economic disruption may reduce the impact of homeownership as a barrier to outmigration.

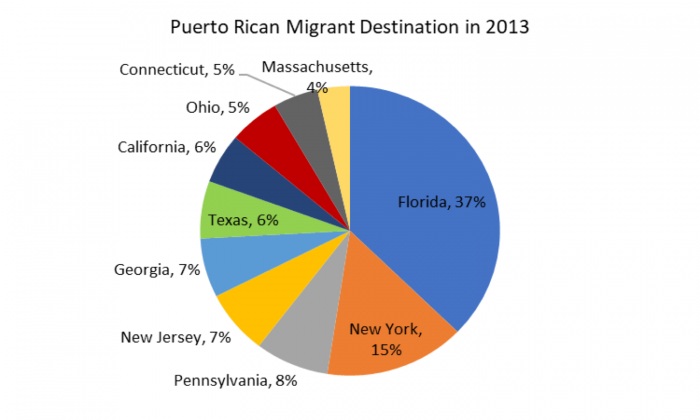

The destinations of people leaving the island has shifted over time. While New York City was a primary destination in earlier decades, people leaving Puerto Rico have been increasingly seeking areas with a lower cost of living and economic opportunity. Figure 4 shows that Florida has become the primary destination of Puerto Rican migrants, particularly to lower cost, fast growing cities like Orlando. Last week in response to the devastation of Hurricane Maria the University of Central Florida in Orlando announced they would offer in state tuition for Puerto Ricans. Puerto Ricans have also increasingly moved to rust belt states like Pennsylvania and Ohio, as well as the sunbelt states of Texas, Georgia and California. If these migration patterns hold the continental US could see a population boost of 0.6% in the coming year and Florida could see a gain of more than 3%. Such a migration could offset the impact of the more limited legal immigration proposed by the Trump Administration and be a boost for housing and other consumption in states like Florida and Pennsylvania. This influx of citizens could also affect electoral prospects in a midterm election year.

It is clear that the devastation of Hurricane Maria will leave a long lasting mark on the island of Puerto Rico and the citizens living there and likely result in complex political wrangling at the federal level in the United States in coming months. Taking a broader view, my colleague Dr. Steve Malpezzi noted in a recent blog that destruction from Hurricanes has become increasingly common reflecting a changing climate, and that probably should prompt a broader reconsideration of building codes and how we provide and finance federal disaster assistance.