Housing market regulation, part III: A closer look at supply-side reform

Regulation per se is neither good nor bad. What matters are the costs and benefits of specific regulations under specific market conditions. (Class Mantra of my courses on Urban and Regional Economics.)

Regulation should always be in a state of “flux and adjustment – on the one hand, with a view to preventing newly discovered abuses, and, on the other hand, with a view to opening a wider opportunity of individual discretion at points where the law is found to be unwisely restrictive.” Emily Talen, quoting Frederick Law Olmsted Jr. (1910)

This post is our “final” post in the six-part series looking at a two-pronged approach to addressing housing market problems. Posts one, two and three presented the arguments for so-called demand-side approaches, or housing vouchers, to subsidize housing for those we deem in need of special assistance – the elderly, the disabled, the poor. Parts four and five were the first two of three entries on the other prong: analysis and reform of the supply side of the housing market, with particular focus on regulations such as zoning, building codes, and so on.

In our previous posts on regulation, we described motivation for regulation and other interventions in housing markets: to control “external” costs and benefits, to address issues of fiscal balance, and, less nobly perhaps, to control who our neighbors might be. Simple supply and demand models were used to conceptually analyze regulations, demonstrating how benefits arise when regulations are used carefully to mitigate externalities and other market failures. However, empirical research on regulations suggested that some metro areas, particularly in California, but also in New York and New Jersey, had gone overboard – with very stringent regulations that drove up rents and housing asset prices, reducing homeownership, but with few observable benefits other than very modest declines in average commuting times.

The empirical studies we reviewed (and a number of other studies not reviewed in detail in these posts for lack of space, but ably discussed in surveys by Fischel; Gyourko and Molloy; Quigley and Rosenthal; and Schill, among others) have a number of implications for the metropolitan areas in our region. Most markets in New Jersey, Connecticut, and New York, while not as stringently regulated as some California markets, and not as expensive, are nevertheless faced with complex regulatory environments compared to most of the country, and expensive housing as a consequence. And New York City is especially complex. The models of regulatory determinants we examined suggest that our region faces pressures to increase the complexity of these land use and development regulations.

If we don’t get these regulatory issues “right,” our citizens will continue to pay the price through higher housing costs and many spillover costs such as reduced mobility.

This post addresses some of the things we can do to address these issues. First, we’ll discuss a few more research results. Then we’ll explain why, when regulation brings both costs and benefits, in principle and often in practice, we see systematic tendencies to “over”-regulation, i.e., when costs are in excess of benefits. Next, we’ll discuss some general principles that can help us set up an appropriate regulatory framework, i.e., one where costs and benefits are in line and fairly distributed. Third, we’ll lay out specific regulatory “do’s and don’ts” that can help address externalities and other market failures without unnecessarily raising housing costs.

A Few More Lessons from Research and Practice

In our previous post, we examined results from a number of studies, but much of the focus was on cross-market studies, e.g., results from studies that examined the effect of various indexes of regulatory stringency on housing costs, tenure, and other outcomes. These have advantages, especially when we wish to be on firm ground when generalizing to a wide range of markets, but can be limited in their ability to analyze very specific regulations in the necessary detail. In contrast, case studies can focus on more detailed analysis of specific regulations, such as our previous studies of rent control and inclusionary zoning, and many other examples such as fire prevention (Butry, Brown and Fuller), seismic issues (NEHRP Consultants), and flooding (Barr, Cohen and Kim), just to name a few. Case studies also permit a deeper look at specific markets (Glaeser Gyourko and Saks, Pollakowski and Wachter, for example).

In 1989 I participated in a study of Malaysia’s housing market by Larry Hannah, Alain Bertaud, Steve Mayo and myself, with input from dozens of Malaysian colleagues. Nearly 30 years later the specific results of the study are dated and no longer apply. But it remains a good example of a methodology that has been extended and applied in a number of countries. Here, we will use the study to illustrate a few general points; a more detailed exposition of the case study can be found here.

