International comparisons of mortgage markets, part III

In previous posts we examined the fundamentals of why finance in general, and mortgages in particular, matter so much for our economy and real estate markets. We took a first look at how country economies varied dramatically in their level of development and the time path to that level, as well as a similar first look at house prices, the most important characteristic of the assets underlying mortgages. We then examined in some detail alternatives for mortgage design, as well as funding sources for mortgages, and how these varied around the world. This final post in the series presents some cross-country “exploratory data analysis.” Specifically, we examine aggregate data on mortgage debt outstanding, and investigate simple relationships with some economic and housing market outcomes: GDP per capita, volatility in housing prices, and homeownership rates. The concluding section summarizes some lessons across all three posts.

How Large Are Mortgage Markets?

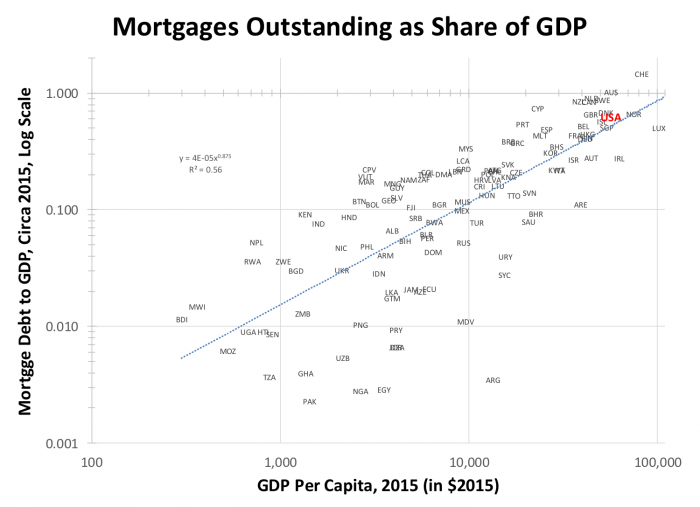

Renaud makes the point that just as housing requires finance, given housing’s size and natural role as collateral, developing a well-functioning housing finance system is an integral part of overall financial development. We already noted that mortgage markets finance a large, widely held asset class. Housing is typically around half a country’s tangible capital stock (Ibbotson Siegel and Love), so we can infer that mortgage markets are also large. How large? Exhibit 1 presents some basic data gleaned from HOFINET, the online global database on housing finance and related topics, run by Penn’s Marja Hoek-Smit.

Exhibit 1

The vertical axis is the ratio between mortgage debt and GDP, the standard way of measuring the overall size of financial markets across countries. Separately we’ve analyzed another aggregate measure, the “mortgage penetration rate” of Badev et al., derived from Gallup surveys of thousands of households in 100 countries; results are not shown here, but they are qualitatively the same.

Both axes are presented in logarithmic scale, which permits a clearer look at the relationship across the entire range of countries.

It’s unsurprising that this measure of mortgage market depth increases with per capita output. Richer countries tend to have more developed financial markets in general, and mortgage markets are of course an important segment of those financial markets.

A little over half (56 percent) of the variation in mortgage depth can be explained by GDP per capita alone, which is a strong correlation by standards of such cross-country data explorations. But then almost half is not explained.

Among richer countries, Switzerland (CHE), Australia (AUS), the Netherlands (NLD), Sweden (SWE), New Zealand (NZA) and Canada (CAN) all have mortgage depth (n.b. a stock) about equal in size to about a year’s GDP (n.b. a flow). Among other rich countries, mortgage depth in Ireland (IRL) is well below where GDP per capita alone would predict; the same is true in several high GDP (but less developed by other measures) oil producers such as Saudi Arabia (SAU), Bahrain (BHR), and the United Arab Emirates (UAE). These latter have mortgage markets equal in size to 10 to 20 percent of GDP.

Across a wide range of low- and middle-income countries, some that have deeper mortgage markets than we might expect include Malaysia (MYS), Cape Verde (CPV), Vanuatu (VUT), Kenya (KEN) and Nepal (NPL). At the other extreme Pakistan (PAK), Nigeria (NGA), Egypt (EGY) and Argentina (ARG) have housing finance systems in nascent form but very small relative to the size of their economy, on the order of 0.2 to 0.3 percent of GDP. The U.S. is right about where our level of development would put it, sized at about 63 percent as of 2015.

Does Mortgage Availability Drive Booms and Busts in Housing Markets?

