The first of three posts on the opportunities of regulatory reform

In past weeks, we’ve argued that successfully attacking the problems of housing costs, especially for our fellow citizens with low incomes, requires a two-pronged approach. On the demand side, for those incapable of paying market rents – the poor, the elderly and the disabled – a well-designed system of housing allowances or vouchers would be the centerpiece for most (along with supportive services for some). On the supply side, reform of the regulatory environment for land use and development, and related real estate regulations, could lower housing costs across the board for all our citizens.

In three previous posts we focused on the demand side, in particular on vouchers that supplement household incomes to help pay rent. Our first post presented some basics: who might require assistance, how the Federal government currently subsidizes housing with a focus on Housing Choice Vouchers, and why vouchers dominate other approaches like inclusionary zoning and the Low-Income Housing Tax Credit. Our second post on the subject examined the potential market effects of a larger voucher program, how vouchers help older and disabled Americans, and how housing vouchers fit into the larger system of income support. Our third post reviewed budgetary trends in vouchers and other Federal housing programs, discussed several Administration proposals for changes to housing assistance, and presented some additional ideas for improvements to Housing Choice Vouchers.

Now it’s time to tackle the supply side, primarily by reviewing the regulatory environment for land and real estate development, and its implication for housing and other real estate. We’ll present three posts in this series, too. In today’s post, after some additional motivation, we’ll assess the following:

- Why regulate real estate markets? Why intervene at all?

- A brief history of planning, zoning, and other regulations.

- An initial examination of different types of real estate regulation.

- Development of a toolkit for a rigorous study of the costs and benefits of regulations.

In a few weeks, with this background underpinning our work, we’ll dive deeper into a range of topics, with a focus on empirical results:

- Measuring regulation, and another important supply determinant: physical geography.

- Why and how communities choose their regulatory environments.

- Regulation and real estate market outcomes: prices and quantities of housing and other real estate, benefits to housing consumers, and possible spillovers to the broader economy.

Finally, in April, our third post on this broad and important topic will use our results from the first two posts to develop recipes for reform, to deliver fairer and more effective real estate regulation, and, even more importantly, fairer and more effective real estate market outcomes.

Of course, this blog is not the first place these concerns have been raised. In addition to the extensive academic literature – some of which we’ll cite in this and the next two posts – advocates, politicians, media, and a wide range of our citizenry have long focused on these issues. Any online search will instantly yield a plethora of discussions of real estate regulations of various kinds. Here are a few recent examples from New Jersey alone. As of this writing, Councilman Daniel Rodrick is proposing that Toms River eliminate all zoning for multifamily homes. (I’m not a lawyer, nor do I play one on TV, but I doubt such a zoning change would long survive judicial scrutiny, if it were to pass. Nevertheless, such an extreme proposal is an indicator of continued political controversies over land use.) Zoning approvals for a mosque in Bayonne and an Orthodox Jewish school in Howell are other examples of recent high profile controversies. A number of New Jersey communities are considering the use of land use regulations to limit cannabis-related businesses. Debates that may seem more prosaic in some ways but matter a lot to those involved include zoning for self-storage units and apartment projects. As we’ll explore in a later post, New Jersey leads the nation (for good or ill?) in farmland and open space preservation programs, which regularly yield stories. And of course, decades later, controversies and lawsuits still revolve around the implementation of Mt Laurel “Fair Share” affordable housing requirements. It’s easy to find many more stories like these, and we’d hit more mother lodes of stories if we searched on “zoning and Connecticut” or “zoning and New York.” Or “NIMBY,” “urban planning,” or “building codes,” just to pick a few.

The need to think harder about real estate regulation, with an eye to reforms, has hardly escaped the notice of politicians and other non-academics, of course. One of the most notable examples, three decades ago, was “Not In My Backyard: Removing Barriers to Affordable Housing,” the report of a national commission chaired by former New Jersey Governor Thomas Kean, instigated by President George H.W. Bush and his HUD Secretary Jack Kemp. Governor Kean, Secretary Kemp and President Bush were, of course, Republicans; but concern about the effects of overly stringent regulations crosses party lines. For example, the Obama White House released a paper entitled “Housing Development Toolkit” that explored significant barriers to housing development including poorly designed land use and development regulations.

So a little time with a search engine and a few key words will convince anyone who might be skeptical of the importance of these urban regulations. (Even better, go to some public meetings of your zoning board, or watch them on your local public access channel.) What can we add to the discussion? Rigorous thinking and evidence. We’ve already mentioned that our second post on this subject, forthcoming in a few weeks, will focus on empirical evidence. But who can wait? Let’s use just one simple chart, to foreshadow that research, and to help motivate our regulatory focus.