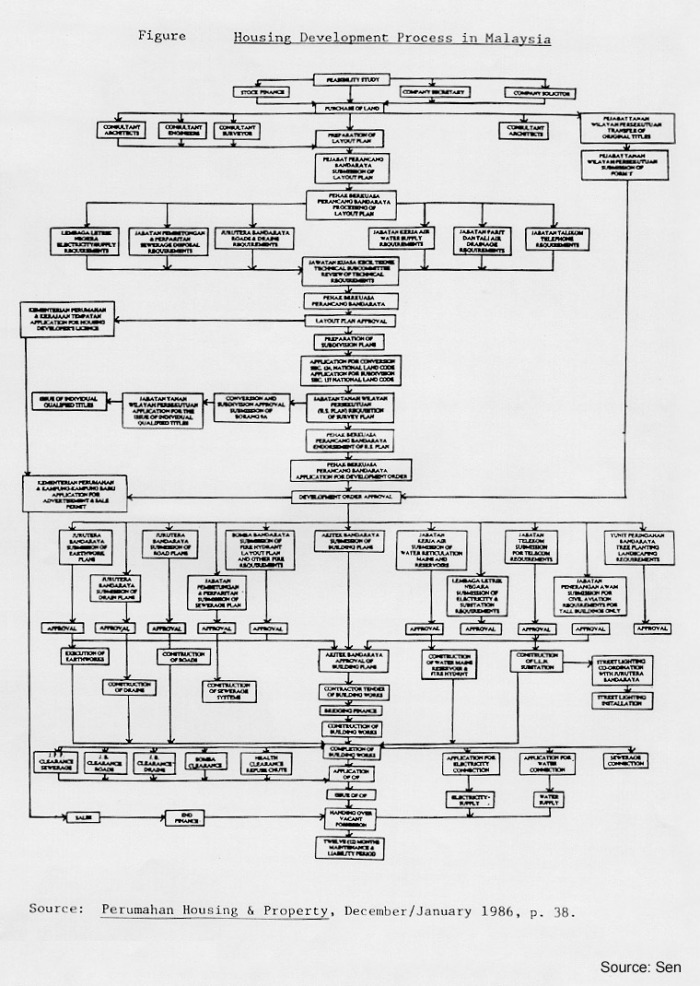

One key input to the analysis was to compute timelines for approvals. Analyses of the processes and time required for approvals of new construction or other businesses are not new of course. The housing development process in Malaysia was particularly complex in the 1980s, with something like thirty major steps required in order to obtain permission to develop residential plots. A flow chart of this process developed by local developer and analyst M.K. Sen (1986). Sen’s chart, reproduced as Exhibit 1.

The Exhibit is old and hard to read, but it’s the complexity that it represents that’s the important takeaway. Presented with an flowchart like Sen’s, showing thirty steps required for land development that take seven years to circumnavigate and which can be short-circuited at any step, anyone can see a problem. Not only was there a holding period cost, but the additional risk involved in development was substantial.

This extreme example from Malaysia illustrates the problem, but the length of the approval process is an issue that knows no national border. Bertaud (forthcoming) discusses a New York City development that took 16 years for basic land entitlements. Such entitlements can be available in other markets in the U.S. in a year or even less.

It is also very instructive that thanks to work by private sector developers like Sen and reform-minded government officials, within a few years of his article’s publication, Malaysia simplified their approval process. We don’t argue that the optimal system has zero approvals, of course. Real estate development does generate externalities that can be mitigated with judicious land use regulation and other interventions like well-designed taxes or impact fees. The exact details of an appropriate approval process will and should vary with the country’s (and city’s) existing institutional framework.

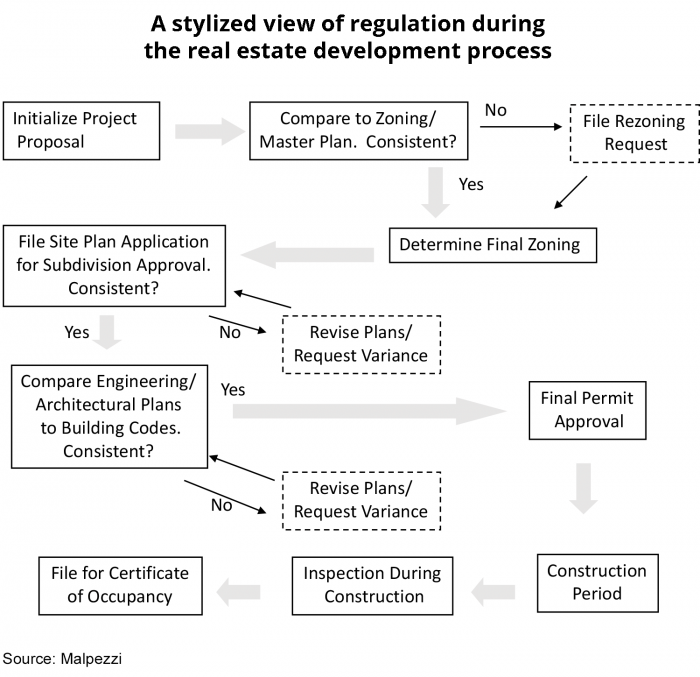

Exhibit 2, from Malpezzi 1998, shows one possible example, in a U.S.-style system with separate building permit, zoning, and subdivision regulations. Such a system can easily be navigated in less than a year, providing a decision to land owners and developers, safeguarding against large external costs, and keeping risks of real estate development to a reasonable level. This example is purely illustrative of course; many other reasonable process designs are possible.