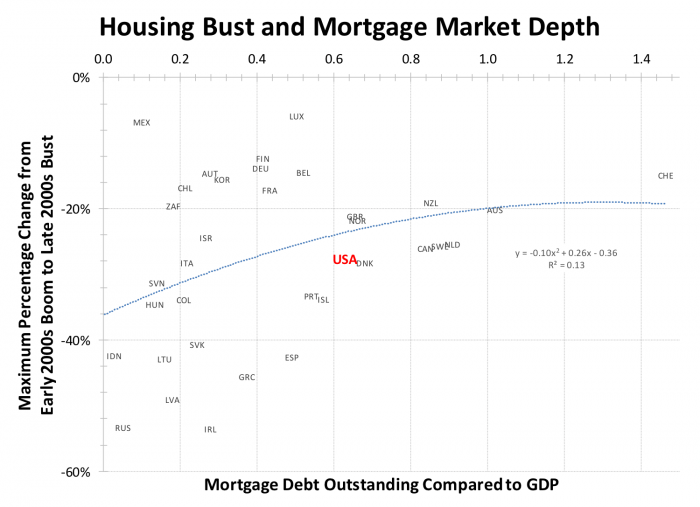

The second post in this series demonstrated that countries varied substantially in the time path of their housing prices, the asset underlying mortgages. Does the mortgage market itself drive housing prices? A simple plot will not answer this question authoritatively; nevertheless, Exhibit 2 provides an exploratory look at the correlation.

Exhibit 2

Our housing price data are inflation-adjusted national averages from OECD, courtesy of the IMF’s Hites Ahir. Many countries experienced booms in the late 90s or early 2000s and busts in the mid-to-late-2000s; but as we saw in our previous post, and as Kim and Renaud confirm, national house price cycles are not synchronous. We use the percentage change in the bust, since it allows us to examine more countries; some of the country data are not available for the late 1990s when the boom started. Larger booms in the early 2000s tend to be associated with larger busts after the mid-2000 peak (Agnello and Schuknecht). By focusing on the bust, we get a larger and more much more diverse sample of countries. Also, mortgage busts are arguably more germane to potential losses in the housing finance system.

Our measure of the bust is computed as follows. The vertical axis in Exhibit 2 is the percentage difference between the maximum real house price between the year 2000 to 2010; and the minimum house price between 2005 to 2016.

Every country experienced a bust of some sort during this period. Mexico (MEX), Luxembourg (LUX), Finland (FIN), Germany (DEU), Australia (AUS), Belgium (BEL), and Switzerland (CHE) were among those with relatively small busts, around 10-20 percent. The largest busts included Russia (RUS), Ireland (IRL), Latvia (LAT), Greece (GRC), Spain (ESP), Indonesia (IDN), Lithuania (LTU), and the Slovak Republic (SVK). All these experienced busts of between 40 and 50 percent. The U.S. bust was (un)comfortably in the middle of the pack at about 28 percent.

In contrast to Exhibit 1, in Exhibit 2 there is little correlation between mortgage depth and our variable of interest a country’s housing bust. That does not mean there is no pattern whatsoever.

Some have posited that markets with more mortgage finance would have bigger housing busts. Our exploratory data analysis is not consistent with this hypothesis. All the markets with well-developed mortgage markets – mortgage depth of 60 percent of GDP or greater – had comparatively modest busts mainly on the order of 15 to 30 percent. Countries with less developed mortgage markets exhibited extreme variation in the size of busts. Mexico (MEX) had one of the lowest busts and a low mortgage depth. In contrast, Russia (RUS), Latvia (LAT), Ireland (IRL) all had big busts and comparatively under developed mortgage markets by this measure. In earlier research, using a different but related metric, Malpezzi (1990) had a qualitatively similar finding: countries with deeper housing finance systems had lower house prices relative to incomes. A reasonable conjecture that could be studied in future research is that countries that have larger housing finance systems also have more elastic housing markets, and that this supply-side effect limits the volatility of house prices more than the demand-side effect of mortgage availability raises volatility.

Does Mortgage Availability Drive Homeownership?

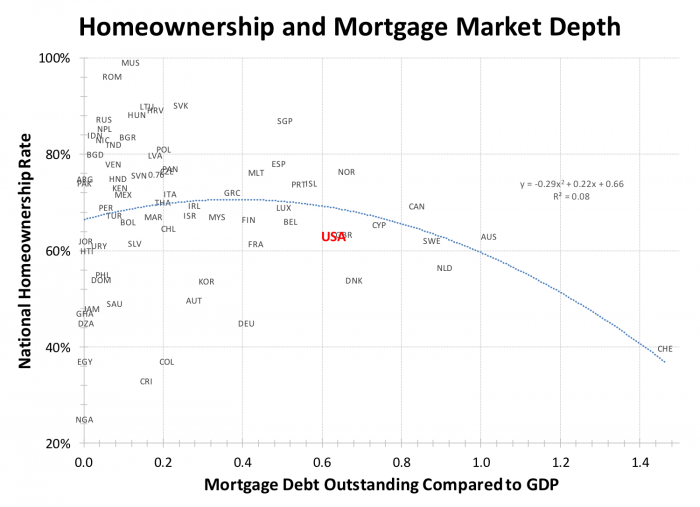

Many of the concerns expressed about changes to the U.S. housing finance system revolve around the purported risks to homeownership. Now, exactly what is meant by homeownership can be a little slippery, especially in poor countries where substantial numbers of households can “own” their units but their tenure is far from secure. See Jimenez for example. So while Exhibit 3 presents data on a wide range of places, let’s focus on “developed” countries.