Additional Motivation: A First Look at Regulations and Housing Costs

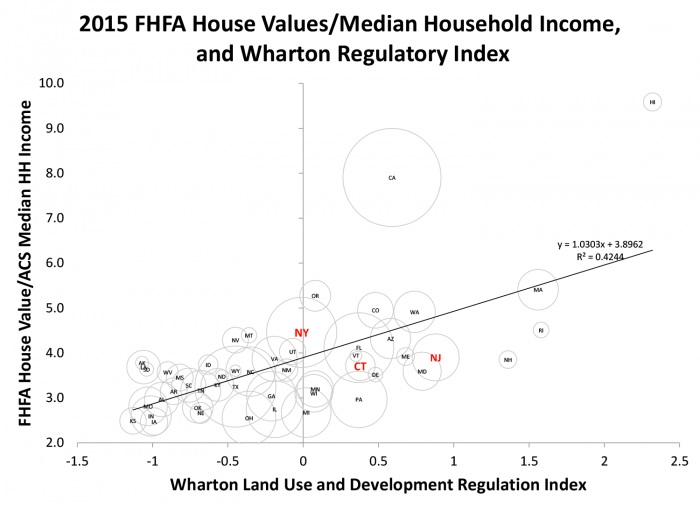

For a first look, let’s begin with statewise measures of regulation and housing costs. For housing costs, we use a state index of housing values from the Federal Housing Finance Agency. Before we even examine the data, it’s well known that while housing costs are high in places like New York and San Francisco, so are incomes. In our next post we’ll have a lot more to say about how to control for incomes, both their level and distribution, and many other variables including demographics, financial conditions and so on. For now, we make a crude adjustment for income differences by dividing each state’s average 2015 housing prices (from FHFA) by that state’s median household income (from Census).

Regulatory measures require a little more discussion. Gyourko, Saiz and Summers (2008) produced one such regulatory measure. Gyourko et al. survey over 2000 municipalities in the U.S. regarding their regulatory practices in the following areas: number of approvals required for zoning changes, number of approvals required for approval of developments already conforming with local zoning, whether there are existing caps on building different kinds of units, and a dummy variable for density restrictions (minimum lot size greater than 1 acre), a dummy for open space requirements, a dummy for exactions (impact fees) for new construction, and measures of the time required for the approval process for three different types of projects (large and small single-family development and a multifamily project). Gyourko et al. supplement these survey results with state-level information on higher level involvement in land use and development regulations, and the nature of state court decisions reviewing e.g. challenges to impact fees, fair share development requirements, building moratoria, exclusionary zoning and the like.

Gyourko et al. combine these metro-level data elements using a type of weighted average (principal components analysis), then average the municipal data by state, yielding the Wharton Residential Land Use Index (WRLUI). The index is normalized so that an average location takes the value zero.

The most stringently regulated states, according to this index, are Hawaii, Rhode Island, Massachusetts, New Hampshire, New Jersey, and Maryland. (Perhaps it’s a bit of a surprise that California comes in as low as number 9 by the Wharton regulatory measure, but we’ll have more to say about that in the next post.) The least regulated are Indiana, Missouri, South Dakota, Louisiana, Alaska, and Kansas. The tri-state area regulates its real estate markets more than most states: New Jersey, as already noted, is ranked 5th among the states in stringency, Connecticut is ranked 13th, and New York is ranked 21st. All are “above average” compared to the nation. To preview, when we unpack by geography we’ll find that some of the larger metropolitan areas in the Tri-State area – notably if unsurprisingly New York City – will turn out to be much more stringently regulated than their statewise averages. And we’ll find some similar results for California metro areas. But we’ll discuss that in a few weeks. For now, note that if we get relationships between regulation and housing costs when we aggregate by state, we can expect the relationships to be even stronger when we disaggregate by metro areas.

In the event Exhibit 1 shows that housing costs more in more stringently regulated markets. We’ve already described the measures on the horizontal and vertical axes; the area of the circles around each state’s abbreviation is proportional to that state’s population. Hawaii is an outlier in both housing costs and regulatory stringency; California is an outlier in housing costs alone. Even if Hawaii and/or California are deleted from the dataset, a strong relationship between these two variables remains. The simple correlation between the regulatory index and our housing cost measure is 0.65 (where 1.0 is a perfect fit and 0 is no linear relationship).

The point, of course, is not that the optimal level of regulation is no regulation, or a minus 2 in this index. Indeed, there are many possible externalities and other market failures that a well-designed regulatory environment can help mitigate, as we will discuss below and Malpezzi (1996), Fischel (1990) and others have emphasized. Rather, it’s that regulations have both costs and benefits, and planners and other regulators need to understand the tradeoffs.

Now that our appetites have been whetted by this taste of data, we’ll feast on more detailed empirical results in a few weeks. We’ll spend the rest of this blog post stepping back and doing some more hard thinking that will also help set that table.

Why Regulate Real Estate Markets? Why Intervene at All?

Few if any readers of this blog need to be convinced that real estate is important for our cities, our economy, our society. Housing alone is more than half the tangible capital stock of the U.S. economy, and it’s the most widely distributed form of wealth, much more important to the portfolios of middle-income Americans than stocks or bonds, as Davis and Palumbo among others have pointed out. If housing and other real estate markets aren’t working efficiently or fairly, that has very large implications for the welfare of our citizens.

There are a number of possible reasons why private markets might fail to reach an efficient or equitable allocation, giving rise to a potential need for regulation or some other government intervention. Detailed surveys and discussion of these rationales appear in any introductory text in public economics; see for example Haveman (1976), Malpezzi (2000), or my notes posted at my personal blog.

There are a number of “classic” reasons markets fail, including so-called “pure” public goods like national defense (once they are provided to one, they have to be provided to all); the existence of monopolies, or near- monopolies, including but not limited to some important classes of infrastructure; “asymmetric information,” or as normal people (non-economists), “I know something you don’t know” (or vice versa); and high transactions costs, including those imposed by congestion but lowered by other aspects of urban agglomerations.

A second source of market failure is the absence of clearly defined and enforceable property rights. In Anglo-American land use law we often use the useful metaphor of “a bundle of sticks” for property rights. These include possession, the right to physically occupy; control, the rights to use and manage; the right to income, i.e. residual returns after paying expenses, mortgages, etc.; security, in the sense of personal safety and the right to avoid involuntary seizure or encroachment; mortgageability, security in the financial sense, the right to borrow against the asset; and transferability, the right to sell or lease the asset, assign it in a will, etc. The definition of such rights, with clear rules for the adjudication of disputes, is a prerequisite for a functioning housing market.