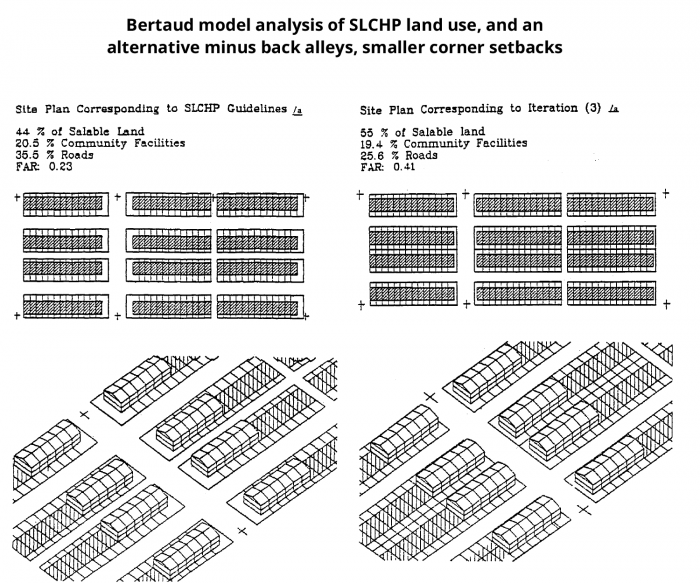

A second key input of the Malaysia case study was to examine the effect of regulations on site land use. This was carried out using the Bertaud Model of land use at the subdivision level, that analyzes the economic cost benefit of alternative site plans.

Consider the output from two iterations of the Bertaud Model, presented here as Exhibit 3. The left panel presents us schematic subdivision layout under the Malaysian Government’s Special Low-Cost Housing Program rules, which were relaxed along several dimensions when compared to prior codes. Nevertheless, there was room for further improvement. The right panel is the same subdivision after Bertaud makes two additional suggested changes: eliminate back alleys, and reduce the setback of corner plots.

In Exhibit 1, as soon as we view M.K. Sen’s flow chart of approvals, we can see a problem. The Bertaud Model exercise reminds us of the opposite phenomenon: sometimes costly regulations are complex and subtle. When Alain first presented Exhibit 3 to me, I didn’t see a huge difference. Then I noticed the FAR, or floor area ratios, associated with each panel. In the first example, a baseline FAR of 0.23 almost doubles to 0.41 after just two changes, a minor change in corner setbacks, and the elimination of back alleys.

Analysis by Bertaud showed that the required setbacks and back alleys eliminated in the right panel of Exhibit 3 were not much valued by consumers, even though they were very expensive in terms of land. Such an increase in FAR with no decline in consumer willingness-to-pay speaks volumes to any potential developer. More to the point, analysis by Bertaud showed that the subdivision regulations tilted profitability away from low-cost housing and towards the high end of the market.

Another insight from the Malaysia exercise was a deeper understanding of what we called the “adding up problem.” A single regulation – say a setback or a back alley, or one more approval – may appear innocuous, or at worst a moderate cost. Once dozens or perhaps hundreds of regulations and taxes are all accounted for, their sum can quickly become significant. Green presents a case study of suburban Wisconsin single-family housing, where regulations requiring full curb and sidewalks for every single-family housing unit – rules that seemed reasonable to those writing the code – added 5 to 10 percent to the cost of entry-level houses. At the upper end of the market, these curb and sidewalks would have been put in anyway, at a modest share of the overall cost. But down-market, they can easily mean the difference between an affordable unit and being priced out of the market.

Another version of the adding up problem comes when comparing the effect of taxes and regulations to the effects of subsidies and other incentives. These can work at cross purposes. For example, state, local and national governments subsidize housing in different ways, trying to encourage homeownership, or affordability, or attract a workforce, or whatever. At the same time these subsidies are on offer, excessive taxes and regulations – those whose costs exceed their benefits – work in the opposite direction.

A Systematic Tendency to “Over”- Regulation?

While New York City’s Planning Commission has created a set of sophisticated web-based tools to help users navigate, it remains that New York’s Zoning Resolution runs 4,338 pages, should one desire to sit down one night with a drink and a printed copy.

Bertaud (forthcoming) recounts that the New York City zoning plan of 1916 divided land uses into three categories: residential, commercial and industrial. These uses were subdivided into a larger number in the revised zoning plan of 1961; and, like Topsy, these have grown over the years, with the proliferation of zoning districts – 72 zones now in commercial areas alone – which are additionally modified by overlays and special districts. Bertaud provides further discussion, but this is not simply a story of New York. For instance, Talen (2013) provides examples from a number of other cities, such as the 242 zoning categories found in Phoenix.

And that’s just the zoning code.

An important theme of this review is that regulations by themselves are neither good nor bad. Some specific regulations have costs which exceed their benefits (“bad”); “good” regulations are those where benefits exceed costs. But much of our discussion on regulation has been in the context of over-regulation, the bad ones. Why is there a systematic tendency to over-regulation? Why do excessive regulations so often offend both efficiency and equity? The answer suggested by the above is that the tendency to over-regulate can be explained by

- the failure to consider costs and benefits, in general;

- situations wherein every interested party adds his own small regulation, which are never considered together (the adding up problem);

- some over-regulation results from a breakdown in exchange between regulators and the regulated;

- inertia and “loss-aversion,” which makes it difficult to change the rules of the game when market conditions change; and

- the fact that regulations are all too often an opportunity for rent-seeking behavior by vested interests.