Exhibit 3

Even a cursory glance at the data in Exhibit 3 shows that plenty of rich countries have similar or higher homeownership rates than the U.S. (at 63 percent in this dataset) without our 30-year fixed rate nonrecourse mortgages. See Finland (FIN), Israel (ISL), Spain (ESP), Norway (NOR), and Canada (CAN) for example. Other countries with similar levels of overall mortgage market development such as the Netherlands (NLD), Denmark (DNK), and Switzerland (CHE) have much lower homeownership rates despite having plenty of mortgage money. Germany (DEU) is also often cited, correctly, as a country with a relatively low homeownership rate, although its mortgage market is also smaller relative to its economy than the U.S. and some other GDP peers.

There is recent and ongoing research that explores what some of the other determinants of homeownership rates might be. Fisher and Jaffe, Chiuri and Jappeli, Gwin and Ong, Englund Kim Malpezzi and Turner are among cross-country studies to date. Bourassa, Hoesli and Scognamiglio; Hubert; Voigtlander; and Werczberger examine the especially interesting cases of Germany and Switzerland in detail. All in, demographics matter, albeit weakly – countries with older populations are more likely to have higher rates of homeownership. The strongest determinant seems to be the relative cost of owning and renting, which is partly determined by finance but also by taxes and market conditions. Both Switzerland and Germany have controls on rents and subsidies for private landlords, albeit of different forms, which also provide incentives to renters.

A Bottom-Line Takeaway

Before the events of 2006 to 2009 – a bust in house prices, spiking mortgage defaults and foreclosures, the Great Financial Crisis, and the Great Recession – it was easy to find descriptions of the U.S. housing finance system that might be labeled triumphalist, suggesting that the U.S. system was uniquely well designed and a clear model for other countries (e.g. Colton, Integrated Financial Engineering, Shilling). A decade later, chastened, we still see that the U.S. system has numerous strengths but we also have a better appreciation that other countries also have something to teach us. We face a number of major issues; for example: increasing interest rates, what to do with Fannie Mae and Freddie Mac, whether to introduce new mortgage instruments such as shared appreciation mortgages (even though they’re not really new as we noted above), whether to make changes to our approaches to recourse and/or prepayment, lenders loosening underwriting standards including higher loan-to-value ratios and lower FICO scores. Institutional change is afoot, not just with Fannie and Freddie but also possible changes in regulators (including key personnel changes at the Fed and the Federal Housing Finance Agency), and loosening the approaches of Dodd-Frank and its stepchild the Consumer Financial Protection Bureau. Risk in mortgage markets may be building up again, as housing prices stretch to and perhaps beyond where fundamental suggests they should be in some markets.

It’s sometimes argued that without the 30-year fixed rate mortgage, or without Fannie and Freddie, or with recourse mortgages, U.S. homeownership would be at risk. This would be a threat to the American Dream according to some advocates such as our good friends at the Realtors. Our examination of data, and practices across countries, suggest this concern is overblown. Tighter underwriting might delay homeownership but can also reduce defaults. It’s often a good thing to become a homeowner. It’s even better to stay a homeowner.

Sources, and Further Reading

Agnello, Luca, and Ludger Schuknecht. “Booms and Busts in Housing Markets: Determinants and Implications.” Journal of Housing Economics 20, no. 3 (2011): 171-90.

Andrews, Dan, and Aida Caldera Sánchez. “The Evolution of Homeownership Rates in Selected OECD Countries: Demographic and Public Policy Influences.” OECD Journal: Economic Studies 2011, no. 1 (2011): 1-37.

Badev, Anton, Thorsten Beck, Ligia Vado, and Simon Walley. “Housing Finance across Countries: New Data and Analysis.” World Bank Policy Research Working Paper, 2014.

Barker, Kate. “Planning Policy, Planning Practice, and Housing Supply.” Oxford Review of Economic Policy 24, no. 1 (2008): 34-49.

Bourassa, Steven, Donald Haurin, Patric Hendershott, and Martin Hoesli. “Mortgage Interest Deductions and Homeownership: An International Survey.” Journal of Real Estate Literature 21, no. 2 (2013): 181-203.