Yet another major class of market failure, perhaps the most important in the context of urban land use, relates to the presence of externalities. External costs are costs that are imposed upon parties outside the transaction. External benefits are benefits conferred upon parties outside the transaction. Externalities are especially important in housing and real estate, so this important class of market failure will be the driving force behind much of the urban regulations we study in these blog posts.

Every real-world real estate development imposes at least some costs on at least a few neighbors. Sometimes these costs are substantial. The location of especially noxious real-estate developments have been regulated for centuries, for example the location of tanneries, slaughterhouses, chandlers and the like in an earlier age; the location of a wide range of factories and other industrial buildings are regulated today. Even the best designed residential development generates some additional traffic congestion. Most new developments will, without some government intervention (or a side deal between developers and neighbors to similar effect) increase the neighborhood’s impermeable surfaces and runoff; and greater demand for education, police, fire and other public services.

Possible Responses to Market Failure

What are possible solutions, or ways to mitigate, market failures? There are five major ways governments intervene in housing markets:

- Definition and enforcement of property rights

- Direct public provision

- Taxation

- Subsidy

- Regulation

Broadly, these interventions can often be treated as substitutes. Certainly they can each be valued, i.e., costs and benefits estimated, and the incidence of the tax, subsidy, regulation or whatever can be studied. But of course, there are other senses in which they are not equivalent. For example, in the environmental literature there is a large body of work that suggests that in most circumstances taxes on pollution may be more effective than command-and-control regulation (Eskeland and Jimenez 1992).

Government interventions, like any other activity, generate both costs and benefits. These costs and benefits may accrue to different agents or elements of society– developers, landlords, governments, or consumers. The aim of any careful analysis of zoning or other real-estate regulations will be to examine their net effect on urban real estate market outcomes, and how these costs and benefits accrue to different people, institutions and firms.

Governments Can Fail as Well as Markets

Any time we can plausibly posit the existence of externalities or some other market failure, government interventions can, in principle, mitigate – if not eliminate – the market failure. But this is not necessarily what happens in practice. Using government interventions to correct for market failures places a very high demand on the ability of politicians and civil servants to understand the exact nature of the market failure, the related magnitudes of costs and benefits, and careful mechanism design to develop a tax or subsidy or regulatory mechanism that is effective and precise in mitigating the market failure. The world is full of examples of regulations or other interventions that overdo it, that “throw the baby out with the bathwater.”

In general government failure occurs whenever an intervention is introduced that does not properly correct for a true market failure, either because no such failure exists in principle, or more commonly, when the intervention is poorly designed and/or poorly implemented. Lack of detailed knowledge about the size and nature of the market failure and of good mechanism design is one source of government failure. Another source is that not every government agent, whether politician or civil servant, is necessarily a disinterested party trying to maximize some theoretical “social welfare function”. Complex systems of taxation and regulation subsidy also give rise to opportunities for corruption.

A Brief History of Planning, Zoning, and Other Regulations

Urban plans and regulations, of a sort, are almost as old as cities themselves. They predate land markets, as we understand them today. Archeologists’ layouts of cities in Mesopotamia, China, Central and South America, and Greece, among other places, clearly demonstrate that the designs of many ancient cities separated residential civic and religious uses (Kostoff). Exhibit 2 (licensed from iStock) presents one such example: an ancient plan of Olympia, Greece. Other examples abound. The Romans set up specific commercial districts. Napoleonic codes require that noxious uses be located outside of city limits.

Many early regulations focused on fire safety. In the 14th century Munich put requirements in place for tile roofs and stone chimneys to reduce fire risk. Well before zoning, fire departments in U.S. cities like New York enforced their own codes and practices. Nuisance laws regulated the location of noxious uses or banned them from the city entirely such as slaughterhouses, distilleries, limestone kilns, tallow chandlers and the like. Massachusetts and New York had these laws as far back as 1692.

In the 1885, Modesto CA implemented what some consider to be the first “modern” zoning ordinance, which regulated laundries, but which was actually meant to exclude Chinese immigrants from certain neighborhoods. Los Angeles began to draw distinctions between residential and commercial zones in 1905. In 1916 New York City passed the first comprehensive zoning law, meant to regulate a wide range of activities (regulate garment workers, keep skyscrapers from blocking air, light and traffic).

The game changed in the 1920s, after then-Secretary of Commerce Herbert Hoover promulgated the Standard State Zone Enabling Act (“SSZEA”), a model set of plans designed by an expert committee headed by New York’s Edward Bassett. Land use regulation is in large part a local matter in the United States, and local governments are “creatures of the state.” So Hoover/Bassett et al.’s document had no legal force itself, but rather served as a model for states; each then passed similar enabling legislation to provide the framework for zoning and other regulatory processes. The speed and ubiquity of SSZEA’s adoption by most of the (then) 48 states explains why, though every municipality has its own specific rules, the broad outlines of zoning procedures are roughly uniform in most states, and remarkably little has changed over the last century.