Given such over-regulation, understanding reduced efficiency is easy: inappropriate regulations impose larger transactions costs than benefits. Inequities also follow: the poor are not usually particularly good at rent-seeking behavior, and since regulations raise costs and restrict supply, it’s often the poor that are rationed out first. Regulations on lot size, for example, aren’t directly binding on the rich.

Other areas may be under-regulated. Environmental regulations, flood plain management, lead abatement and fire safety are among the areas where cost-benefit analyses tell us sometimes more needs to be done. The discussion above suggests a clear path for all regulation: undertake to analyze the cost benefit of major regulations, eliminate or modify regulations whose benefits exceed costs, keep or enact or enforce the ones which make the grade. “Get the regulations right.” The superficial inconsistency of arguing for tighter environmental regulations or more on fire safety while reducing regulations elsewhere disappears in this framework. Even more importantly, we have a tool to discriminate between important and frivolous environmental issues and policies, between effective and ineffective safety and security regulations.

The December 2016 tragedy of the so-called “Ghost Ship” warehouse fire in Oakland that took 36 lives is one recent reminder of an extraordinary irony. Excessively stringent land use and development regulations drive up rents and other housing costs in Oakland as in other cities; and are rigorously enforced, largely because NIMBY forces continually pressure local governments to do so. At the same time, regulations affecting basic public safety which may have a more favorable benefit cost ratio, if we may be momentarily abstract about 36 lost lives – are less well enforced, while the cost of land use and development regulations paradoxically contribute to the pressure for users to violate public safety regulations and for officials to be lax in enforcing these rules, which have less effective support from NIMBYs or others.

Principles of Regulatory Design

Well-designed regulations address market failures. To improve over “failed” markets in practice as well as in principle, i.e., to capture the benefits discussed above, cities need to follow certain general principles. First, applying the principles of cost-benefit analysis to regulatory choice is essential to developing an efficient system. Designing regulations that improve over a failed market makes large demands on regulators. The regulator must know a lot about market conditions, the nature and size of the externality, as well as specific effects of the regulations. Interaction and adding up effects must be dealt with. The incidence of regulatory burden must be untangled.

Fairness is also important in good regulatory design. Urban regulations have profound distributional effects. Experience suggests that many bodies politic will accept systems that generate significant wealth transfers if it is perceived that those adversely affected are not chosen systematically, and that some remedies exist for really extreme negative effects on wealth. For example, in the U.S. zoning changes that reduce the value of some properties and increase others are broadly (not universally) accepted, as long as the process of determining winners and losers is perceived to be roughly fair and as long as compensation is available to those with the largest losses (i.e. when regulatory changes leave property essentially valueless).

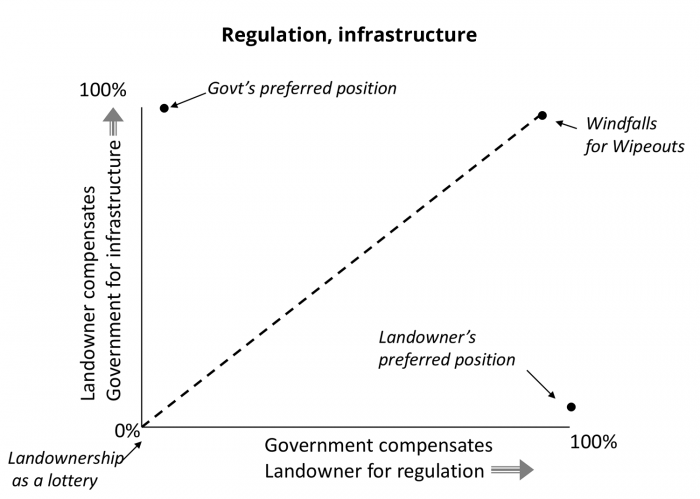

An important and somewhat contentious issue is that of compensation and insurance for regulatory decisions. For example, in the United States there is a high-profile debate over the nature of property rights and whether real estate regulation, e.g. zoning, can be considered a “taking” when it reduces the value of the property. Exhibit 4 illustrates a range of possibilities. Two polar views of public interventions in land development can be discerned.

The first can be referred to as “Windfalls for Wipeouts” and is associated with the work of Hagman and Misczynski. This view suggests that any public intervention that reduces the value of real estate should be compensable; but on the other hand, the gains from public investment should accrue to the public, not private landowners. Thus Hagman and Miscznski would tax away benefits from public infrastructure, and (using these resources) compensate owners fully for costs of regulation.

The other polar position emphasizes that landownership has risks and rewards, as argued by Bromley. In this view, regulation is like an earthquake, infrastructure is like manna from heaven. The gains and losses are associated with the risks one takes when one invests in land. Presumably such risks can be and are priced, and to the extent such markets exist, could be insured against.

Each position has its own internal logic, and its own practical difficulties. The Windfalls for Wipeouts position has obvious practical problems: for example, what baseline would we use to measure costs and benefits of public intervention? The Landownership is a Lottery position downplays the role of uncertainty as opposed to risk, as for example when the “rules of the game” change (as they do from time to time), and questions arise of whether there is a social gain to reducing risks in holding land. And would those who advocate this position exempt land from capital gains taxation, on the grounds that the mirror image losses from regulation are not deductible?