Bourassa, Steven, Martin Hoesli, and Donato Scognamiglio. “International Articles: Housing Finance, Prices, and Tenure in Switzerland.” Journal of Real Estate Literature 18, no. 2 (2010): 261-82.

Bracke, Philippe. “How Long Do Housing Cycles Last? A Duration Analysis for 19 Oecd Countries.” Journal of Housing Economics 22, no. 3 (2013): 213-30.

Cerutti, Eugenio, Jihad Dagher, and Giovanni Dell’Ariccia. “Housing Finance and Real-Estate Booms: A Cross-Country Perspective.” Journal of Housing Economics (2017).

Cheshire, Paul, and Stephen Sheppard. “Land Markets and Land Market Regulation: Progress Towards Understanding.” Regional Science and Urban Economics 34, no. 6 (2004): 619-37.

Colton, Kent W. Housing Finance in the United States: The Transformation of the Us Housing Finance System. Joint Center for Housing Studies, Harvard University, 2002.

Connor, Gregory, Thomas Flavin, and Brian O’Kelly. “The US and Irish Credit Crises: Their Distinctive Differences and Common Features.” Journal of International Money and Finance 31, no. 1 (2012): 60-79.

Demirgüç-Kunt, Aslı, and Ross Levine. Financial Structure and Economic Growth: A Cross-Country Comparison of Banks, Markets, and Development. MIT press, 2004.

Englund, Peter, Kyung Hwan Kim, Stephen Malpezzi, and Bengt Turner. “Housing Tenure across Countries: The Effects of Regulations and Institutions.” Paper presented at the European Network for Housing Research, 2005.

Fisher, Lynn M, and Austin J Jaffe. “Determinants of International Home Ownership Rates.” Housing finance international 18, no. 1 (2003): 34-37.

Gwin, Carl R, and Seow-Eng Ong. “Do We Really Understand Homeownership Rates? An International Study.” International Journal of Housing Markets and Analysis 1, no. 1 (2008): 52-67.

Hilber, Christian AL, and Wouter Vermeulen. “The Impact of Supply Constraints on House Prices in England.” The Economic Journal 126, no. 591 (2016): 358-405.

Holly, Sean, M Hashem Pesaran, and Takashi Yamagata. “The Spatial and Temporal Diffusion of House Prices in the UK.” Journal of Urban Economics 69, no. 1 (2011): 2-23.

Hubert, Franz. “Private Rented Housing in Germany.” Netherlands journal of housing and the built environment 13, no. 3 (1998): 205-32.

Ibbotson, RG, LB Siegel, and KS Love. “World Wealth.” The Journal of Portfolio Management 12, no. 1 (1985): 4-23.

Integrated Financial Engineering Inc. “Evolution of the U.S. Housing Finance System: A Historical Survey and Lessons for Emerging Mortgage Markets.” U.S. Department of Housing and Urban Development, 2006.

Jimenez, Emmanuel. “Tenure Security and Urban Squatting.” The Review of Economics and Statistics (1984): 556-67.

Kim, Kyung-Hwan, and Bertrand Renaud. “The Global House Price Boom and Its Unwinding: An Analysis and a Commentary.” Housing Studies 24, no. 1 (2009): 7-24.

Loungani, Prakash, and Hites Ahir. “International Monetary Fund Global Housing Watch.” http://www.imf.org/external/research/housing/index.htm.

Malpezzi, Stephen. “Urban Housing and Financial Markets: Some International Comparisons.” Urban Studies 27, no. 6 (December 1990): 971-1022.

Malpezzi, Stephen, and Stephen K. Mayo. “Getting Housing Incentives Right: A Case Study of the Effects of Regulation, Taxes, and Subsidies on Housing Supply in Malaysia.” Land Economics 73, no. 3 (August 1997): 372-91.

Malpezzi, Stephen, and Susan M. Wachter. “The Role of Speculation in Real Estate Cycles.” Journal of Real Estate Literature 13, no. 2 (2005): 143-64.

Reinhart, Carmen M, and Kenneth Rogoff. This Time Is Different: Eight Centuries of Financial Folly. Princeton University Press, 2009.

Renaud, Bertrand. “Housing and Financial Institutions in Developing Countries.” World Bank Staff Working Paper 658 (1984).

Shilling, James D. ” International Differences in Homeowner Borrowing Costs.” University of Wisconsin Center for Urban Land Economics Working Paper, 2004.

Tukey, John W. Exploratory Data Analysis. Reading, MA: Pearson, 1977.

Voigtländer, Michael. “Why Is the German Homeownership Rate So Low?”. Housing Studies 24, no. 3 (2009): 355-72.

Werczberger, Elia. “Home Ownership and Rent Control in Switzerland.” Housing Studies 12, no. 3 (1997): 337-53.