Zoning and other government regulations affect the value of land and other property. In U.S. jurisprudence the concept of a “taking”, of equal protection and of due process, famously flow from the Bill of Rights:

Article V. No person shall be held to answer for a capital, or otherwise infamous crime, unless on a presentment or indictment of a Grand Jury, except in cases arising in the land or naval forces, or in the militia, when in actual service in time of war or public danger; nor shall any person be subject for the same offence to be twice put in jeopardy of life of limb; nor shall be compelled in any criminal case to be a witness, against himself, nor be deprived of life, liberty, or property, without due process of law; nor shall private property be taken for public use, without just compensation.

Later, the 14th amendment bound state and local governments by the same rules:

Article XIV (Section 1). All persons born or naturalized in the United States, and subject to the jurisdiction thereof, are citizens of the United States and of the State wherein they reside. No State shall make or enforce any law which shall abridge the privileges or immunities of citizens of the United States; nor shall any State deprive any person of life, liberty, or property, without due process of law; nor deny to any person within its jurisdiction the equal protection of the laws. (1868)

One could conceivably construe these Constitutional strictures to require compensation for loss of value, when it occurs from zoning or other public actions. In fact, the concept of a “taking” in land use law is narrowly defined as a consequence of a physical taking of actual land, e.g. for a highway. Regulatory losses (and for that matter, losses from taxes, or gains from infrastructure) have been“off the table” since 1926, when the landmark case Village of Euclid v. Ambler Realty Co. was decided. In 1922 Euclid, a suburb of Cleveland, adopted a comprehensive zoning ordinance. Ambler owned a parcel whose use was restricted. They sued, arguing that zoning had confiscated and destroyed a substantial portion of the value of their property (a taking, requiring compensation according to the U.S. constitution). The Supreme Court held otherwise, that zoning was a legitimate exercise of the police power. Other cases have established that zoning or other regulatory actions that effectively left zero value to the land could be construed as a taking, but these are rare.

A Deeper Dive into the Types of Real Estate Regulation

This is a good place to mention that “zoning” is so ubiquitous in the United States that we often use “zoning” as a shorthand for the broader set of land use and development regulations. This can lead to confusion at times. Also, many Americans assume that zoning per se will play a similar role in real estate regulation in other countries, though such is not always the case. For example, in Britain, while they are bound by rules, governmental urban planners have much more autonomy than their American counterparts in making decisions about development, for better or for worse.

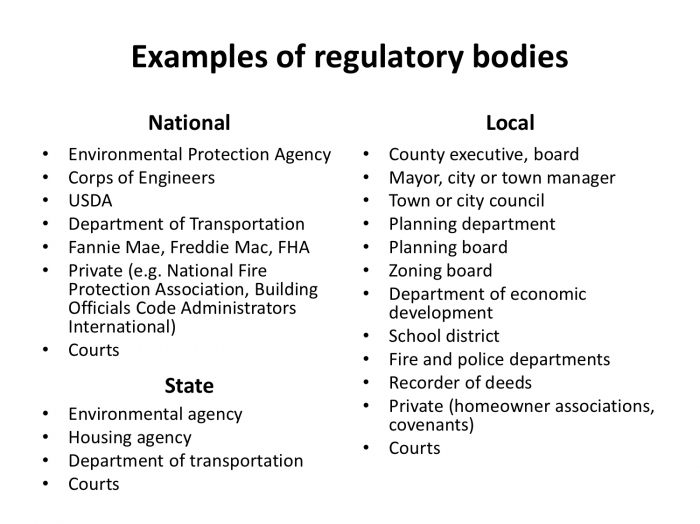

Exhibit 3 presents a partial list of types of real estate regulations, in no particular order.

As we have already discussed above, government subsidizes, regulates, taxes and otherwise intervenes in real estate markets for a wide variety of purposes. There are many kinds of land use and related urban regulations, as Exhibit 3 confirms. It would take a book – several, actually – to discuss the list in Exhibit 3 fully. Useful reviews include Pace Law School (n.d.), Peters (2010), and Malpezzi (1999). Instead, in this section we’ll take a first look at some of the rationales behind broad classes of regulation.

One way to think the rationales for zoning and other land use and development regulations (hereafter, “zoning” for brevity), is to make distinctions between nuisance zoning, exclusionary zoning, fiscal zoning and design zoning.

Nuisance zoning is meant to correct for externalities arising from “incompatible” land uses. It’s the classic response to the classic urban externalities problem. But there are other rationales.

Another reason we zone or regulate is to exclude certain people (Fisher and Marantz). Recall that the first zoning ordinance in the U.S. was Modesto, CA, to regulate location of laundries, and in so doing regulate the location of their Chinese proprietors and workers.

A subtler form of exclusion is termed fiscal zoning. Fiscal zoning focuses less on the race or ethnicity of the (potentially) excluded, and more on the purported effects on local government budgets. Specifically, fiscal zoning aims to encourage land uses that purportedly increase the property tax base more than they require in services, and discourage land uses that require more spending on services than they generate in revenue. For example, local governments may believe that encouraging large commercial developments but discouraging modest apartments with 3 or more bedrooms – children require schools.

Consistency is the hobgoblin of small minds, it’s been said, and no one ever said U.S. real estate regulation was small minded, I mean consistent. It’s surprisingly common for municipalities to layer on a range of regulations that explicitly or implicitly exclude households of certain income ranges, or other characteristics. Then, when advocates point out the lack of “affordable housing,” these same municipalities layer programs of “inclusionary zoning” – a tax on housing development – atop the exclusionary zoning. We’ve seen in a previous post that this strategy has little to recommend it.

Design and aesthetics can play a role. We like our cities to look nice. Some cities – Williamsburg and Alexandria, Virginia come to mind – require very specific building materials and designs to mimic the planner’s views of design that’s compatible with colonial-era buildings. Open space requirements and historic preservation are related regulations that stem from the imposition of a certain aesthetic.