In any event few societies are near either polar position. This is perhaps unsurprising, since major actors in land development would be opposed to either position. Landowners would, naturally, prefer a world in which infrastructure, property rights enforcement and the like were free (or more precisely paid for by others) while they were compensated for regulatory losses. Governments, at least in their public choice incarnation, would prefer to be paid for infrastructure investments and the like with impact fees and other user charges, while remaining able to regulate without liability for the consequences.

General Lessons about Regulations and Other Public Interventions

The next few paragraphs discuss some general themes that run through much of the results presented above, and in other literature.

Regulations have benefits as well as costs. But there are systematic reasons why regulatory costs are sometimes – far too often – much greater than benefits. The systematic tendency to over-regulate can be explained by the following:

- Governments often fail to explicitly consider costs and benefits when developing the regulatory framework.

- Often each interested party adds their own (often small) regulation, which may seem reasonable taken on its own. Generally such regulations are never considered together; but the effect of many small regulations can add up. And as we argued above, there are often significant interactions among regulations.

- Some regulation undoubtedly results from a breakdown in exchange between regulators and the regulated. Coasian exchange (see our previous discussion, and Fischel) may not work well. When it doesn’t, “informal Coasian exchange” – corruption – will be more prevalent.

- Regulations are also an opportunity for rent seeking behavior. Over time vested interests develop, and the political economy of relaxation of regulation becomes quite difficult.

Distributional aspects of regulation, particularly land use regulation, are often neglected. The distributional analysis of rent control summarized above is but one illustration. The corpus of Bertaud’s work shows time and again that inappropriate regulations often tilt profitability away from the low end of the market. Malpezzi and Green show that qualitatively more stringent land use regulations affect the bottom end of the market more than the high end. Often infill development and up-zoning arouse strong local opposition (Lowry and Ferguson).

A survey of U.S. developers in three cities with widely disparate regulatory regimes found the greatest number of complaints by developers were not about the specifics of regulation – the zoning code itself, impact fees or whatever – but rather the process. “In all three sites, developers complained most about procedural complexity and delay – complex and expensive applications for rezoning or subdivision permits, dealings with many agencies over peripheral issues, planning staffs unsympathetic to the developer’s vision, slow clerical processing, repeated postponement of decisions, intervention by poorly informed or selfish neighborhood groups.” (Lowry and Ferguson p. 113).

In fact, some land use regulation is often favored by the real estate development industry, or at least parts of it. Well-crafted regulation can reduce uncertainties and delays, and provide benefits of standardization. Regulation can also forestall competition from outsiders. (Landis)

Real estate regulation is extremely subject to insider/outsider problems. Regulations that excessively constrain the market will reduce supply and drive up prices. Whether this is a “good thing” or a bad depends largely on whether one owns property when the stringent regime is put in place.

Local decentralization of land use decisions is not always best. Local regulators know local conditions best, and the lack of absolutes in the design and implementation of specific regulations suggests local control. But Malpezzi (1996) argues that insider/outsider problems generally get worse as decisions are pushed to lower levels with fewer and more homogenous insiders. The Keane Commission made this argument and suggested that at least some land use regulations were better implemented at the state level than the local, as states would presumably reflect a broader concept of the public interest. Asabere, Huffman and Mehdian found that local historic preservation regulations depressed property values much more than national. It appears there is no easy answer here. Perhaps local regulation with oversight at the provincial or national level is one direction to go. The higher level of government could institute some diagnostic statistics, primarily prices; when prices exceed some predetermined level, a regulatory audit and greater oversight is triggered.

A Possible Regulatory Framework for Real Estate in a Stylized City

What are the “regulatory fundamentals” in real estate? How might a municipality go about creating effective, efficient and fair regulations for consumer protection and safeguard consumers from negative externalities?

There are examples of model codes and “best practices” – for example Dewberry & Davis; U.S. Department of Housing and Urban Development (1993); Jakabovics et al.; Vranicar, Sanders and Mosena. It almost goes without saying that any model code requires careful thought and analysis before application to any particular city. When examining model codes, look more at principles, functions and processes, and less at specific regulations. The forthcoming book by Alain Bertaud, Order Without Design, is a masterclass in how to think deeply about regulatory issues.

Land use regulation will always have a strong political element. There is no such thing as “Pareto-optimal” land development, i.e., that benefits some but harms no one. But take technical advice and design the regime to minimize rent seeking and regulatory capture. Transparency and “voice” are important. For example, if building permits are limited, or a similar growth management scheme is put in place, auction permits rather than assign them randomly, first come-first served, or based on political clout. Taxes, including impact fees and exactions set at a level that mirrors the true marginal cost of development are also appropriate.

