Hurricanes, housing and climate change: Risks and responses

Hurricanes Harvey and Irma are just the latest in a long history of cyclones and other extreme weather events that cost lives, real estate, and social bonds. We examine several aspects, including how much of the U.S. is at risk of coastal events and links between increased severity of hurricanes and climate change. We examine a number of steps to strengthen the private and public responses to these and other disasters.

Introduction

Hurricane Harvey recently hammered Houston, America’s fourth-largest city, with over 50 inches of rain. Hurricane Irma, the strongest hurricane ever measured that formed in the Atlantic Ocean outside the Caribbean and the Gulf devastated large portions of Florida. Memories of Hurricane Sandy are still fresh, so we’re empathetic. Now Hurricane Jose is following up the Atlantic seaboard, heading for our home turf; by the time this post is up, we’ll know if and how much our region has taken much from the storm. The hurricane “season” has over 2 months left, so we may not be done yet.

In our last posting, my fellow blogger Dr. Julia Coronado examined some of the probable macroeconomic effects of hurricanes in general, and Harvey and Irma in particular. Julia pointed out that the two storms would destroy a lot of capital, including but not limited to housing, commercial real estate and infrastructure. She also noted that these losses are forecast to be on the order of $120 to $340 billion or more. That’s a lot — For comparison the Katrina rebuild cost about $120 billion. Dr. Coronado pointed out that these losses actually don’t appear directly in our usual measures of GDP, which only measures the flow of economic activity, neglecting changes in stocks. In fact, as measured, after an initial decline as households and their workers re-group, eventually GDP is boosted as reconstruction channels resources and increased employment into the affected areas. The lesson, then, is not that natural disasters are somehow “good” for a local economy, but that GDP is a very incomplete measure of a disaster’s economic (to say nothing of human) effects.

In this post we’ll examine a few other aspects of hurricanes and, in passing, other disasters. Our main focus will be the effects on the housing market.

A Lot of Coastal Real Estate (and Population) are At Risk

The United States is a coastal nation. Jordan Rappaport and Jeffrey Sachs have calculated that over half of U.S. population lives in counties within 80 kilometers of a coastline. Even though these counties comprise only 13 percent of the continental U.S. land mass, 60 percent of our civilian income also resides there.

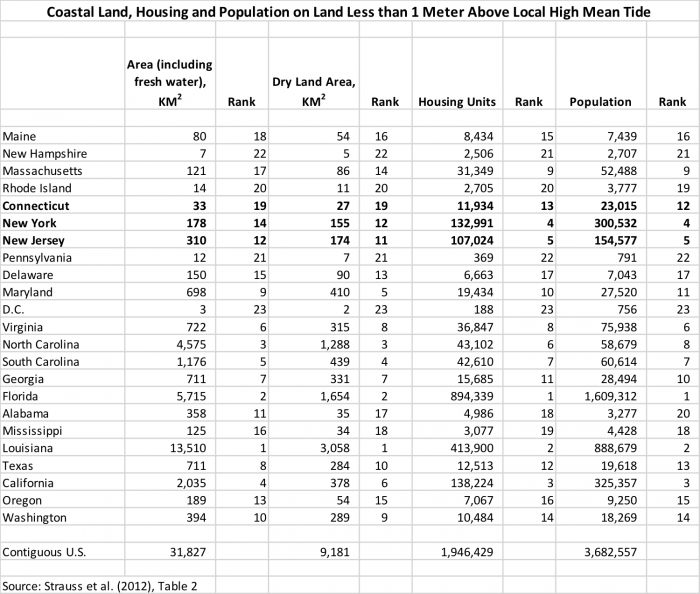

Some – not all – of the risks associated with being near a coast is associated with being near a coast and near sea level. Benjamin Strauss and coauthors undertook a careful accounting of the Census blocks that were near saltwater coasts in the “continental” 48 states and District of Columbia. (Great Lakes coasts, Hawaii and Alaska were omitted from their analysis). Some of their data are provided in this table:

Strauss et al. note that sea level could easily rise a meter or more during the next century; some estimates would be double that, and even a 2-meter rise is not the most extreme of the serious estimates. Strauss et al. take the 1-meter rise as their benchmark, and calculate the amount of land, the number of houses, and the number of people at direct risk from a 1-meter rise in sea level. They note that the usual measure of elevation, from a broad average, is misleading because of local variation in tides. So their estimates are based on sea levels at each location’s high tide, which can add as much as 3 meters to the elevation.