Who Regulates?

So far we’ve abstracted from who, exactly, does the regulating. There’s a long history of academic consideration of what the different levels of government might do, and actually do (Malpezzi 2000). But no one who’s ever walked a development through the regulatory process needs economists or political scientists to explain the complications that can arise from the different roles played by national, state and local governments; and even more complex, from the different roles played by various agencies and offices within a given level. Exhibit 4 presents some examples of governmental and other regulatory bodies involved in typical development processes. Every level of government gets into the act.

At the Federal level, we have already noted the foundational role of the Standard State Zone Enabling Act and related activities. In addition to the SSZEA, the national government regulates directly, especially in the environmental area. For example, the National Environmental Policy Act requires environmental impact statements for federal or federally supported developments such as airports, low-income housing, transportation infrastructure. Many other federal regulations exist, such as airport noise abatement, wetlands protection, protection for endangered species, to name just a few. Federal authorities are heavily involved in major infrastructure projects, including but not limited to the Corps of Engineers. And the Federal government backstops much of the flood insurance in the country, including the development of maps and other threat assessments; see Barr, Cohen and Kim for evidence that these very much need to be updated and improved.

The states have long played a role, both indirectly (local governments are all “creatures of the states,” legally if not always completely subservient politically) and directly. During the so-called “Quiet Revolution” in land use control during the seventies, states created regional commissions, California Coastal Commission, the Minneapolis-St Paul Metro Council, etc., and began to require legislative approval of local plans. The aforementioned Kean Advisory Commission on Regulatory Barriers suggested states have a role to play in addressing “excessive” regulation by some local governments, a question we’ll return to in future posts.

Local governments are very much the front lines of most land use and development regulation. The establishment of zoning and major changes are carried out by local legislative bodies (town or city council, or board of supervisors). Administration and minor adjustments are carried out by Zoning Boards of Administration (ZBAs). Sometimes a planning commission has input at least in theory.

Courts exist at all three levels of government, and are required to resolve the many conflicts sure to arise in such a complex, high-stakes area. To the extent that American zoning and related regulations are less about planning than about entitlements, land use lawyers will play a major role, often more critical in practice than planners.

The large number of regulating agencies and institutions can cause its own problems. Agencies can have contradictory objectives, rules, and enforcement practices. Typically each agency takes a myopic look at its own narrow responsibility, without considering how its practices might spill over to other areas. This includes what we sometimes call the “adding up” problem – a single regulation or two might appear to impose modest costs, but when many agencies regulate, the cumulative effect might be very different. Dealing with these coordination problems will be an important part of our third post’s policy discussion.

How to Study Regulations

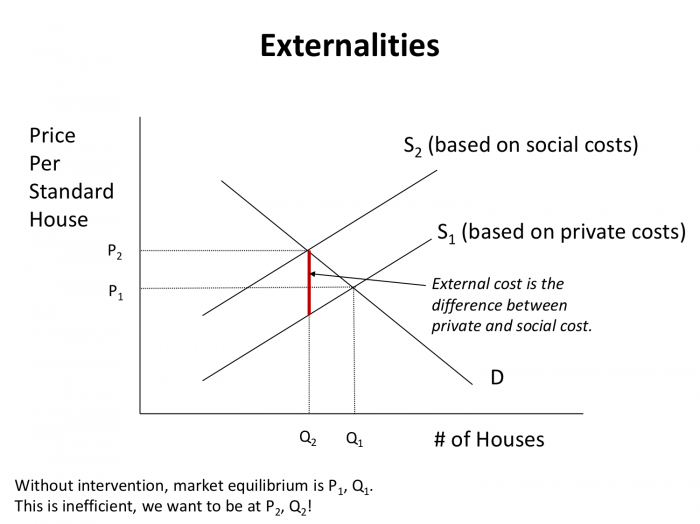

The most commonly discussed sources of market failure in land use and real estate development stem from externalities. This is so central that we present the basic economic analysis in Exhibit 5. The analysis has a long and fruitful history, stemming from the work of Arthur Pigou (1920).

Externalities can exist on either the cost or the benefit side. We begin with a cost example. Consider a city in which market supply and demand can be represented as Exhibit 5. Assume for simplicity that all houses are identical, and that we are considering the “flow” market (i.e., the number of new houses supplied or demanded in a year). As drawn, without any regulation or other government intervention, market supply and demand clear whenever Q1 standard houses are built, at a price of $P1 per house.

Recall from your Econ 101 course (or our brief online review) that demand curves are determined by benefits, on the margin, and that supply curves are determined by marginal costs. A familiar result from any principles course is that when costs rise, the supply curve shifts up and to the left.

What costs? In the simplest model of a housing market, developers face a range of costs, including the purchase of land, on-site infrastructure, design and architects’ fees, construction materials and labor, and some normal profit, reflecting the opportunity cost of the developer’s time. These costs are paid, one way or another, by the developer; eventually, in a competitive market, they are passed along to consumers.

But what if there are external costs – that is, costs that, while real, are not paid by developer or consumer, but are external to the transaction? Plausible examples include costs of congestion, such as longer commutes born by neighbors; environmental costs such as increased runoff, or loss of views; or fiscal costs borne by general taxpayers for (say) additional trunk infrastructure, or schools.