All large cities have planning departments and other regulatory bodies. Generally the planning department will need to maintain an overall view of the city’s real estate, associated infrastructure, and provision of other services that “run with the land.” Functionally, for each parcel in a city we have to know who owns it and/or has long-term use rights, so there must be a system of registration. Most U.S. cities tax real estate, so there will be a corresponding institution with access to registration to assess and collect taxes. Generally we would expect to find one or more institutions that keep track of permitted and actual uses of each parcel and that review development proposals for conformity with subdivision and building codes. Sometimes one institution, like the planning department, will undertake several of these tasks. In other cases responsibilities are more unbundled. In the latter case different departments will need clear lines of communication. Whatever style is chosen, keep it simple. Streamline the regulatory process where possible.

Link means and ends. Regulations should be viewed as a method to reach a stated goal, not an end in themselves. Goals should be clearly articulated externalities clearly defined and, where possible, measured. The way the regulation takes us towards the goal should be clear. Costs of regulation, including unintended consequences, should be laid out clearly ex ante and monitored over time.

Set performance standards for institutions, e.g. decisions on permits, will be returned within so many weeks. Institute a transparent process for obtaining exceptions to rules, with clear guidelines on what criteria will be used to judge such requests. Make sure that cost benefit and distributional criteria are part of the decision rules. Develop some form of quasi-judicial appeals process, but keep it straightforward and ensure rapid decisions. Appeals that overturn the original decision should be the exception, not the rule; if many appeals overturn prior decisions, something is wrong with the original decision process, or the appeal process.

Monitor indicators of market and regulatory performance (Quigley and Rosenthal). Direct indicators of regulatory stringency include the time taken to receive approvals for development (e.g. six months or so to a decision is good; two years is bad. Some cities routinely take 5-7 years). Land development multipliers (the ratio of the price of serviced developable land on the fringe to similar land not yet converted) range from 1.5 to 3 in well-functioning markets. Poorly functioning markets exhibit ratios of 5 and above. The house price to income ratio is another key indicator. Markets where typical house prices are 2-3 times typical incomes are performing well. Markets where this ratio is running 5-8 or higher are distorted. Regulators must monitor their city. Planners should follow the market as closely as any for-profit developer.

Common overdesigns include are codes that specify large lots, that require curbs and gutters and sidewalks for all streets, regardless of population density, and inappropriately wide roads. In many cases, for example, grassy swales can substitute for full curbs and gutters; neighborhood roads that later sport speed bumps are the universal sign of an overdesigned street. Are construction codes linked to local conditions? For example, are foundation and footing requirements linked to soil type? Are infrastructure standards linked to density and income?

Base impact fees and other exactions on marginal costs. Include, where relevant, those things like congestion costs that are hard to measure if they’re real. Consider carefully the equitable basis for allocating those costs. Should specific costs be allocated by unit value or per capita?

Remember that when considered individually, in isolation from other regulations and outside of the cost benefit framework, most land use regulations appear reasonable and benign. Typically each regulation reflects a different interest (schools, fire department, roads department, sanitation department, water authority, and so on) each of which consider their interest apart from the costs imposed. Someone outside the individual institutions affected has to analyze the big picture. It’s only when you add up the regulatory costs and compare them to the benefits that the true picture is revealed. Undertake a “regulatory audit” from time to time. The “Bertaud model” of land use planning and the “Malaysia model” of incentives are examples of the kinds of analyses that can serve well here.

Regulatory Do’s

- Plan trunk infrastructure, and an installation schedule. To the extent possible, such infrastructure should follow current and likely future development locations, as revealed by the market. Well-designed impact fees can finance such infrastructure.

- Plan for the provision of local services, such as schools, police, fire and clinics.

- Permit density, but allow for a mix of densities and income levels. Do not micromanage the development process. If governments find themselves legislating lots of low- and middle-income development, where the big market is, that’s a signal that some regulations or other upstream interventions are tilting profitability away from the middle and to the high end. Find and treat the disease, don’t try to legislate away the symptom.

- Use cost-benefit principles to examine proposed regulations. Quantifying benefits, even approximately, with likely bounds when precise figures are unavailable, is far superior to making a regulatory judgement with no such quantification. Every regulatory decision imposes real costs and confers some benefit; better to measure with error than not to try. Every regulation put in place means we’ve made an implicit judgement about benefits and costs. Put these judgements to the test.

- If necessary undertake “regulatory triage.” Separate regulations into (1) those whose benefits clearly exceed costs, and strengthen and enforce them; (2) those whose costs clearly exceed benefits, and remove or reform them; and (3) a middle category of those for whom the net cost-benefit is too imprecisely known to be confident of the need for change. In many if not most cities, an initial focus on (1) and (2) will keep regulators busy enough for some time, and will yield significant returns.

- Consider fairness and political feasibility as well as efficiency in the design of regulatory regimes. Real estate regulations have powerful distributive effects.

- No regulation is so well drawn that it never needs change or variances. Allow for exceptions and changes, in a transparent process.

- “Corner solutions” are rarely the best. Outright prohibitions, e.g. on development within a large greenbelt, are rarely an efficient way to obtain the desired regulatory benefits. Encourage negotiated outcomes.