As the table shows, Strauss et al. estimate that about 3.7 million of the US population lives on land that’s within a meter of high tide. In 544 coastal municipalities and 38 counties, over 10 percent of the population lives on land below this threshold.

Florida, Louisiana, and California are the states that have the most people and places at risk. But as the table from Strauss et al. shows the tri-state area – Connecticut New York and New Jersey – are also among the areas at most serious risk. Taken together our three states have about a quarter million housing units and half a million population within these risky areas with elevations within 1 meter of high tide level.

Of course, these numbers are only indicative of a baseline of risks, for several reasons. First, sea level rises could be substantially more (or possibly less) than the 1-meter forecast. Second, rising sea level’s direct effect is not the only threat to coastal real estate – storm surges can certainly wreak havoc much farther inland, as we’ve seen. Third, Strauss et al. limit their examination of potential real estate at risk to housing; commercial real estate and infrastructure are also adversely affected. Finally, rains and flooding are often associated with hurricanes, but everyone knows these are not problems that are limited to low lying and/or coastal areas.

Risks of Hurricanes and Other Extreme Weather Events Appear to Be Increasing

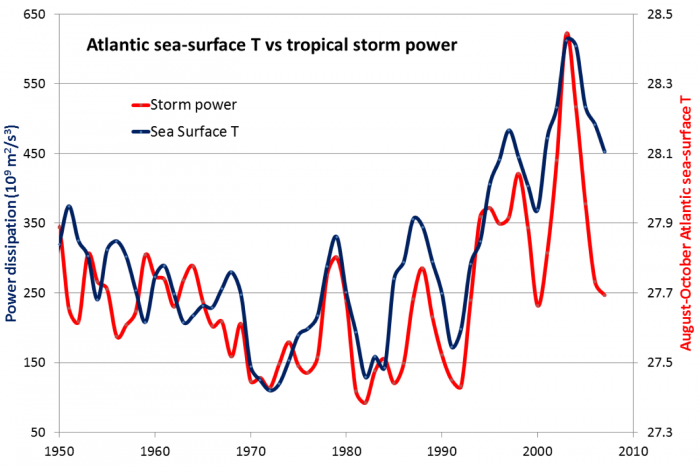

The increased severity of hurricanes appears to be in part by warmer surface water. The next figure from MIT’s Kerry Emanuel, shows the correlation between the two over six decades.

Why? Surface water is growing warmer in the Atlantic partly because of changing climate, which in turn stems from the global effects of greenhouse gases (carbon, methane, and water vapor) and the local effects of particulates. There’s also natural variability that needs to be taken into account.

It’s not just hurricanes (cyclones) that are getting stronger. Research by Tippett, Lepore and Cohen shows that tornadoes, the scourge of parts of the Midwest, also appear to be increasing in intensity. Heavy rains and floods are no stranger to the inner provinces. Our friends in the Midwest or even residents of the Tri-State area living well away from the coasts will face some additional extreme weather risks going forward.

The Stages of Disaster Preparedness and Response

So, what should we do about these increased risks?

The first stage is preparation. Important elements include physical preparation, plans for coordination, and insurance. Primary responsibility lies in the hands of local officials and communities, although outside agencies can assist. At the national level, the Federal government plays a large role in certain insurance markets, particularly flood insurance (which is rarely included in private insurance policies). FEMA (the Federal Emergency Management Agency) is the primary coordinating agency, although other critical agencies including HUD, those responsible for public health, and the Coast Guard.

Stage 2 is emergency reaction as the event unfolds. Primary response is usually that of local first responders, although outside help is required for larger events. These include non-governmental organizations like the Red Cross; in addition to the aforementioned Coast Guard, National Guard and other military may be pressed into service. Rescue, basic security, communication, medical supplies, water and sanitation are key at this stage. In the aftermath of Hurricane Katrina, FEMA’s response was widely derided; some private sector agents like WalMart were initially more effective. Fortunately, FEMA had stronger leaders after the weak Katrina response and the groundwork was laid for a much stronger initial response to this year’s events, though much remains to be done. The Coast Guard plays a large role in hurricane response, and was one of the few Federal agencies that was extremely effective in the early Katrina going; it’s fortunate that the Trump Administration appears to be rethinking its plans to severely cut the Coast Guard budget.

Stage 3, recovery, takes much longer. This stage includes getting markets and public services back on track. Reconstruction and redevelopment often takes years if the event is major. Here’s where the real estate industry must step up. Every element will be involved, including but not limited to brokerage, development, finance, and appraisal.