Define social costs as the sum of private costs plus external costs. In other words, if external costs are present, social costs and private costs are no longer equivalent. This is shown in a stylized way in Exhibit 5. S1 is the supply curve based on private costs; S2 is the supply curve based on social costs; the vertical difference between S1 and S2 at any Q is the magnitude of the external cost at that level of Q. It is extremely important to recognize that first, external costs, by their nature, are not part of the private cost-benefit calculus that governs transactions in a stylized laissez-faire market without any government intervention. Second, just because they are not priced and not part of the private transaction does not mean that they are not real. (They may be difficult to measure precisely, but that is another matter.)

As drawn, S1 and S2 are parallel; there is no requirement that this is so. Some externalities like congestion probably increase on the margin as higher levels of output are reached.

In the event, assuming a substantial external cost as in Exhibit 5, the market will produce at P1, Q1; that is, it will produce too much housing at too low a price. What do we mean by “too much” and “too low”? Because private costs do not accurately reflect the marginal costs of the houses to society, the market is sending the wrong signal to producers and consumers; the last few houses built are not the best use of society’s scarce resources used in developments, and prices do not reflect true opportunity costs. The social optimum, in fact is at P2, Q2.

How can we solve this problem? The classic solution is government intervention. This can in turn take many forms. One method would be for government to simply fix the number of building permits at Q2 (a “growth management” program). A similar quantitative restriction is sometimes cast as a requirement to hook up to, say, a sewer system, and those connections are themselves limited to Q2. Such a growth management system, if properly implemented, can lead to an improved efficiency result; but before we discuss whether this also happens in practice, let us assume an efficient regulator setting Q2 directly, and point out some interesting distributional, or equity, issues.

How are the building permits to be distributed? Suppose they are handed out on a first-come, first-served basis. The developers who are quick off the mark make an additional excess profit equal to Q2 (P2 – P1). Developers who are slow-footed and do not get permits lose producers’ surplus bounded by the original price line P1, the vertical line Q2, and the original equilibrium point; but note that this triangle was an excess profit but was also a deadweight loss to society because S1 did not reflect true costs. The excess profit Q2 (P2 – P1) is a transfer from consumers to developers.

Another way the permits could be allocated would be to have some government agent(s) allocate them. In turn, there are many ways this could happen, not all mutually exclusive. A planning agency could have a “beauty contest” and choose the planner’s favorite physical design. Developers could compete by offering to build community facilities or some other favored use like moderate-income housing in order to obtain approval for other projects. In a darker vein, if some public agents have discretion in allocation, and ethical standards are not all that they should be, bribery could take place (even though it is illegal). In a similar vein, developers might be encouraged to contribute to local political campaigns, which of course is not “illegal”, and is very different from a bribe. (Hmmm.)

While the details differ in each of the methods just described, some of the social surplus goes into additional excess profits for the developers, a planner’s pet project, a bribe, or a campaign contribution. Another option would be to openly auction the permits. Developers would bid up to Q2 (P1 – P2) for the permits, but those revenues would now flow into the public treasury. Thus they could fund infrastructure improvements, better schools, or perhaps even a local tax cut. Economists love auctions in situations like this.

So far, our discussion has been in terms of some kind of “command and control” growth management regulation. Another way in which government can tackle the externality problem is with a tax. Suppose that government imposed a tax on developers equal to the vertical distance between S1 and S2 at the optimum, i.e. at Q2. If developers pay a tax equal to (P1 – P2) on each unit built, this has the effect of shifting the private supply curve up to the social supply curve. Because the developer pays the tax, what was an external cost is now matched by a private cost; in a phrase beloved by economists (but probably no one else), the tax has “internalized the externalities.”

A third general approach steps away from Pigou’s approach of taxing (or regulating or subsidizing) to a process of private bargaining in what is called a Coasian solution. In a classic article, Nobel prize winner Ronald Coase demonstrated that markets could indeed handle externalities like the congestion associated with housing development in a private bargaining, if two important conditions are met: (1) property rights (either of a developer to build, or of the neighbors to veto nearby development) are clearly defined and enforced, but can be traded; and (2) that everyone has full information and low transaction costs of bargaining. Remarkably, Coase shows that society will reach the same optimum, or efficiency result, whether (1) developers have an untrammeled right to build, but neighbors band together and compensate developers to reduce construction to the point where the neighbors’ last dollar spent in compensation just equals the benefit to those neighbors of less housing development; or (2) if neighbors have a veto over any or all development, but developers compensate the neighbors to permit construction, up to the point where the last dollar the neighbors receive in compensation just equals the benefit to those neighbors of less housing development. This will be (surprise!) at P2, Q2.

Several further points should be made about this “property rights” solution to an externality. First, there are a few other assumptions embedded in the model: notably (A) that either all neighbors have the same valuation of congestion and other externalities, or alternatively, that the neighbors can reach some joint position, perhaps through a voting rule; and (B) that all the neighbors (and developers) stick to the bargain, i,e., there are no strategic holdouts (see the classic Jean Arthur – Jimmy Stewart – Lionel Barrymore – Ann Miller movie “You Can’t Take It With You” for a clear exposition of holdouts in real estate development). Second, remarkably the efficiency result is the same whether developers have the right to build or the neighbors have the right to veto all building, but the distributional result is very different. In one case, neighbors pay developers, and in the other case, developers pay neighbors, and it is hard to imagine a much greater difference in distributional outcomes. Third, and perhaps most importantly, the conditions under which Coasian bargaining works are very stringent. In particular, it is often the case that in real-world cases transaction costs are high and the case breaks down. On the other hand, one can consider that such bargaining might take place between developers and a local government that, at least in theory, attempts to represent the interests and preferences of a collection of neighbors that might have difficulty bargaining in a unified way. Ideologues who assert that Coasian bargaining can replace all other real estate regulation have not contemplated transaction costs sufficiently, but on the other hand the model has much to teach us about the kind of bargaining that does and should go on.