- Use impact fees. Set these fees to approximate the (formerly) external costs of development. Keep a nexus between fees and services.

- Push decisions down to local level, where possible. But push decisions up, where insiders have an inordinate say at the expense of outsiders.

- Solicit feedback from a wide range of actors, developers, and community representatives. Voice is important.

- Provide a range of options suited to the income, preferences and culture of the city’s inhabitants. Standards must fit local conditions: income, density, materials availability, soil and topography. Forget VIP pit latrines in dense, middle-income cities. Forget Western-standard sewer systems in small low-income settlements.

- Simplify procedures to establish more “by right” development, when proposals conform to a simple, robust zoning code with a reasonable number of classifications. Permit more mixing of residential types and appropriate commercial uses.

- Regulate and price parking appropriately. For many kinds of developments, decisions about parking can be left to developers (and ultimately consumers). “Free” parking can be very expensive and a barrier to development.

- Consider changes in codes as technology provides new options. For example, some codes based on old technologies call for expensive manholes every 200 feet or so (at a rough cost of $1,000 each); while with new technologies for laying curved pipe and clearing blockages, manholes can be placed infrequently if not eliminated.

- Development regulation must follow the market. New towns and large public development projects have especially large risks.

Regulatory Don’ts

- Don’t import a “turnkey” system whole. But do study other city’s systems for ideas. Consider local conditions and resources. New York City or Newark will have different needs from Glen Rock or Lake Placid.

- Don’t put unnecessary roadblocks to redevelopment and densification. New construction on the fringe is important, but so is redevelopment and infill. The latter are not as noticeable and are sorely neglected by many cities.

- Don’t adopt regulations that no one can realistically follow. The rules will be broken, corruption will increase, and the rule of law will be weakened. But when regulations are appropriate – that is, well founded in cost-benefit terms and equitable – allocate sufficient resources for their administration and enforcement.

- Don’t make codes overly detailed and inflexible. Set performance standards, e.g. “a fire door in an office building must test to withstand a fire of 2,000 degrees for 15 minutes,” not “all fire doors must be 2-inch steel.”

- Don’t rely on rigid quantitative targets for development when setting infrastructure or land conversion guidelines. In market economies, peak to trough of the development cycle can easily be 3:1 or greater.

- Don’t prohibit small lots. Don’t prohibit large lots. Rather, regulate or tax to implicitly price lots to cover the externalities generated, and let the market decide.

- Don’t adopt large greenbelts. Scattered parks are better. Buy the land for parks, rather than prohibit the development of private land.

- Don’t institute rent controls, on residential or commercial property. The conditions under which they yield net benefit are virtually never obtained in practice, and once in place they are extremely difficult to remove or reform.

- Don’t put differential land taxes on favored uses. Avoid the trap found where these have been adopted, where land can be held off the market well past its social optimum for development because of tax exemptions for agricultural use.

- Don’t tilt profitability away from the middle and low end of the market by imposing differential costs. Large lot zoning, excessive land use standards, and the like, have this effect around the world.

- Don’t neglect commercial and industrial development and its associated infrastructure. But don’t make it a fetish – strive for the proper balance between residential and nonresidential uses.

- Don’t limit land purchases or development approvals to favored developers. Non-transparent land sales can be a particularly serious problem in some formerly socialist countries, but on a smaller scale do come up the U.S. in “forced sales” for foreclosures, tax sales, and the like. But favoritism in obtaining tax breaks and entitlements is a universal problem. Auction land and its associated development rights with transparent processes.

- In large cities, multifamily housing is an especially important element of affordable housing supply. In smaller cities and rural areas, mobile homes and manufactured housing are especially important. Avoid zoning and codes that make these types of housing especially difficult to put in place.

Sources, and Additional Reading

Asabere, Paul K, Forrest E Huffman, and Seyed Mehdian. “The Adverse Impacts of Local Historic Designation: The Case of Small Apartment Buildings in Philadelphia.” The Journal of Real Estate Finance and Economics 8, no. 3 (1994): 225-34.

Barr, Jason, Jeffrey P Cohen, and Eon Kim. “Storm Surges, Informational Shocks, and the Price of Urban Real Estate: The Case of Hurricane Sandy.” Paper presented to the American Real Estate and Urban Economics Association, 2017.

Bertaud, Alain. Order without Design. MIT Press, Forthcoming.

Bromley, Daniel W. Environment and Economy: Property Rights and Public Policy. Basil Blackwell Ltd., 1991.

Butry, David T., M. Hayden Brown, and Sieglinde K. Fuller. “Benefit-Cost Analysis of Residential Fire Sprinkler Systems.” National Institute of Standards and Technology, 2007.

Dewberry & Davis, and the National Association of Homebuilders National Research Center. “Affordable Housing Development Guidelines for State and Local Government.” U.S. Department of Housing and Urban Development, 1991.

Elliott, Donald L. A Better Way to Zone: Ten Principles to Create More Livable Cities. Island Press, 2012.

Fischel, William A. “Zoning Rules! The Economics of Land Use Regulation.” Cambridge, MA: Lincoln Institute of Land Policy (2015).