Stage 4 is preparation for the next disaster, in light of lessons learned. We circle back to Stage 1.

More Lessons Learned – We Can Do Even Better

Build with the weather in mind. Billionaire Richard Branson rode out Hurricane Irma in his reinforced wine cellar. Not everyone can afford that level of construction, but there are some relatively simple and inexpensive ways to improve the survivability of a house besides filling up sandbags and tacking up plywood as the storm approaches. One of the simplest is to use improved fasteners. Secure the roof to the house frame with metal straps and use extra-long nails (say 6 inches) for the shingles. Elsewhere use metal straps in strategic places on the frame, and where possible use bolts and screws which are more resistant to wind than nails. Money spent on reinforced concrete columns to lift a coastal house well above the ground may pay off in a large storm.

FEMA estimates that 450,000 people are expected to request disaster assistance from these hurricanes. Many households will have trouble making rent. Use emergency housing vouchers liberally. Housing vouchers are, of course, government assistance to households to assist in paying rent. In principle, they can also be designed to assist homeowners with mortgage payments and other costs of homeownership, although in the United States these are less common. (Davis, Malpezzi and Ortalo-Magné designed an emergency housing voucher program of somewhat different design to combat the post 2007 mortgage crisis, but to our chagrin it was never implemented.)

The Housing Choice Voucher program is now the largest subsidized housing program for low income households (though it is dwarfed by tax subsidies for upper income households). At times of disasters HUD and state agencies can make these vouchers temporarily available on an emergency basis and can relax rules about location to make them portable anywhere in the region; even better, anywhere within the US.

Other HUD programs that channel money to state and local governments such as CDBG and the HOME programs are also tools for disaster relief. Stepping back from emergencies, there are many ways that these programs could be improved, but zeroing them out without replacement is probably not a good idea in the face of disasters like Harvey and Irma (and Sandy). Another useful policy is that FHA puts a 90 day for foreclosure moratorium on their loans.

The third broad area for improvement is flood insurance. The National Flood Insurance Program (NFIP) is a government insurance program against residential losses in floods. NFIP insurance is required if you borrow from a GSE insured loan and you are in a notional 100 year floodplain. There are several problems with this. The private market does not currently offer significant amounts of flood insurance, partly because the underpricing of federal flood insurance drives amount of the market. (There was a partial pricing reform with the Biggert-Waters Flood Insurance and Reform Act of 2012, but after political pushback Congress decided to delay some increases and eliminate others). Second, not everyone borrows from GSE’s, or borrows at all; , and even those who do borrow often stop paying the insurance premiums after a few years. There is not much enforcement follow-up. Finally, the floodplain maps used by the NFIP are grossly outdated, as Barr, Cohen and Kim have noted.

High on any to-do list should be to reform flood insurance. Reprice it to be actuarially sound and vary the price more with the actual risks involved. As long as we fail to price flood insurance in line with the true risk gradient, large contingent liabilities will remain in the public sector and the private sector will remain priced out.

Long Run – Tackle Climate Change

Hurricanes and other extreme weather events will always be with us. But these risks will increase, as will others, unless we begin to take a more realistic attitude towards climate.

A recent poll of 40 eminent economists found that 22 strongly agreed with the use of a carbon tax to mitigate climate change; 15 agreed, two were uncertain, and one disagreed. The economist who disagreed, conservative economist Edward Lazear, noted that he disagreed because he thought that a carbon tax large enough to make a serious dent in the problem would be politically infeasible. Nevertheless, carbon taxes are becoming more and more credible even among many self-identified conservatives, as Feldstein et al. illustrate. But given the uncertainties involved in modeling the exact links between carbon and methane emissions and global warming, we need a two-pronged approach. First, tax greenhouse gases, for sure, but also focus on developing more resilient human habitats. Second, reform insurance and other pricing to stop subsidizing the development of the riskiest areas. Where costs and benefits are in line, build appropriate infrastructure as the Dutch have done for centuries. Invest in data collection and research to further refine our knowledge of the problems and the most effective solutions. Continue to improve our governmental and private responses to hurricanes and other events when they do occur.