Let us return to the” traditional “Pigouvian” model of taxation and/or regulation. It should be obvious that even if the conditions described in Exhibit 5 and the results we then discuss are obtained in theory, there is an important consideration in practice. Whoever sets the tax or the growth control regulation has to know a lot about the market. Not only does “The Regulator” need to know the (private) supply and demand for the good, they also have to know the size of the externality. Merely arguing that externalities exist is not enough; to set the tax or regulation we need quantitative knowledge that is often in short supply. Pigouvian taxation or regulation makes great demands on The Regulator and the economists that support them. Amazingly, some governments set tax rates or set regulations without advice from economists. A growth control target or impact fee that is poorly designed can easily do more harm than good.

If there is one thing that is clear by now it is that land use regulation is about equity as well as efficiency. Regulations typically benefit some members of society at the expense of others. How can we weigh such transfers? Here’s the economists’ jargon, with a simple explanation of each:

-

Pareto Criterion: undertake an action if some people are helped and no one is harmed.

-

Hicks-Kaldor Criterion: undertake any action whose net cost benefit is positive.

-

Revised Hicks-Kaldor Criterion: undertake any Hicks-Kaldor actions and compensate the losers.

The Pareto criterion has a lot of initial appeal, until we realize that there has never been a significant real estate development that meets it. Some neighbors are always inconvenienced, some competitors always lose some revenue.

The Hicks-Kaldor criterion is efficient, but will often be perceived to be unfair. And fairness often drives political decisions much more than does efficiency.

In many respects, the “revised” Hicks-Kaldor approach is the most appealing: we get to be efficient and fair at the same time. Often this is difficult to do in practice, as the torturous history of “takings” in American land use decisions confirms. On the other hand, every developer has experience of providing compensation to move efficient developments along, sometimes with impact fees and other exactions, but also with the development of parks and other public areas, contributions to trunk infrastructure, and traffic lights and other improvements.

Externalities in Practice

What potential externalities could raise social costs of housing above private costs, and hence, in principle, require regulation? Among many candidates are the following:

-

Congestion. Building additional housing units in a community generally increases traffic locally (although it may well reduce total commuting distance).

-

Environmental costs. Building additional housing units may reduce the local supply of greenspace, may affect air quality, and may increase pressure on local water, sanitation and solid waste collection systems (although again the global impact is less clear).

-

Infrastructure costs. These may rise as communities invest to grapple with the above problems. Effects will vary depending on whether the particular community has yet exhausted economies of scale in the provision of each type of infrastructure.

-

Fiscal effects. In addition to the obvious effects from the above, demand for local public services may increase (education, fire and police protection, new residents believing libraries should be open on Sundays in contradiction to local custom). New residents may or may not pay sufficient additional taxes to cover the marginal costs.

-

Neighborhood composition effects. New households may be different from existing households. If existing households value living with people of similar incomes, or the same race, they will view it as a cost if people different from them move in.

If such externalities are large, and are correctly measured by the regulating authority, and the specific policy instrument used to regulate is sufficiently precise, regulation can correct for these externalities. But even if such externalities exist, departures from the preceding rather stringent requirements could leave society worse off in practice.

Of course, not all potential externalities associated with housing raise costs. Many arguments suggest that other externalities exist that increase social benefits beyond private benefits. In such cases including social benefits would push the demand curve out to D2 in the second panel of Exhibit 5. Among potential external benefits are:

-

Productivity and employment. A well-functioning housing market may be required for a well-functioning labor market. In particular, labor mobility may be adversely affected and wages rise to uncompetitive levels if housing markets are not elastic.

-

Health benefits. At least at some level lower crowding and improved sanitation may be associated with lower rates of mortality and morbidity.

-

Racial and economic integration. One person’s external cost (see above) may be another person’s external benefit, if some households value heterogeneity, for themselves or for others. To the extent we are particularly concerned with employment of low income households and/or minorities, concerns about the productivity and employment effects mentioned earlier are reinforced.

-

Externalities associated with homeownership. More housing units and/or lower housing prices may be associated with greater opportunity for homeownership. Homeownership has been argued to be associated with many desirable social outcomes ranging from improved maintenance of the housing stock to greater political stability.

In fact, despite much discussion and assertion, surprisingly little literature exists to confirm the existence of – or to measure most of – the specific externalities on the cost side or the benefit side. But we can observe revealed behavior and conclude that many people must believe such externalities exist. In fact, American housing policy is schizophrenic. When considering land use regulation, revealed behavior suggests that cost-raising externalities dominate. When considering financial policies, tax breaks and other housing subsidies, we appear to assume that extra social benefits dominate.

Recent research, which we’ll discuss in a later post, aims to quantify these costs and benefits in a rough and ready way. When studying regulations, it’s important to remember to examine both potential costs and potential benefits.

Watch This Space!

Now we’ve got a framework for analysis, we know the jargon, and have taken at least a first albeit simplistic look at data that suggests land use and development regulations matter.

In a few weeks look for a follow-up post in which we dive much deeper into evidence on the costs and benefits of different kinds of regulation; that will in turn prepare us for a discussion of how to develop more efficient and fairer regulations and perforce fairer and more efficient real estate markets.