Glaeser, Edward L, Joseph Gyourko, and Raven E Saks. “Why Is Manhattan So Expensive? Regulation and the Rise in Housing Prices.” The Journal of Law and Economics 48, no. 2 (2005): 331-69.

Green, Richard K. “Land Use Regulation and the Price of Housing in a Suburban Wisconsin County.” Journal of Housing Economics 8, no. 2 (1999): 144-59.

Gyourko, Joseph, and Raven Molloy. “Regulation and Housing Supply.” In Handbook of Regional and Urban Economics, edited by Gilles Duranton, J Vernon Henderson and William C Strange: Elsevier, 2015.

Hagman, Donald G, and Dean J Misczynski. Windfalls for Wipeouts: Land Value Capture and Compensation. Chicago: American Society of Planning Officials, 1978.

Hannah, Larry, Alain Bertaud, Stephen Malpezzi, and Stephen K Mayo. “Malaysia: The Housing Sector; Getting the Incentives Right.” World Bank Sector Report 7292 (1989).

Jakabovics, Andrew, Lynn M Ross, Molly Simpson, and Michael Spotts. “Bending the Cost Curve: Solutions to Expand the Supply of Affordable Rentals.” Washington, DC: Urban Land Institute, 2014.

Kean, Thomas (Commission Chair). “Not in My Backyard: Removing Barriers to Affordable Housing.” Washington, D.C.: Report to President George H.W. Bush and Housing and Urban Development Secretary Jack Kemp by the Advisory Commission on Regulatory Barriers to Affordable Housing, 1991.

Landis, John D. “Land Regulation and the Price of New Housing: Lessons from 3 California Cities.” Journal of the American Planning Association 52, no. 1 (Win 1986): 9-21.

Lowry, Ira S, and Bruce W Ferguson. Development Regulation and Housing Affordability. Urban Land Institute, 1992.

Malpezzi, Stephen. “Housing Prices, Externalities, and Regulation in U.S. Metropolitan Areas.” Journal of Housing Research 7, no. 2 (1996): 209-41.

———. “The Regulation of Urban Development: Lessons from International Experience.” In World Bank, background paper for the 1999 World Development Report. Washington, D.C., 1999.

Malpezzi, Stephen, and Richard K. Green. “What Has Happened to the Bottom of the Us Housing Market?” Urban Studies 33, no. 10 (December 1996): 1807-20.

Mitchell, Thomas W, Stephen Malpezzi, and Richard K Green. “Forced Sale Risk: Class, Race, and the Double Discount.” Fla. St. UL Rev. 37 (2009): 589.

NEHRP Consultants. “Cost Analyses and Benefit Studies for Earthquake-Resistant Construction in Memphis, Tennessee.” National Institute of Standards and Technology, 2013.

Pollakowski, Henry O, and Susan M Wachter. “The Effects of Land-Use Constraints on Housing Prices.” Land Economics (1990): 315-24.

Quigley, John M, and Steven Raphael. “Regulation and the High Cost of Housing in California.” American Economic Review 95, no. 2 (2005): 323-28.

Quigley, John M, Steven Raphael, and Larry Rosenthal. “Measuring Land Use Regulations and Their Effects in the Housing Market.” In Housing Markets and the Economy: Risk, Regulation, and Policy — Essays in Honor of Karl E. Case, edited by Edward L. Glaeser and John M. Quigley, 271. Cambridge, MA: Lincoln Institute of Land Policy, 2009.

Quigley, John M, and Larry A. Rosenthal. “Design and Implementation of a National Database on Regulatory Barriers to Affordable Housing Development.” Program on Housing and Urban Policy, University of California, Berkeley, 2004.

Quigley, John M., and Larry A. Rosenthal. “The Effects of Land Use Regulation on the Price of Housing: What Do We Know? What Can We Learn?”. Cityscape: A Journal of Policy Development and Research 8, no. 1 (2005): 69-110.

Schill, Michael H. “Regulations and Housing Development: What We Know.” Cityscape: A Journal of Policy Development and Research 8, no. 1 (2005): 5-19.

Schuetz, Jenny. “Guarding the Town Walls: Mechanisms and Motives for Restricting Multifamily Housing in Massachusetts.” Real Estate Economics 36, no. 3 (2008): 555-86.

Sen, M.K. “Dilemmas of the Housing Delivery System in Malaysia.” Perumahan Housing and Property (Dec.-Jan.) (1986).

Shoup, Donald C. The High Cost of Free Parking. Planners Press Chicago, 2005.

Talen, Emily. City Rules: How Regulations Affect Urban Form. Island Press, 2012.

U.S. Department of Housing and Urban Development. “Removing Regulatory Barriers to Affordable Housing: How States and Localities Are Moving Ahead.” Carol Robbins and others of Aspens Systems Corp. for HUD Policy Development and Research, 1992.

Vranicar, John, Welford Sanders, and David R Mosena. Streamlining Land Use Regulation: A Guidebook for Local Governments. The Office, 1980.