Final Thoughts

Hurricanes Harvey and Irma, and Andrew and Sandy and many others before them, have cost Americans lost treasure and lives, along with untold stresses on families and, for that matter, governments. But it’s worth keeping in perspective. At the same time as Harvey took a toll of (at latest count) 82 lives, and Irma so far under 10. Those deaths are tragic, of course, but at about the same time an estimated 1400 have lost their lives in South Asian cyclones. Closer to home, Caribbean Islands like Anguilla and St Martin have been very hard hit. And America has suffered grievous casualties in the past, perhaps most famously some 8,000 lives lost in the 1900 Galveston hurricane. Our higher incomes, our stronger institutions, improved readiness and preparation all have contributed to generally declining deaths from disasters. Let’s resolve to take the steps necessary to continue to move down that curve.

References, and Further Reading

Barr, Jason, Jeffrey P Cohen, and Eon Kim. “Storm Surges, Informational Shocks, and the Price of Urban Real Estate: The Case of Hurricane Sandy.” Paper presented to the American Real Estate and Urban Economics Association, 2017.

Birch, Eugenie L, and Susan Wachter, eds. Rebuilding Urban Places after Disaster: Lessons from Hurricane Katrina. Philadelphia: University of Pennsylvania Press, 2006.

Boustan, Leah Platt, Matthew E Kahn, and Paul W Rhode. “Moving to Higher Ground: Migration Response to Natural Disasters in the Early Twentieth Century.” The American Economic Review 102, no. 3 (2012): 238-44.

Boyd, Eugene, and Oscar R Gonzales. Community Development Block Grant Funds in Disaster Relief and Recovery. Congressional Research Service, 2008.

Comfort, Louise K, Thomas A Birkland, Beverly A Cigler, and Earthea Nance. “Retrospectives and Prospectives on Hurricane Katrina: Five Years and Counting.” Public Administration Review 70, no. 5 (2010): 669-78.

Dilley, Maxx, Robert S. Chen, Uwe Diechmann, Arthur L. Lerner-Lam and Margaret Arnold. Natural Disaster Hotspots: A Global Risk Analysis. Washington, D.C.: World Bank, 2005.

Emanuel, Kerry. “Increasing Destructiveness of Tropical Cyclones over the Past 30 Years.” Nature 436, no. 7051 (2005): 686.

Feldstein, Martin, Ted Halstead, and N Gregory Mankiw. “A Conservative Case for Climate Action.” The New York Times, February 8, 2017 2017.

Fischer, Will, and Barbara Sard. Housing Needs of Many Low-Income Hurricane Evacuees Are Not Being Adequately Addressed. Center on Budget and Policy Priorities Washington, DC, 2006.

Gornitz, Vivien, Stephen Couch, and Ellen K Hartig. “Impacts of Sea Level Rise in the New York City Metropolitan Area.” Global and Planetary Change 32, no. 1 (2001): 61-88.

Johnson, C. “Strategic Planning for Post-Disaster Temporary Housing.” Disasters 31, no. 4 (2007): 435-58.

Kahn, Matthew E. “The Death Toll from Natural Disasters: The Role of Income, Geography, and Institutions.” Review of Economics and Statistics 87, no. 2 (2005): 271-84.

Kousky, Carolyn, Erwann O Michel-Kerjan, and P Raschky. “Does Federal Disaster Assistance Crowd out Private Demand for Insurance.” Risk Management and Decision Processes Center The Wharton School, University of Pennsylvania 10 (2013).

McCarty, Maggie, Libby Perl, and Bruce Foote. “The Role of HUD Housing Programs in Response to Disasters.” 2005.

Nordhaus, William D. The Climate Casino: Risk, Uncertainty, and Economics for a Warming World. Yale University Press, 2013.

Strauss, Benjamin H, Remik Ziemlinski, Jeremy L Weiss, and Jonathan T Overpeck. “Tidally Adjusted Estimates of Topographic Vulnerability to Sea Level Rise and Flooding for the Contiguous United States.” Environmental Research Letters 7, no. 1 (2012): 014033.

Tippett, Michael K, Chiara Lepore, and Joel E Cohen. “More Tornadoes in the Most Extreme U.S. Tornado Outbreaks.” Science 354, no. 6318 (2016): 1419-23.

Vale, Lawrence J, and Thomas J Campanella. The Resilient City: How Modern Cities Recover from Disaster. Oxford University Press, 2005.

World Bank. Building Safer Cities: The Future of Disaster Risk. 2005.

Yezer, Anthony, and Claire B Rubin. The Local Economic Effects of Natural Disasters. Institute of Behavioral Science, University of Colorado, 1987.

Zedlewski, Sheila R, and MA Turner. “After Katrina: Rebuilding Opportunity and Equity into the New New Orleans.” The Urban Institute. Retrieved July 24 (2006): 2007.