Sources, and Further Reading

Asabere, Paul K, and Peter F Colwell. “Zoning and the Value of Urban Land.” Real Estate Issues 9, no. 1 (1984): 22-27.

Babcock, Richard Felt, and Charles L Siemon. The Zoning Game Revisited. Lincoln Institute of Land Policy, 1985.

Barr, Jason, Jeffrey P Cohen, and Eon Kim. “Storm Surges, Informational Shocks, and the Price of Urban Real Estate: The Case of Hurricane Sandy.” Paper presented to the American Real Estate and Urban Economics Association, 2017.

Bertaud, Alain, and Stephen Malpezzi. “Measuring the Costs and Benefits of Urban Land Use Regulation: A Simple Model with an Application to Malaysia.” Review of 2001. Journal of Housing Economics 10, no. 3 (September 2001): 393-418.

Buchanan, James M, and William C Stubblebine. “Externality.” In Classic Papers in Natural Resource Economics, 138-54: Springer, 1962.

Coase, Ronald H. “The Problem of Social Cost.” The Journal of Law and Economics 3, no. 1 (1960): 1.

Datta-Chaudhuri, Mrinal. “Market Failure and Government Failure.” Journal of Economic Perspectives 4, no. 3 (1990): 25-39.

Davis, Morris A. and Michael G. Palumbo. “A Primer on the Economics and Time Series Econometrics of Wealth Effects.” Washington, D.C.: Board of Governors of the Federal Reserve System, 2001.

Ellickson, Robert C. Order without Law: How Neighbors Settle Disputes. Harvard University Press, 2009.

Eskeland, Gunnar S, and Emmanuel Jimenez. “Policy Instruments for Pollution Control in Developing Countries.” The World Bank Research Observer 7, no. 2 (1992): 145-69.

Fischel, William A. “Externalities and Zoning.” Public Choice 35, no. 1 (1980): 37-43.

———. “Do Growth Controls Matter?”. Lincoln Institute of Land Policy, Cambridge Massachusetts (1990).

———. “Fiscal Zoning and Economists’ Views of the Property Tax.” In Available at SSRN 2281955: Dartmouth College Department of Economics, 2013.

———. “Zoning Rules! The Economics of Land Use Regulation.” Cambridge, MA: Lincoln Institute of Land Policy (2015).

Fisher, Lynn M, and Nicholas J Marantz. “Can State Law Combat Exclusionary Zoning? Evidence from Massachusetts.” Urban Studies 52, no. 6 (2015): 1071-89.

Glaeser, Edward L, Joseph Gyourko, and Raven E Saks. “Why Is Manhattan So Expensive? Regulation and the Rise in Housing Prices.” The Journal of Law and Economics 48, no. 2 (2005): 331-69.

Green, Richard K. “Land Use Regulation and the Price of Housing in a Suburban Wisconsin County.” Journal of Housing Economics 8, no. 2 (1999): 144-59.

Gyourko, Joseph, Albert Saiz, and Anita Summers. “A New Measure of the Local Regulatory Environment for Housing Markets: The Wharton Residential Land Use Regulatory Index.” Urban Studies 45, no. 3 (2008): 693.

Haveman, Robert H. The Economics of the Public Sector. John Wiley & Sons, 1976.

Kean, Thomas (Commission Chair). “Not in My Backyard: Removing Barriers to Affordable Housing.” Washington, D.C.: Report to President George H.W. Bush and Housing and Urban Development Secretary Jack Kemp by the Advisory Commission on Regulatory Barriers to Affordable Housing, 1991.

Knack, Ruth, Stuart Meck, and Israel Stollman. “The Real Story Behind the Standard Planning and Zoning Acts of the 1920s.” Land Use Law & Zoning Digest 48, no. 2 (1996): 3-9.

Kostof, Spiro. “The City Shaped Urban Patterns and Meaning Throughout History.” Bulfinch, Boston (1991).

Le Grand, Julian. “The Theory of Government Failure.” British journal of political science 21, no. 4 (1991): 423-42.

Malpezzi, Stephen. “Housing Prices, Externalities, and Regulation in U.S. Metropolitan Areas.” [In English] Review of 1996. Journal of Housing Research 7, no. 2 (1996): 209-41.

———. “The Regulation of Urban Development: Lessons from International Experience.” In World Bank, background paper for the 1999 World Development Report. Washington, D.C., 1999.

———. “What Should State and Local Governments Do? A Few Principles.” University of Wisconsin-Madison, Center for Urban Land Economics Research, 2000.

Pace Law School. “Beginner’s Guide to Land Use Law.” Pace University, n.d.

Peters, Carl E. “Basic Building, Planning and Zoning Rules in the State of New Jersey.” Carl E. Peters LLC, 2010.

Pigou, Arthur Cecil. The Economics of Welfare. Palgrave Macmillan, 1920 (reprinted 2013).

Quigley, John M., and Larry A. Rosenthal. “The Effects of Land Use Regulation on the Price of Housing: What Do We Know? What Can We Learn?”. Cityscape: A Journal of Policy Development and Research 8, no. 1 (2005): 69-110.

Sagalyn, Lynne B, and George Sternlieb. Zoning and Housing Costs: The Impact of Land-Use Controls on Housing Price. Center for Urban Policy Research, Rutgers University, The State University of New Jersey, 1972.

Winston, Clifford. “Government Failure Versus Market Failure.” Microeconomics Policy Research and Government Performance. Washington, DC: AEI-Brookings Joint Center for Regulatory Studies 74 (2006).